A short thread follows

See, for instance, here kansascityfed.org/~/media/files/…

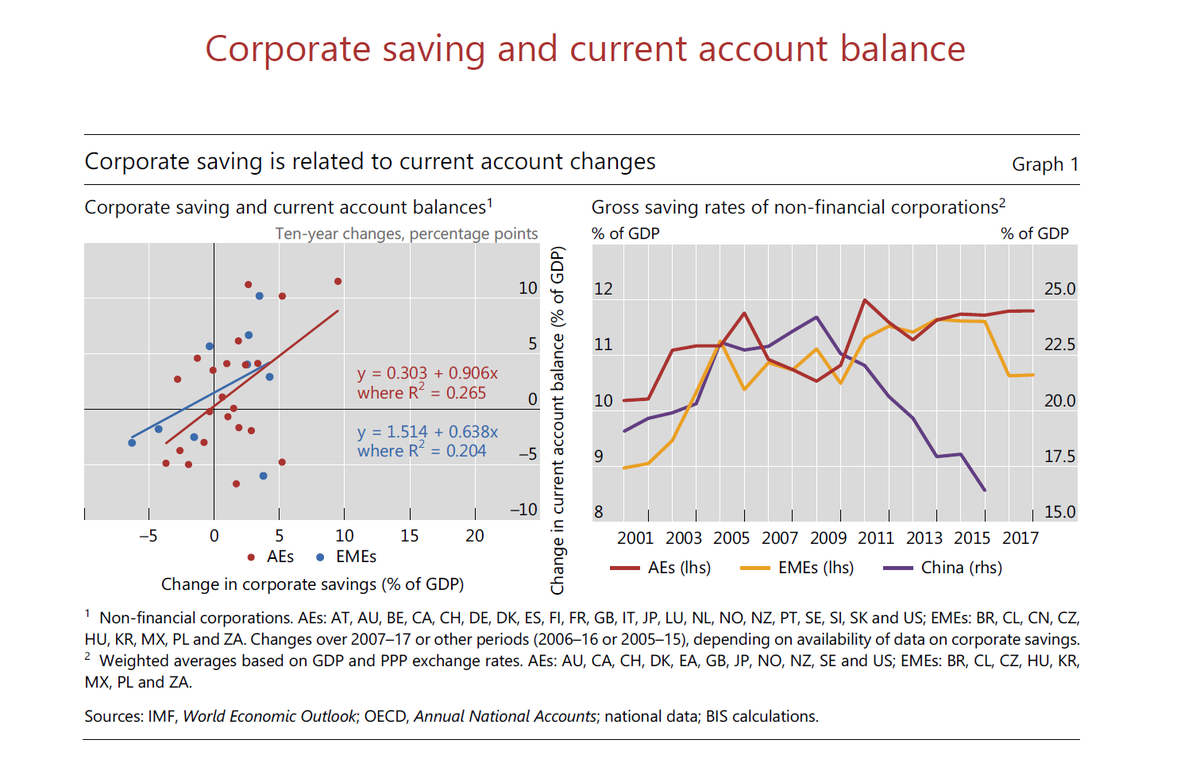

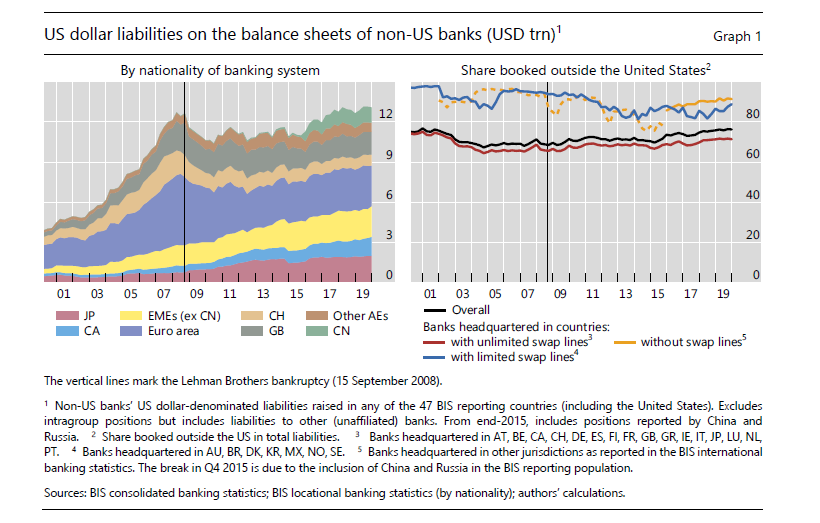

Global firms don't fit neatly into the "island economy" model; they operate globally, producing and employing workers in several islands, and owned by shareholders globally

