THE CFOs' ILLEGAL ACCOUNTING MANEUVERS WITH THE SPS INCREASED FOR FREE (COUNT 3 & 4)

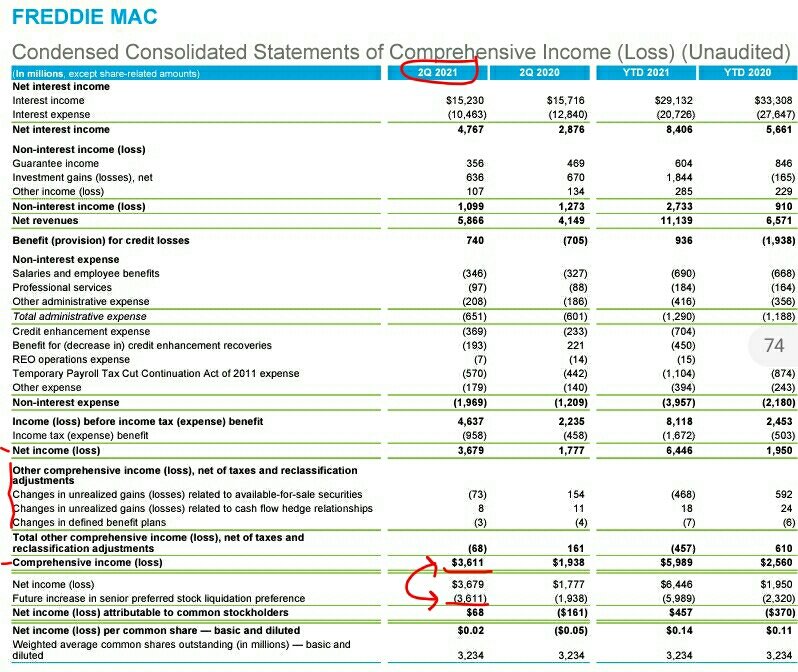

FnF report Comprehensive Income, not just Net Income.

What FnF do:

Not an expense result of operations

A change in Equity from nonowner sources

Distribution to a Preferred Stockholder.#Fanniegate

FnF report Comprehensive Income, not just Net Income.

What FnF do:

Not an expense result of operations

A change in Equity from nonowner sources

Distribution to a Preferred Stockholder.#Fanniegate

https://twitter.com/CarlosVignote/status/1432189385173348353

This is why FnF don't include it in Other Comprehensive Income for the Total Comprehensive Income,but outside the Comprehensive Income, as a distribution of income, like occurs with a cash dividend to the JPS/SPS holders.

This is misleading because the ending result is Net Income

This is misleading because the ending result is Net Income

attributable to shareholders, but it's also known as Net Income distributable to shareholders. By considering it like a cash div, there's no income left for distribution, when that's untrue. SPS increased for free means that there's no cash wire,so the Net Income is available for

distribution to shareholders(after the JPS div)

BOTTOM LINE

A pure Equity transaction that is only recorded on the Bce Sheet and,as a liability compensation,it's debited,i.e.,record an offset charged against Additional Paid-In Capital(see initial SPS for free)or Retained Earnings

BOTTOM LINE

A pure Equity transaction that is only recorded on the Bce Sheet and,as a liability compensation,it's debited,i.e.,record an offset charged against Additional Paid-In Capital(see initial SPS for free)or Retained Earnings

BULLET POINTS

(1)FnF include it on the Statement of Comprehensive Income because they consider it a change in Equity from nonowner sources.

(2)Not an expense,otherwise,along with (1),it should have appeared as Other Comprehensive Income.

(3)FnF fail recording it as cash dividend.

(1)FnF include it on the Statement of Comprehensive Income because they consider it a change in Equity from nonowner sources.

(2)Not an expense,otherwise,along with (1),it should have appeared as Other Comprehensive Income.

(3)FnF fail recording it as cash dividend.

CONCLUSION

FnF are sure that it's a change in Equity,not an expense, which is correct.

FnF fail to post this change later in Equity on the Bce Sheet (count 3:Fin Statement Fraud)

Notice that FASB had a similar debate with the ESOPs(employee stock ownership plans) and it concluded

FnF are sure that it's a change in Equity,not an expense, which is correct.

FnF fail to post this change later in Equity on the Bce Sheet (count 3:Fin Statement Fraud)

Notice that FASB had a similar debate with the ESOPs(employee stock ownership plans) and it concluded

that it's a pure Equity transaction,even though, unlike SPS increased for free, ESOPs are an expense.

Notice that ESOP shares are committed to be released,but recorded today and debited. Like the SPS that are also stocks committed to be "increased" at the end of the next quarter.

Notice that ESOP shares are committed to be released,but recorded today and debited. Like the SPS that are also stocks committed to be "increased" at the end of the next quarter.

We see that, not only FnF don't post the correct amount on the balance sheet, but also,the supposedly "real data" is also wrong, as it should appear also the SPS committed to be released the next quarter, as "compensation liability".

This is a Deceivership, not a Conservatorship.

This is a Deceivership, not a Conservatorship.

The NW Activity table that FMCC should have published:

We see that Comprehensive Income increases.The scam artists repeat that FnF build Capital, like @TheJusticeDept's SG,@FHFA,@USSupremeCourt,etc.But it's wiped out with the offset.

OUTCOME

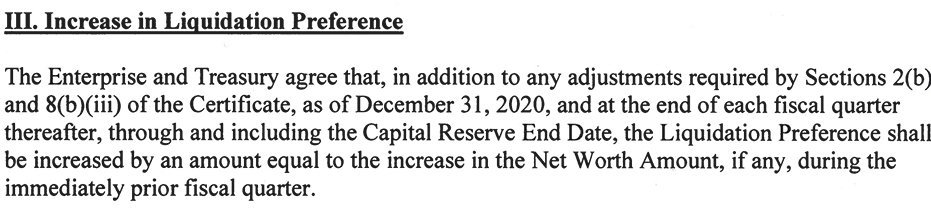

FnF's NW increase=SPS increase

NWS 2.0

We see that Comprehensive Income increases.The scam artists repeat that FnF build Capital, like @TheJusticeDept's SG,@FHFA,@USSupremeCourt,etc.But it's wiped out with the offset.

OUTCOME

FnF's NW increase=SPS increase

NWS 2.0

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh