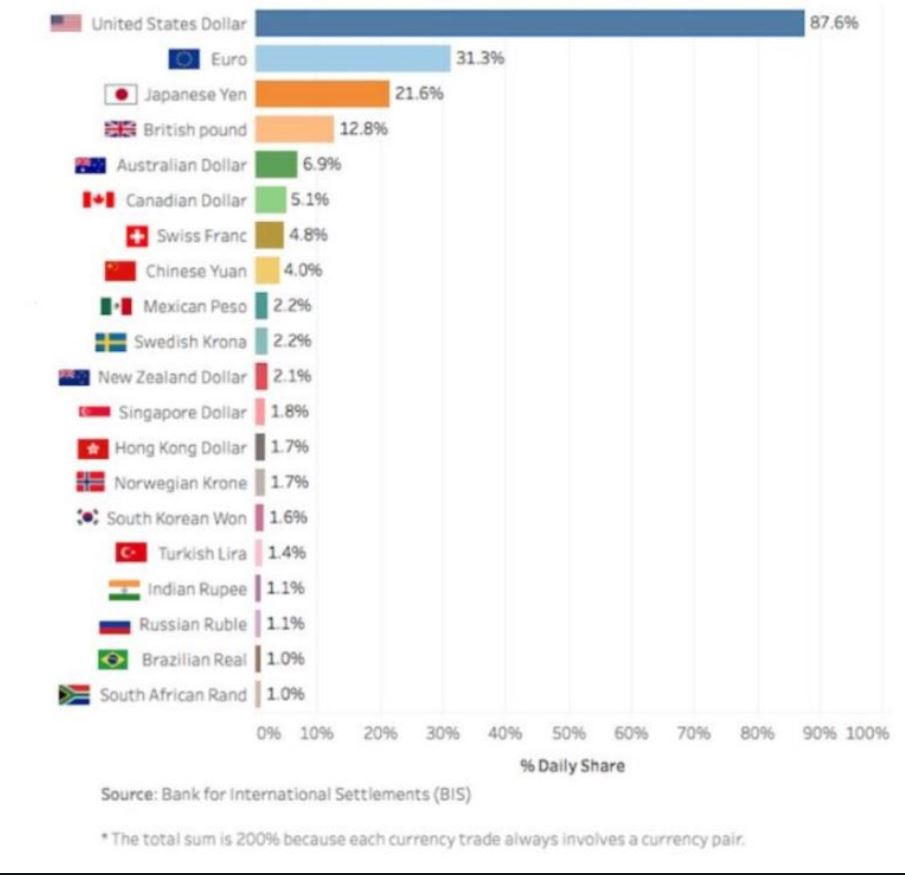

1) No contender. Use of other currencies is much weaker.

