Indian Investors have converted this famous WB quote to buy “quality” at any price! IMHO this is one of the costliest incidences of Chinese whisper!!!!!

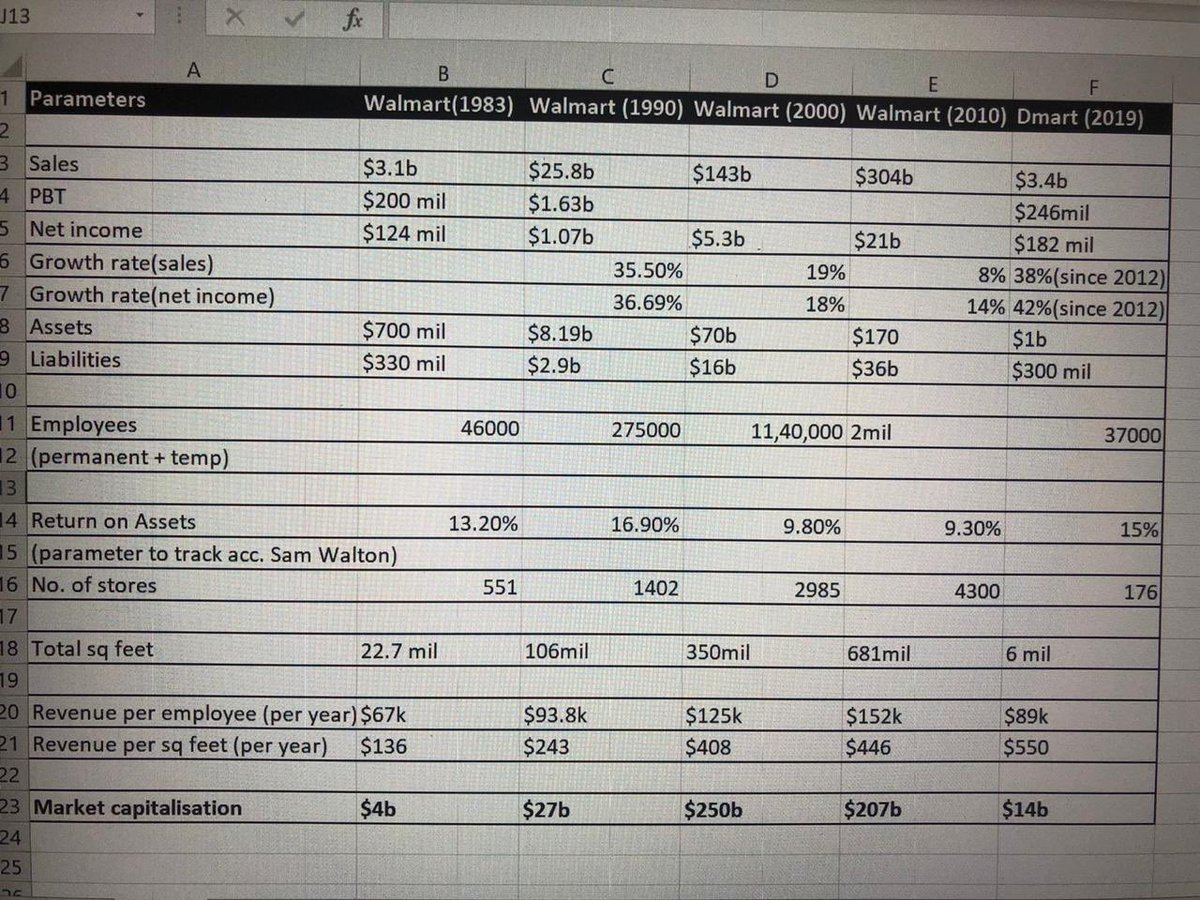

However today I look at #Jubilant FoodWorks which appears to be a fair company at absurd valuations

Negative

•Doesn’t own the brand!! (Risk of dispute not factored)

•Questionable Promoters (Tried to extract a royalty for using the “Jubilant” brand. This for a co. which pays royalty to use #Dominos brand!!)

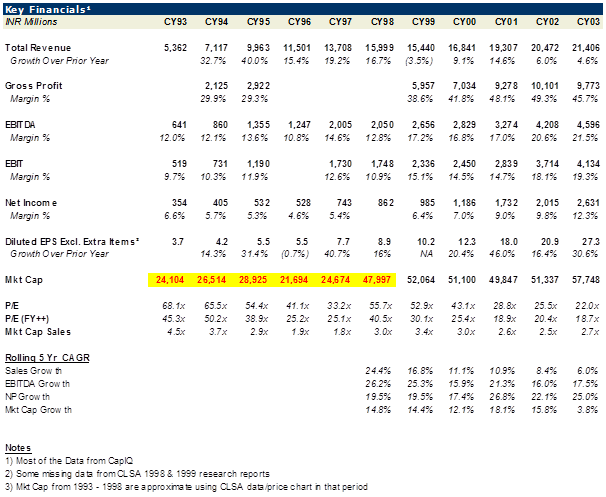

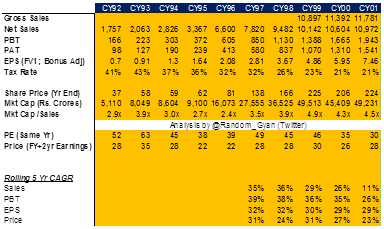

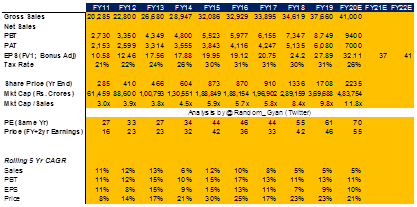

•Growth Slowdown (from ~40% to ~15%)

•Decline in return ratios

Disruption Risk- Earlier hardly any restaurants delivered. However post swiggy and Uber Eats the biggest USP for Jubilant is challenged

Constant Promoters selling– From 61% in Sept’10 to 57% Sept’12 to 50% in Sept’14 to 45% in Sept’16 to 42% in Mar’20 (Makes you wonder)

For a co. with no brand ownership, questionable management, <20% growth, 8-12% expected IRR over the next 10 yrs in the best case, investors are willing to pay ~60x FY22.

Highly unfavourable Risk Reward!!

It needs to fall at least 40% to merit a 2nd look.