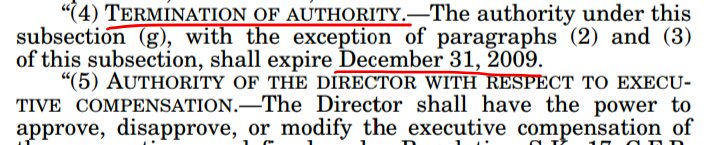

INC POWER: IN THE BEST INTERESTS OF FHFA-C,NOT @FHFA

"Authorized by this section". It should've been Act,like FDI Act.Drafted by Calabria?

Power: S&S condition. FHFA chose solvent 1st(reduce SPS)instead of soundness(1st,Recap until Undercap for release,then reduce SPS)#Fanniegate

"Authorized by this section". It should've been Act,like FDI Act.Drafted by Calabria?

Power: S&S condition. FHFA chose solvent 1st(reduce SPS)instead of soundness(1st,Recap until Undercap for release,then reduce SPS)#Fanniegate

Other examples of this Inc Power:

-The best interests of FnF is recapitalization(earnings),but FHFA chose a prudent stance forcing them to over-reserve for future losses(more than 2x the actual credit loss through 2011),increasing the losses(SPS)

-Selling off loans to reduce risk

-The best interests of FnF is recapitalization(earnings),but FHFA chose a prudent stance forcing them to over-reserve for future losses(more than 2x the actual credit loss through 2011),increasing the losses(SPS)

-Selling off loans to reduce risk

Multiple examples of what a conservator can do,instead of focusing on earnings.What also is behind the word "may".But once FnF post earnings (C. Capital),it's kept for Recap.

Scotus interpreted it w/ "in the best interests of the Agency and,by extension,the public it serves".Sick

Scotus interpreted it w/ "in the best interests of the Agency and,by extension,the public it serves".Sick

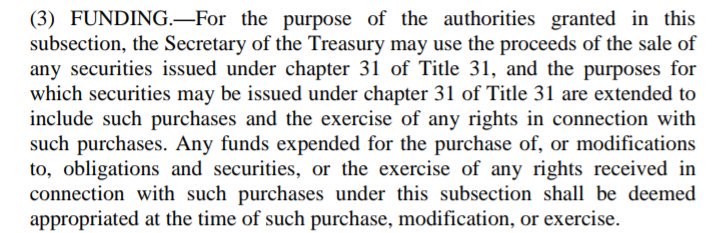

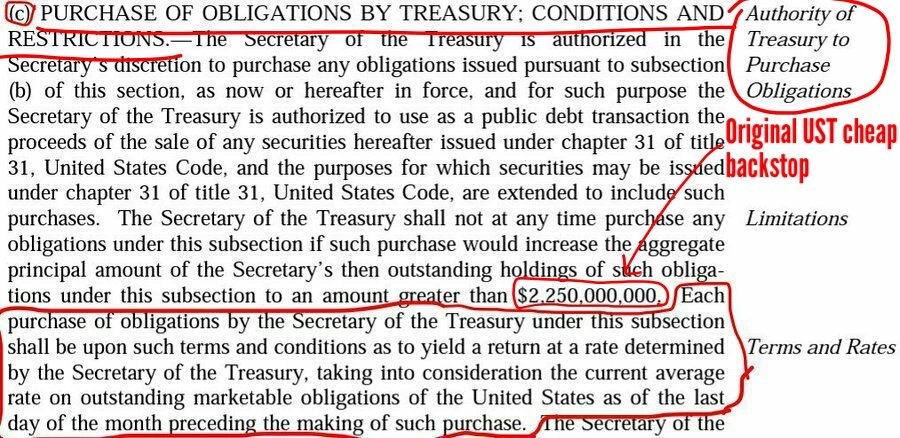

FHFA-C could've recapitalized FnF to Adeq Capitalized,before start repaying the SPS. @USTreasury doesn't care(SPS's cumulative div).Although the Warrant is a security authorized (iii)to protect the taxpayer,i.e.,collateral(barred in the Fee Limitation).It lowers a low rate to 0%.

The idea that FHFA-C chose SPS reduction 1st, surges when it authorized Capital distributions.The law only authorizes it for the reduction of SPS,otherwise restricted.A div is Capital distribution.

In 2011,the ill-conceived CFR1237.12,for Recap(SPS about to be repaid)

SECRET PLAN

In 2011,the ill-conceived CFR1237.12,for Recap(SPS about to be repaid)

SECRET PLAN

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh