If I could check previous week range of #Nifty & #BankNifty and see how many times Index stays inside the previous week range, where prev week high is not broken and also prev week low is not broken,if happens often, then I can create a non directional option selling strategy 1/n

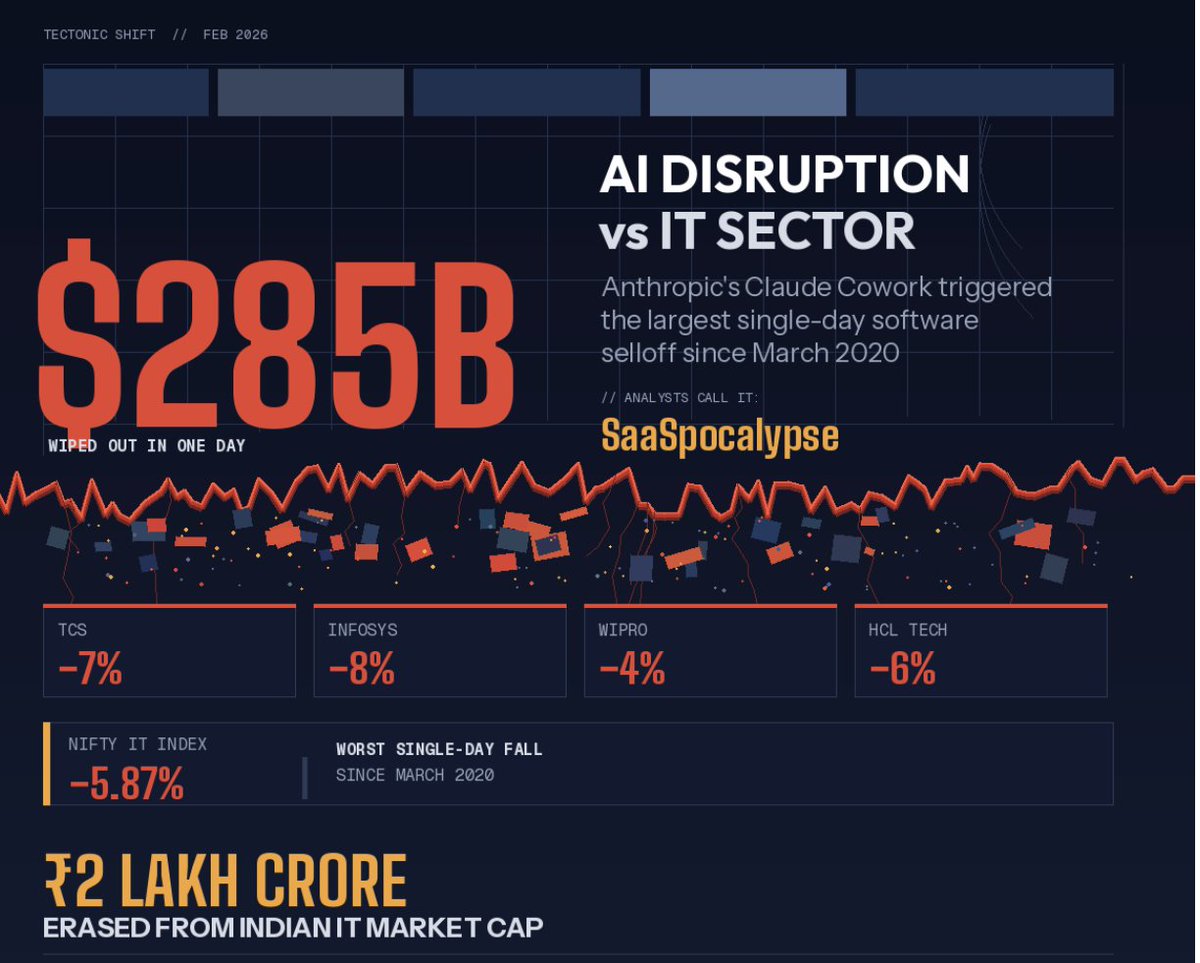

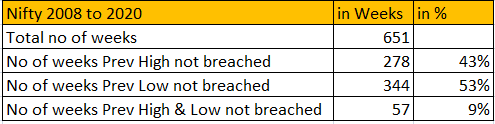

So I did a analysis, to find how many times Index DID NOT break its previous week high, previous week low and how many times did not break either high or low. This chart shows the details of #Nifty

Out of 651 weeks, less than 10% of the times Nifty stayed inside previous day range, as market trend up over the long run, more than 53% of the time previous week low was not breached at all.

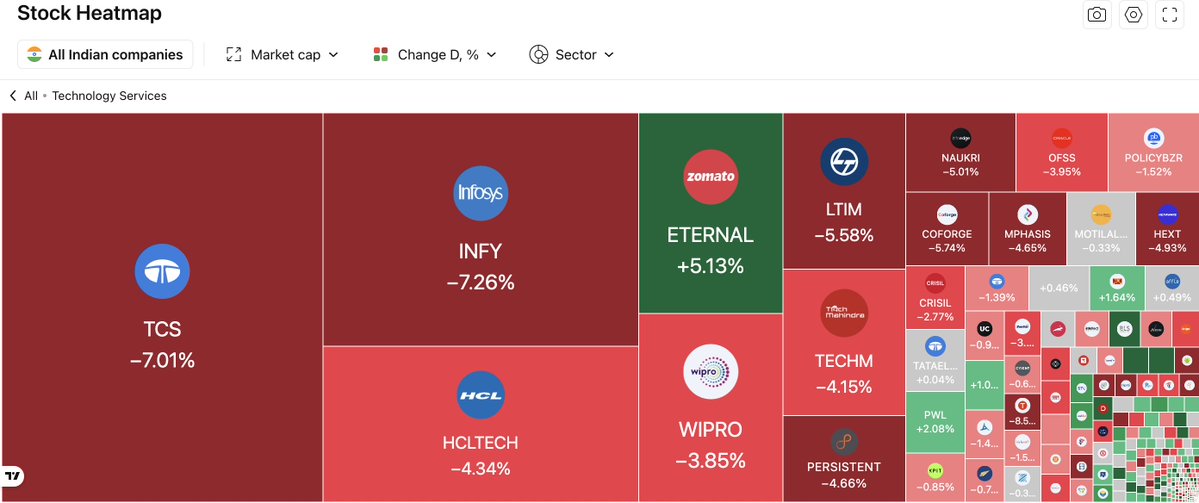

Here's the similar analysis for #BankNifty where maximum number of times, its previous week low was not breached.

Out of 540 weeks, only 10% of the times BankNifty stayed inside previous day range, as market trend up over the long run, more than 55% of the time previous week low was not breached at all.

I was curious to find what happens when we focus on those 10% of time where index stayed inside the previous week range, what happened the following week after that? Could see explosive moves after range contraction.

This is how both Nifty and Bank Nifty reacted on a weekly basis for past 10+ years.

• • •

Missing some Tweet in this thread? You can try to

force a refresh