SWEENEY LACKS KNOWLEDGE ON THE TYPES OF SECURITIES

She claims WaFd(common shareholder)can't identify an injury unique to them and applies Fairholme case(NWS),despite signaling the Warrant is 79.9% COMMON STOCK Beneficial Ownership & Fairholme is JPS holder.#Fanniegate @WhiteHouse

She claims WaFd(common shareholder)can't identify an injury unique to them and applies Fairholme case(NWS),despite signaling the Warrant is 79.9% COMMON STOCK Beneficial Ownership & Fairholme is JPS holder.#Fanniegate @WhiteHouse

A common stock represents ownership interest in FnF. They own 100% of the company. Thus,they have a direct claim on the issuance of a warrant that is Beneficial Ownership (SEC rule)regardless of being exercised.

Fairholme's claim is derivative(NWS): the injury is suffered by FnF.

Fairholme's claim is derivative(NWS): the injury is suffered by FnF.

The Warrant is a Direct claim by the Common Shareholders,but Sweeney/@TheJusticeDept omit the Warrant to justify that their allegations are Derivative.

Sweeney labels the injury as an overpayment of FnF, just like an excess of dividend,when a Warrant isn't a dividend(retribution)

Sweeney labels the injury as an overpayment of FnF, just like an excess of dividend,when a Warrant isn't a dividend(retribution)

This mistake comes from what is stated at the beginning of the ruling: she claims that the Warrant was "surrendered in return for @USTreasury's funding commitment".Thus,as retribution.

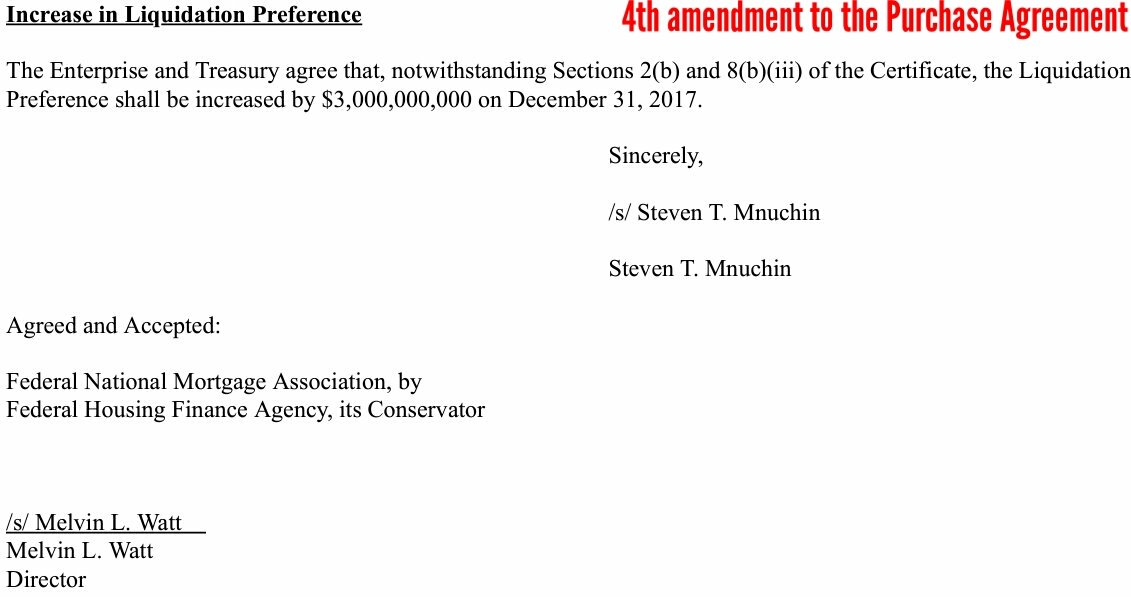

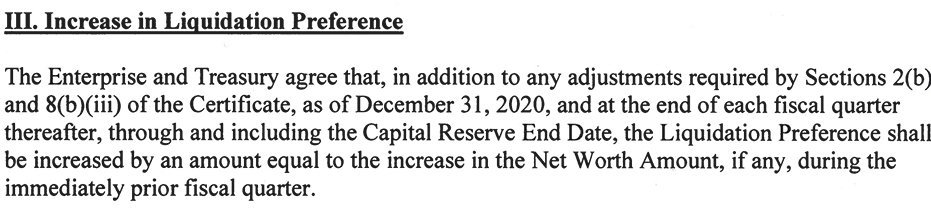

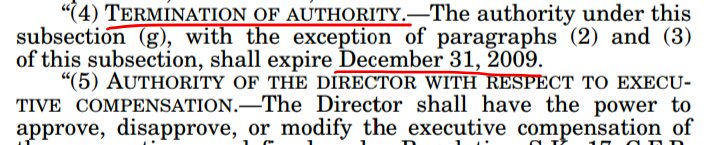

The Warrant was ONLY authorized (iii)to protect the taxpayer (from SPS losses), not for profit.

The Warrant was ONLY authorized (iii)to protect the taxpayer (from SPS losses), not for profit.

(iii)to protect the taxpayer, is related to the authority that HERA gave to UST to buy securities, like a Warrant.She can't cherry-pick the law. Do you see that the Warrant is authorized for profit?

She also omits that the Charter bars ANY retribution to UST other than cheap SPS.

She also omits that the Charter bars ANY retribution to UST other than cheap SPS.

The TIPP-EX queen distorts the Plaintiffs' Takings claim, reducing it to allegations of being "deprived of their rights" (rightfully transferred to the Conservator), omitting that the lawsuit adds "disregard of PROPERTY INTEREST w/ oppresive Warrant +use of FnF for Public Policy"

BOTTOM LINE

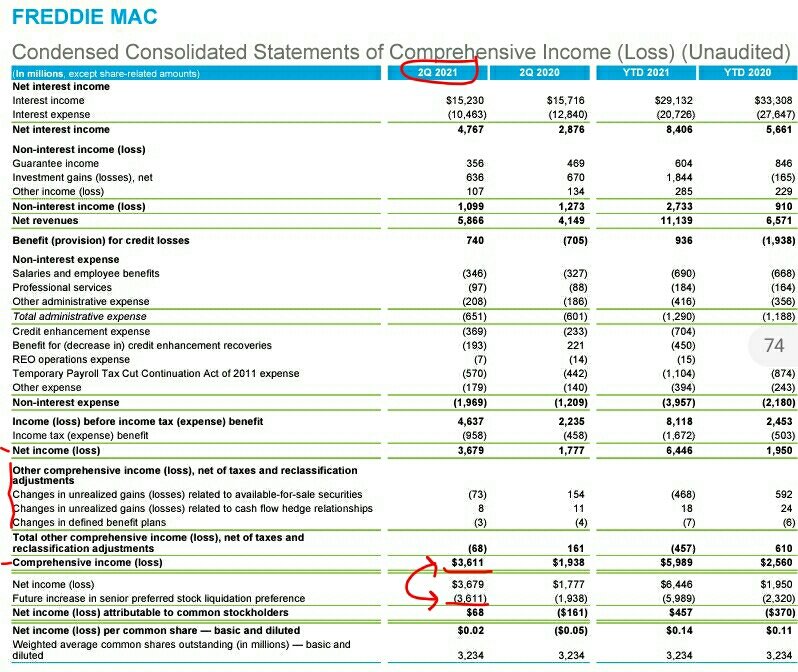

She has no idea what a Warrant is and the effect it has. E.g.FnF publish earnings reports on a diluted basis,i.e., assuming that the warrant was exercised.

The alleged felony is ongoing, as the current shareholders are deprived of a 100% ownership interest on FnF too.

She has no idea what a Warrant is and the effect it has. E.g.FnF publish earnings reports on a diluted basis,i.e., assuming that the warrant was exercised.

The alleged felony is ongoing, as the current shareholders are deprived of a 100% ownership interest on FnF too.

@threadreaderapp unroll.

• • •

Missing some Tweet in this thread? You can try to

force a refresh