The latest #BIS_Bulletin provides a bird's eye perspective, showcasing the use of BIS banking statistics at its best bis.org/publ/bisbull27…

A thread follows

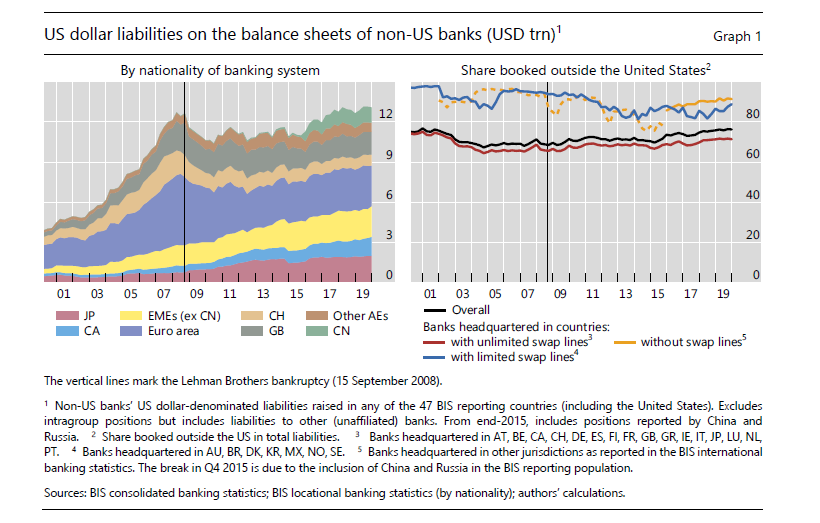

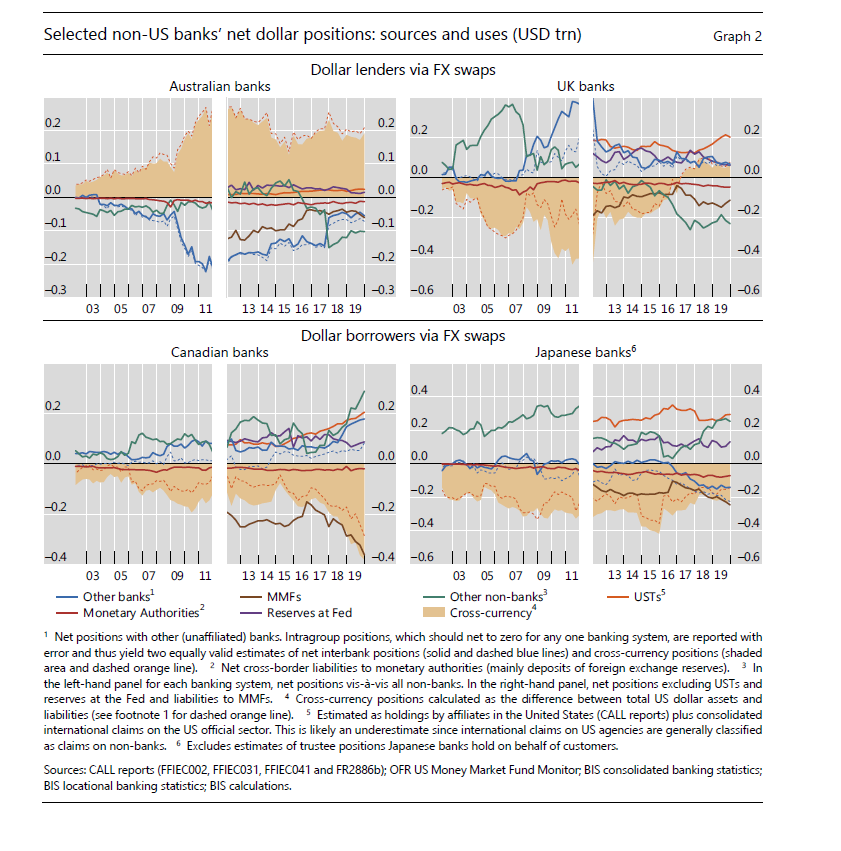

The gross #DollarFunding amounts tell only part of the story; short-term liabilities can be more telling, and we also need to factor in how much short-term assets banks have

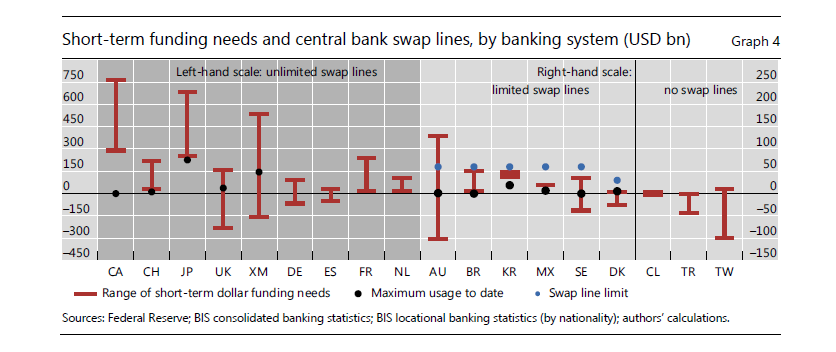

So, here is the punchline of today's #BIS_Bulletin in one chart

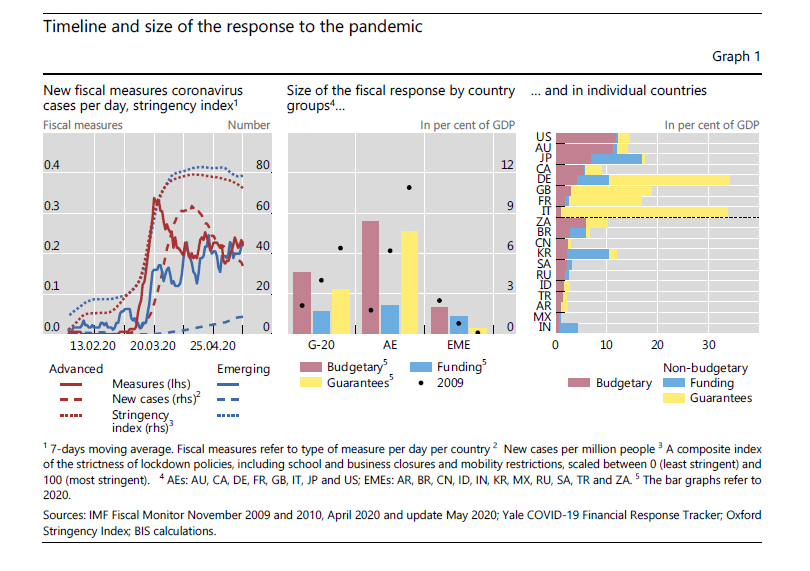

The fiscal response to the Covid-19 pandemic has been substantial and swift; it was one of the defining moments in the policy response...