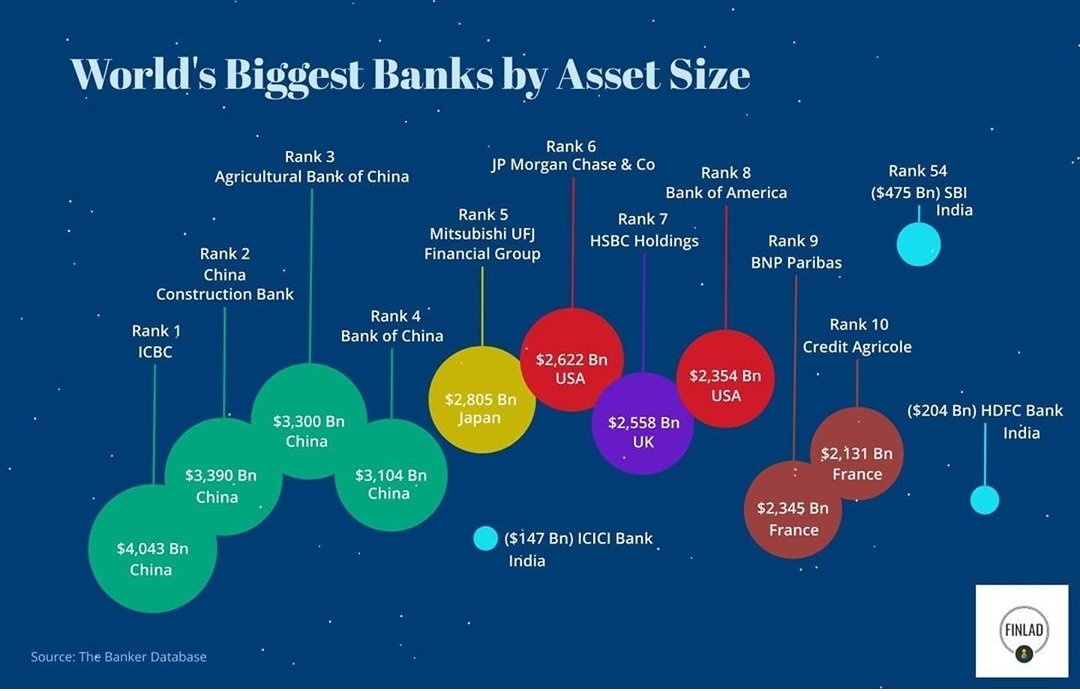

World's biggest banks by asset size

top 4 are Chinese

Indias biggest SBI is ranked 54

India's biggets by market cap- HDFC bank and ICICI bank are not even in top 100!

#SBI #HDFCBank #ICICIBank

top 4 are Chinese

Indias biggest SBI is ranked 54

India's biggets by market cap- HDFC bank and ICICI bank are not even in top 100!

#SBI #HDFCBank #ICICIBank

Ruchi Soya is a 100 bagger

Market Cap (Rs Cr.)42,469.46

India's 2nd and 3rd largest PSU banks:

Punjab National Bank,

Market Cap (Rs Cr.)34,960.49

Bank of Baroda

Market Cap (Rs Cr.)24,050.05

PSU banks are valued poorly or Ruchi Soya investors are crazy?

Market Cap (Rs Cr.)42,469.46

India's 2nd and 3rd largest PSU banks:

Punjab National Bank,

Market Cap (Rs Cr.)34,960.49

Bank of Baroda

Market Cap (Rs Cr.)24,050.05

PSU banks are valued poorly or Ruchi Soya investors are crazy?

Patanjali should change name of

Ruchi "Soya" to

Ruchi "Bhaga" after seeing it's dream run

🤣

Ruchi "Soya" to

Ruchi "Bhaga" after seeing it's dream run

🤣

After 8,818% rally in 103 days, Ruchi Soya faces red flag; analysts want a Sebi probe

The company on Friday posted a net loss of Rs 41.24 crore for the quarter ended March 31.

Read more at:

economictimes.indiatimes.com/markets/stocks…

The company on Friday posted a net loss of Rs 41.24 crore for the quarter ended March 31.

Read more at:

economictimes.indiatimes.com/markets/stocks…

The perils of an illquid counter

when it falls... or begins to fall

buyers disappear

and value will vanish before you know it.. with no option to sell

BEWARE!

#ruchisoya

when it falls... or begins to fall

buyers disappear

and value will vanish before you know it.. with no option to sell

BEWARE!

#ruchisoya

The perils of an illquid counter part 2

Omaxe

The bears hit harder than the bulls!

2 months of gains may be wiped off in 2 days!

BEWARE

#Omaxe

Omaxe

The bears hit harder than the bulls!

2 months of gains may be wiped off in 2 days!

BEWARE

#Omaxe

The descent has started and may continue

When fundamentals are not present

and its more likely operator driven

in a crash and 5% down circuits

you may not get a change to even sell

as there will be ZERO buyers

BEWARE of such stocks!

When fundamentals are not present

and its more likely operator driven

in a crash and 5% down circuits

you may not get a change to even sell

as there will be ZERO buyers

BEWARE of such stocks!

See what happened to Omaxe

https://twitter.com/IndiaER/status/1277830927914201094?s=20

BEWARE!

Stay away from fundametally weak stocks that have been hititng upper circuit

like Ruchi Soya, Omaxe, borosil or Alok,

onc ethey start falling

you may get wiped off with no change to sell in illquid counters

Stay away from fundametally weak stocks that have been hititng upper circuit

like Ruchi Soya, Omaxe, borosil or Alok,

onc ethey start falling

you may get wiped off with no change to sell in illquid counters

🙏🏾🤣

• • •

Missing some Tweet in this thread? You can try to

force a refresh