1️⃣ Why your tax firm needs RPA

2️⃣ Why you probably won't buy it from today's vendors

3️⃣ How to build an API for your client tax data

Legacy tax software is perfectly-suited for RPA:

-Boilerplate forms & inputs

-A large volume of the same thing in a standardized format

On the spectrum of things RPA can do, putting data into, and pulling data out of tax software should be straight-forward.

🤸♂️ CCH, Thomson Reuters & Intuit profit massively from platform lock-in, but RPA can liberate your data, syncing it with virtually any external system.

But here's the reason why 99.9% of small firms haven't bought it:

Small firm owners are hustlers, they need to get sh*t done. GSD mode isn't a safe place for pie-in-the-sky. I'll happily cut a check when you show me what will get me home for dinner tomorrow.

✅ I'll happily buy an RPA library that works with my toolset, Host the implementation for me, and sell me the top 3 use cases.

😍 Sales pitch 2: UltraTaxBuddy - An API for your client & tax data. Sync tax data to any system automatically, and make it searchable & actionable.

Building an API for your tax software actually shouldn't be that hard, what's frustrating is that we're the ones having to build it ourselves.

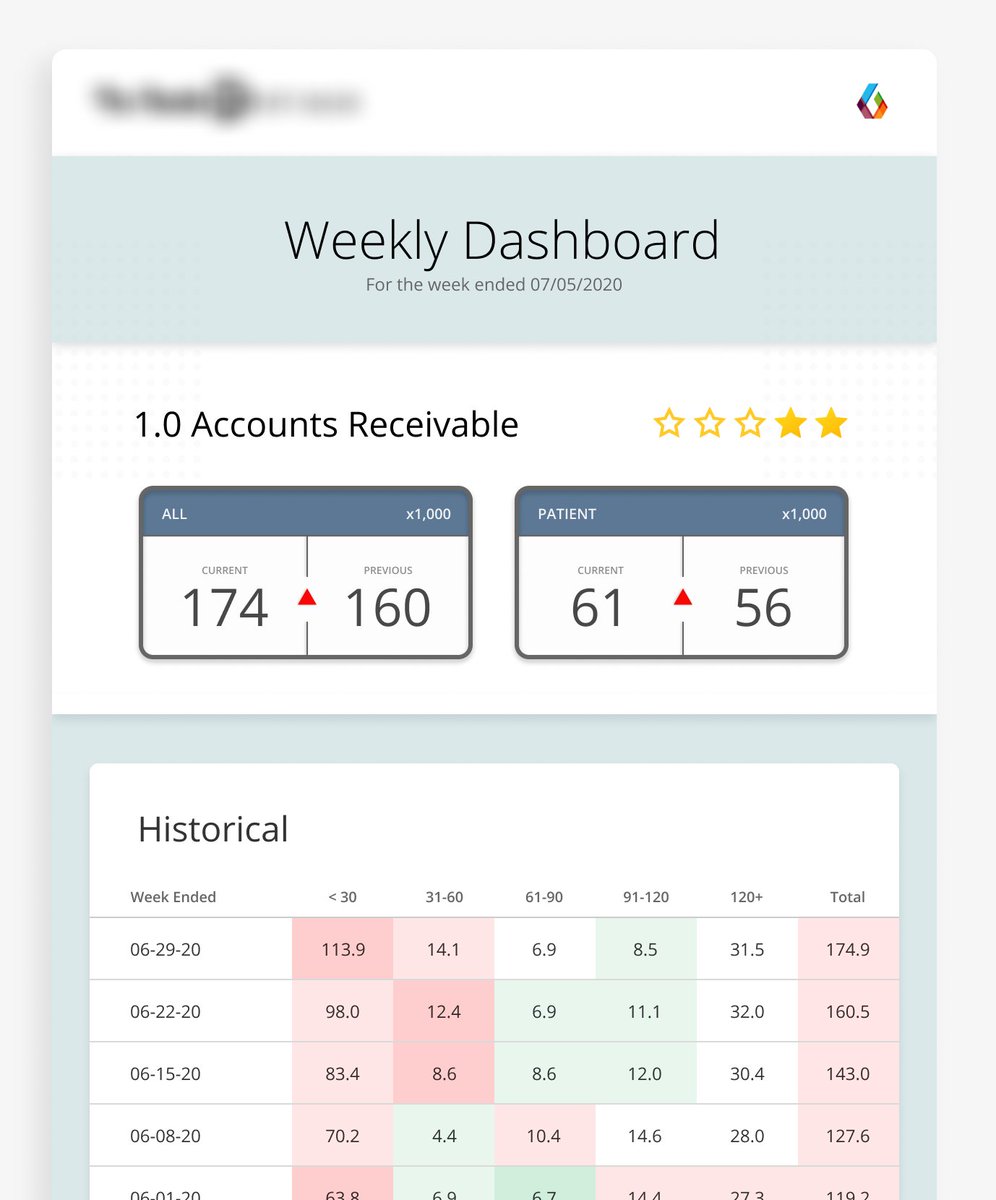

⬅️ Pulling data out of your system

➡️ Pushing data into your system

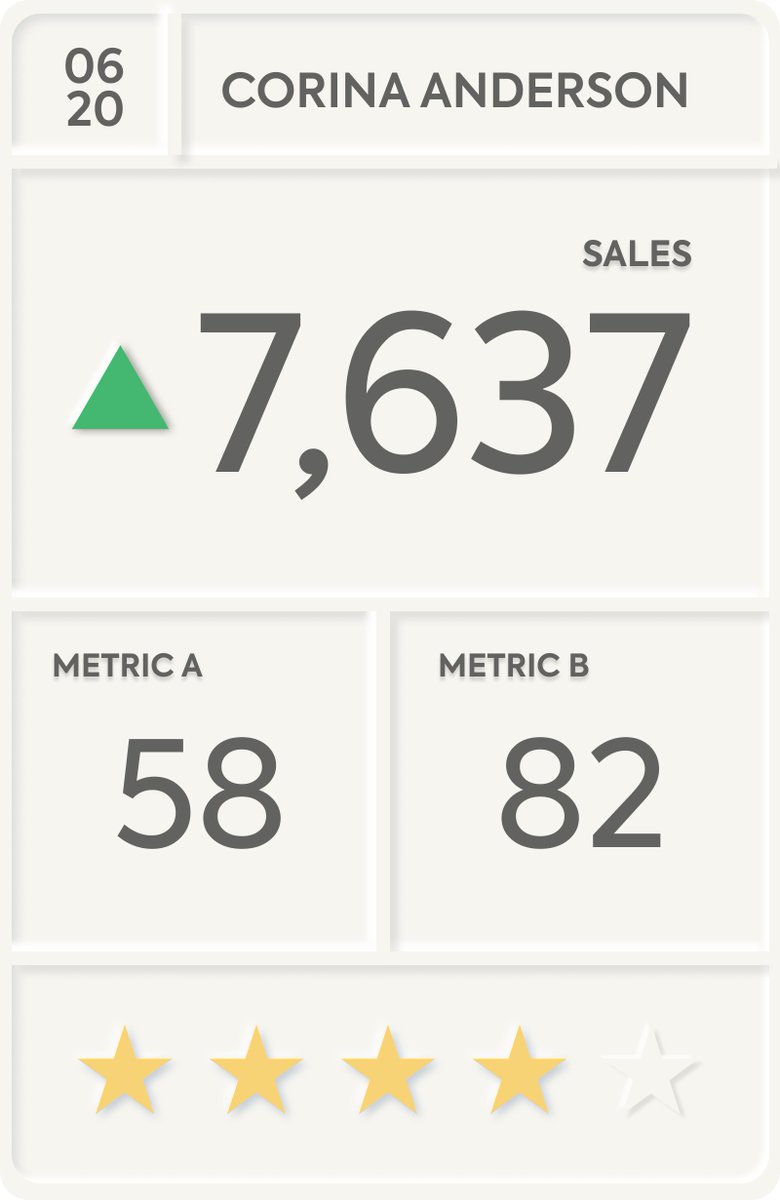

Decide what data points you want to pull from returns. Using 1040s as an example, maybe you want to see if a specific tax form is present, like a Schedule C. Maybe you want AGI, QBI, NOL, etc. Could be any number of data points.

🔍 Drop it into a web-based DB with a strong API (Airtable), and you've got an API for your tax data.

Determine which inputs you want to be accessible, and train your bot where the relevant input fields are.

Connect with a client-facing system, like a form asking for any changes to their personal info, and push those updates to your tax software.

Don't store sensitive data like SSNs & EIN

Associate data with a client ID, not their identity (name/social)

Tax software vendors can torpedo this via bot-proof authentication

RPA vendors, please don't make us build these things ourselves-We're accountants