Get your copy here:

open.alberta.ca/publications/0…

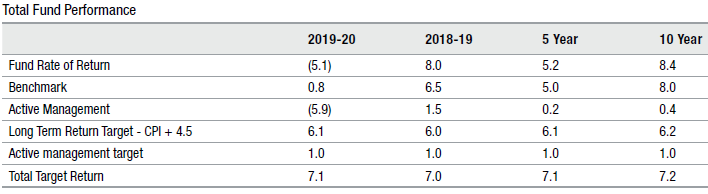

It isn't accurate to use 1 year numbers. So I will use the 5 year numbers in my example. Funnily enough that about equates to Kevin's time at the helm of AIMCO. #ABLeg

The next line: Benchmark returned 5.0%. This is what an indexed portfolio with the same asset mix would have returned.

Because, on the next line, you see that active investment management (buying and selling securities) added 0.2% (5.2%-5.0%) to the return. #ABLeg

Look at the next line: the "Active Management Target" is 1.0%.

So the expectation for "good" performance would be benchmark plus active management. For this 5 year period the fund would have had to return 6.0% per year for "good" returns.

This is the relative (to the market) performance metric. #ABLeg

"Against the policy benchmark, the Fund outperformed by 20 bps, although this did not surpass the value-added

target of 1 per cent."

...and that value add target is why we paid Kevin $2.976 million dollars last year. #ABLeg

Not so much this year. #ABLeg