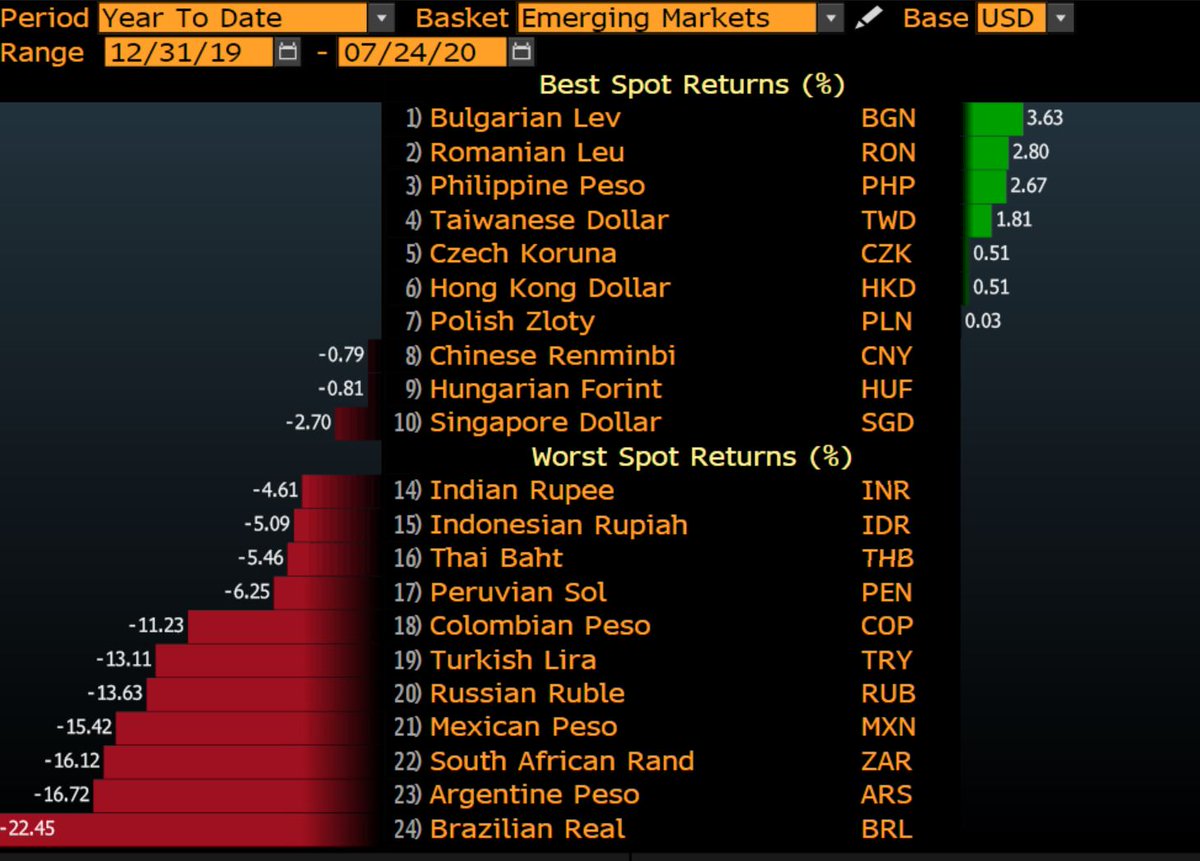

2) The US Dollar is UP vs most emerging currencies.

3) There is no Gold-backed currency out there

Gold is money. Fiat money is credit.

Thread:

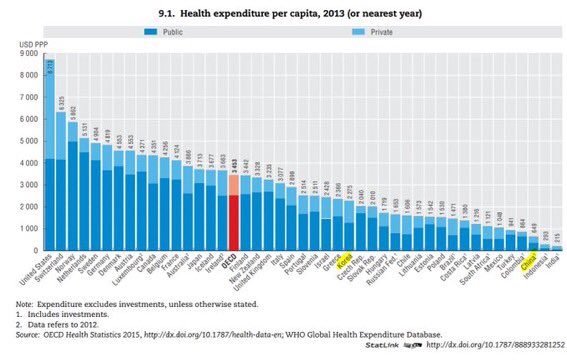

Hence, buy Gold. Not euros or even weaker currencies.

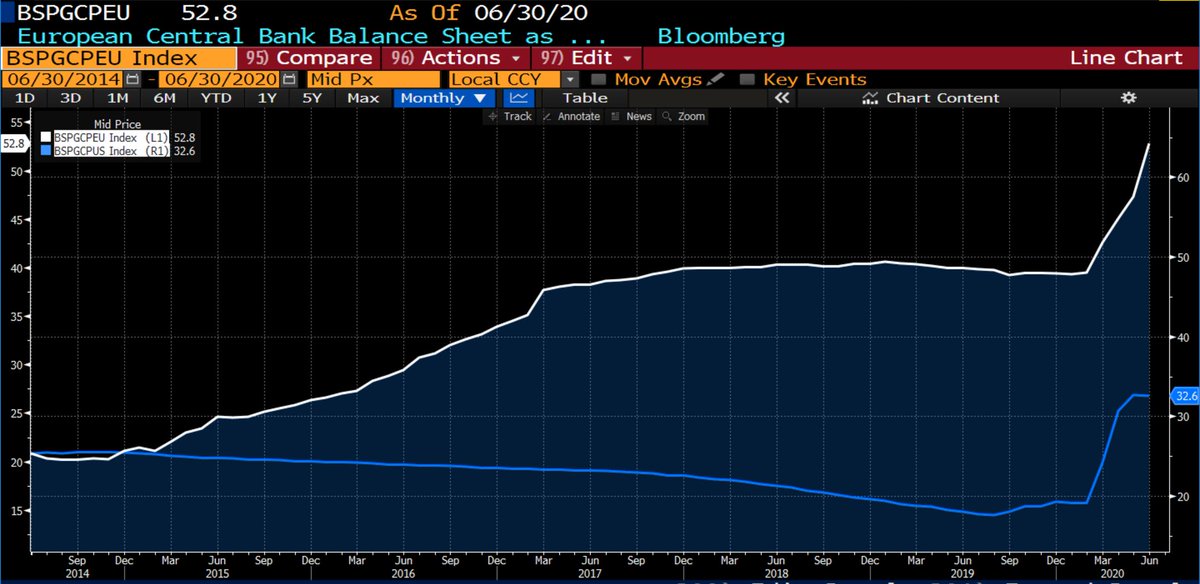

And without the $ global demand

Buy Gold and Silver, maybe some crypto. Monetary insanity will get crazier as recovery hopes vanish, particularly in Europe. End thread