(Philip Lane joined as a co-author, together with Stefan Avdjiev and Mary Everett)

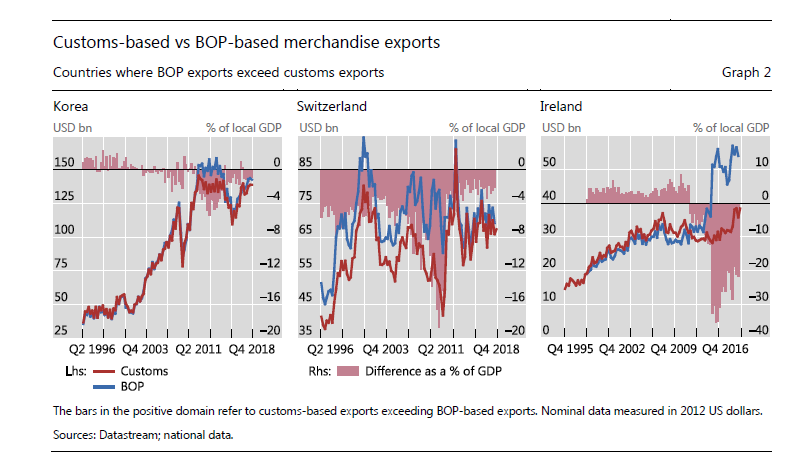

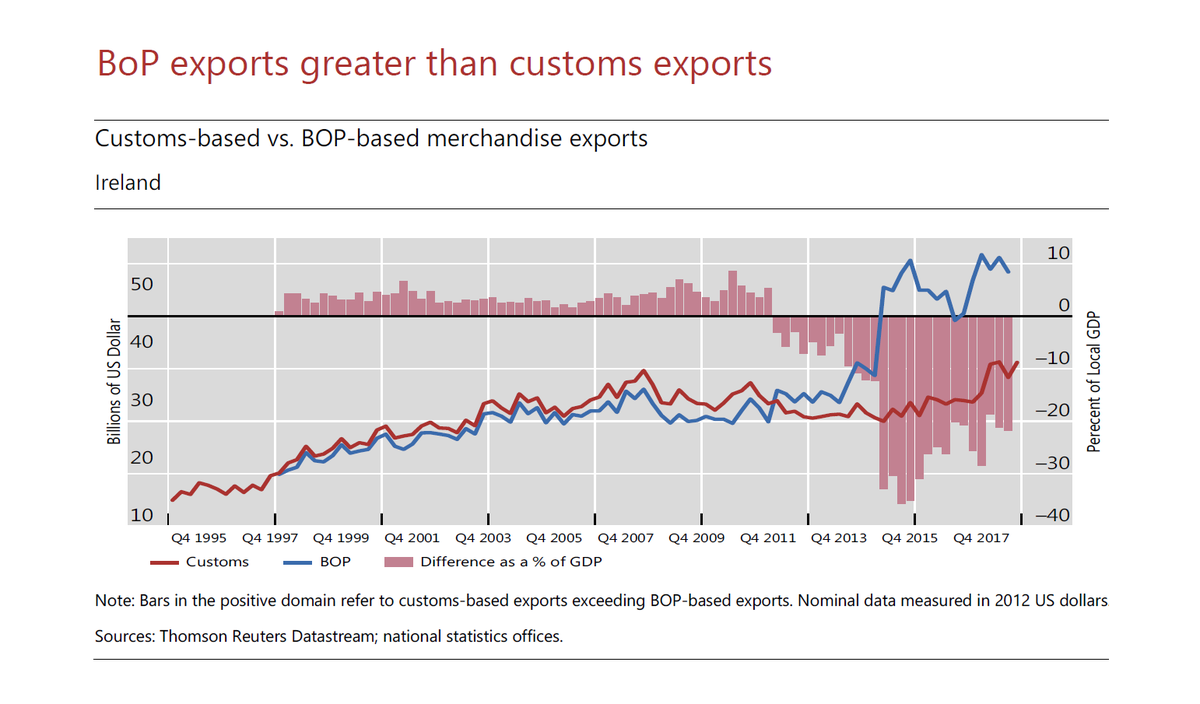

The growing footprint of global firms means that even merchandise exports need to be understood better; "exports" does not mean that the good actually crosses the border