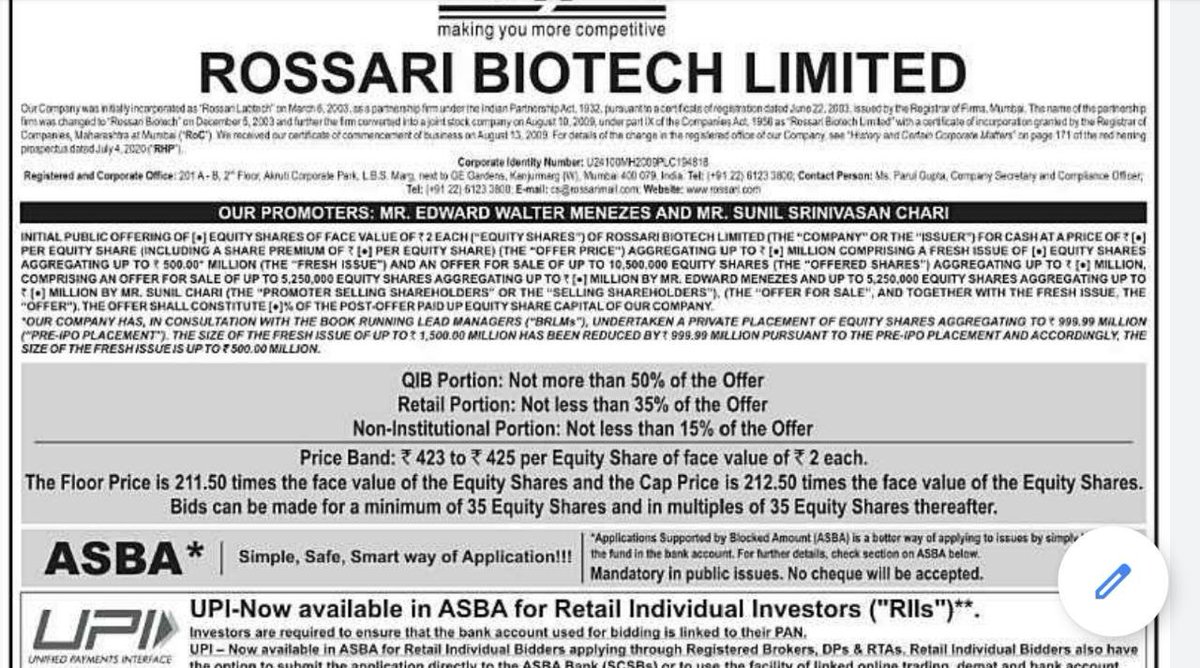

IPO of Rossari Biotech Limited:

Price band - 8th July (Wednesday)

Webinars for Press, Broker & Analysts - 8th July (Wednesday) & 9th July (Thursday)

Anchor book - 10th July (Friday)

IPO opens - 13th July (Monday)

IPO closes - 15th July (Wednesday)

Listing - around 23rd July

Price band - 8th July (Wednesday)

Webinars for Press, Broker & Analysts - 8th July (Wednesday) & 9th July (Thursday)

Anchor book - 10th July (Friday)

IPO opens - 13th July (Monday)

IPO closes - 15th July (Wednesday)

Listing - around 23rd July

Interesting that grey market is active even before price band is announced!!

Rossari Biotech IPO

Grey market premium is 38-45

Kostak is 275-300 per bid lot

Rossari Biotech IPO

Grey market premium is 38-45

Kostak is 275-300 per bid lot

Rossari Biotech IPO

Price band is 423-425

Grey market premium 115-120;

one broker suggesting 130 as well.

Price band is 423-425

Grey market premium 115-120;

one broker suggesting 130 as well.

Rossari Biotech IPO

GMP 108 +/- 2

Yes Bank FPO

GMP 0.80 +/- 0.05

GMP 108 +/- 2

Yes Bank FPO

GMP 0.80 +/- 0.05

Rossari Biotech

grey market premium : Rs 125-130

per lot kostak: Rs 575

Yes Bank

grey market premium for 2 lakh application : Rs 3,500

grey market premium : Rs 125-130

per lot kostak: Rs 575

Yes Bank

grey market premium for 2 lakh application : Rs 3,500

HNI breaking the bank to invest

NII ar 240x for Rossari Biotech IPO

QIB: 85x

retail 7x!!

Overall, 79.4x

investors are just hungry for stocks?

#IPO

NII ar 240x for Rossari Biotech IPO

QIB: 85x

retail 7x!!

Overall, 79.4x

investors are just hungry for stocks?

#IPO

Rossari Biotech

Basis of Allotment

QIB MF - 284.75x

QIB others - 89.696x

HNI - 236.748716x

Retail - 52:235 will get 35 shares 4.519x with avg. allotment of 7.44 shares

Basis of Allotment

QIB MF - 284.75x

QIB others - 89.696x

HNI - 236.748716x

Retail - 52:235 will get 35 shares 4.519x with avg. allotment of 7.44 shares

👏👏👍👍 Rossari Biotech now at 700! #IPO

#Rossari #Biotech debuts at Rs 670 with 58% premium over IPO price

The listing premium was much higher than the grey market premium (of around Rs 160-180 per share) as well as analysts' expectations of Rs 130-175 per share.

#Rossari #Biotech debuts at Rs 670 with 58% premium over IPO price

The listing premium was much higher than the grey market premium (of around Rs 160-180 per share) as well as analysts' expectations of Rs 130-175 per share.

NSE bulk trades report

MANY MANY intraday trades on Rossari Biotech (blue and peach)

with one notable exception in the middle in yellow

Goldman Sachs buys INR 33.3 crore worth shares!!

#goldmansachs #rossari #biotech #IPO #RossariBiotech #RossariBiotechIPO

MANY MANY intraday trades on Rossari Biotech (blue and peach)

with one notable exception in the middle in yellow

Goldman Sachs buys INR 33.3 crore worth shares!!

#goldmansachs #rossari #biotech #IPO #RossariBiotech #RossariBiotechIPO

• • •

Missing some Tweet in this thread? You can try to

force a refresh