PhD #Economist #Author. Chief Economist, Tressis. #Professor @IEbusiness #Advisor @frdelpino. YouTube: https://t.co/sjWtBdfIT7

15 subscribers

How to get URL link on X (Twitter) App

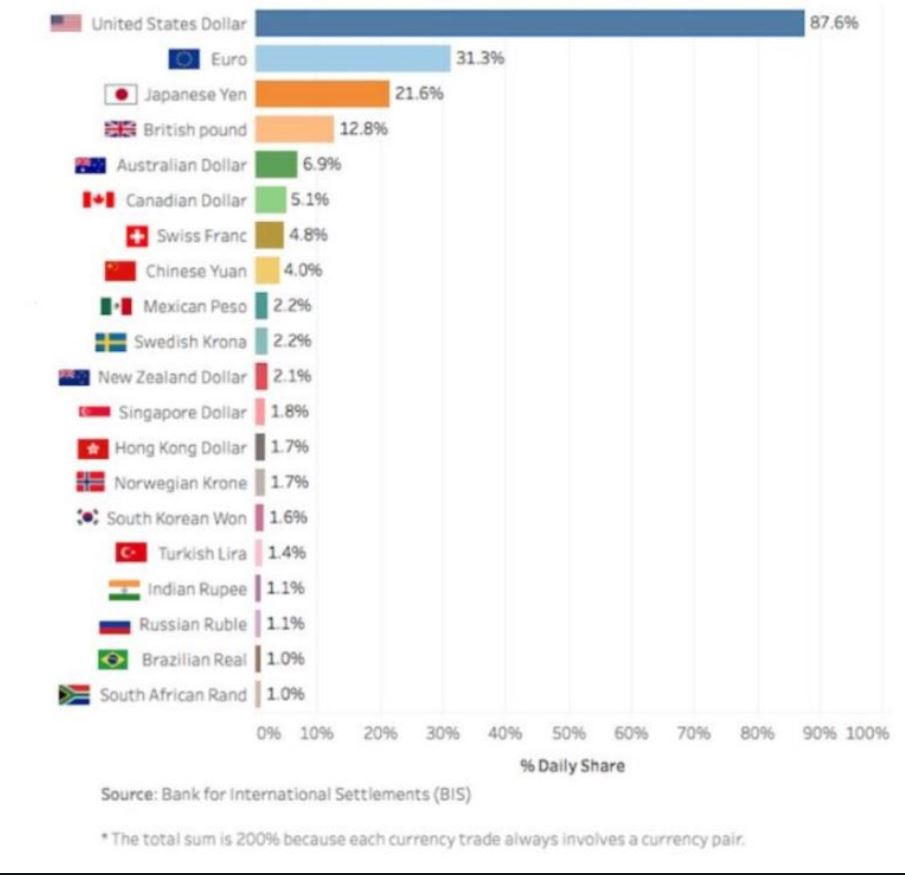

Since the end of the gold standard, massive debt build and risk-taking have made financial crises more frequent albeit shorter.

Since the end of the gold standard, massive debt build and risk-taking have made financial crises more frequent albeit shorter.

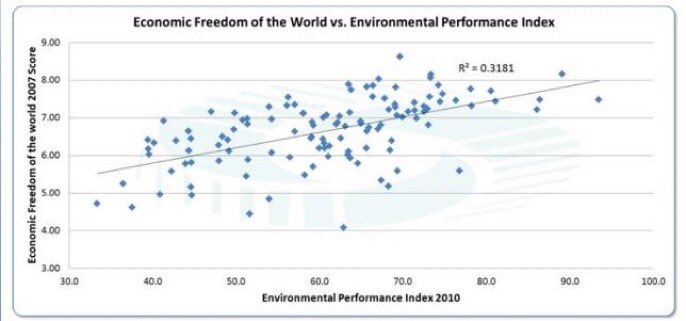

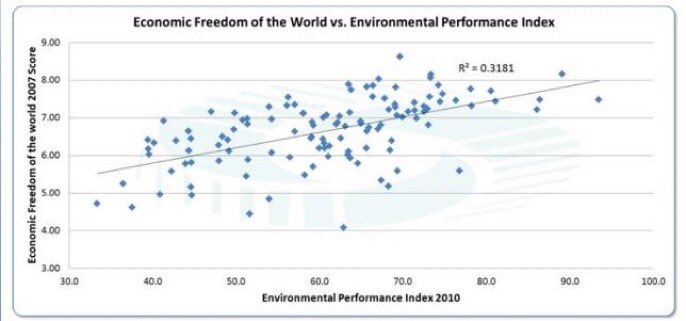

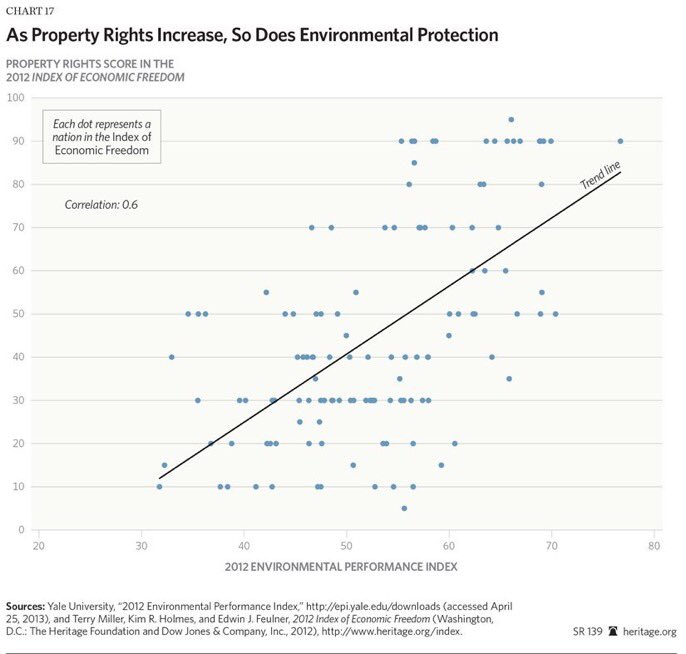

Interventionism and socialism have never protected the environment. They always subsidize the most polluting sectors and raise taxes on citizens with the excuse of the weather.

Interventionism and socialism have never protected the environment. They always subsidize the most polluting sectors and raise taxes on citizens with the excuse of the weather.

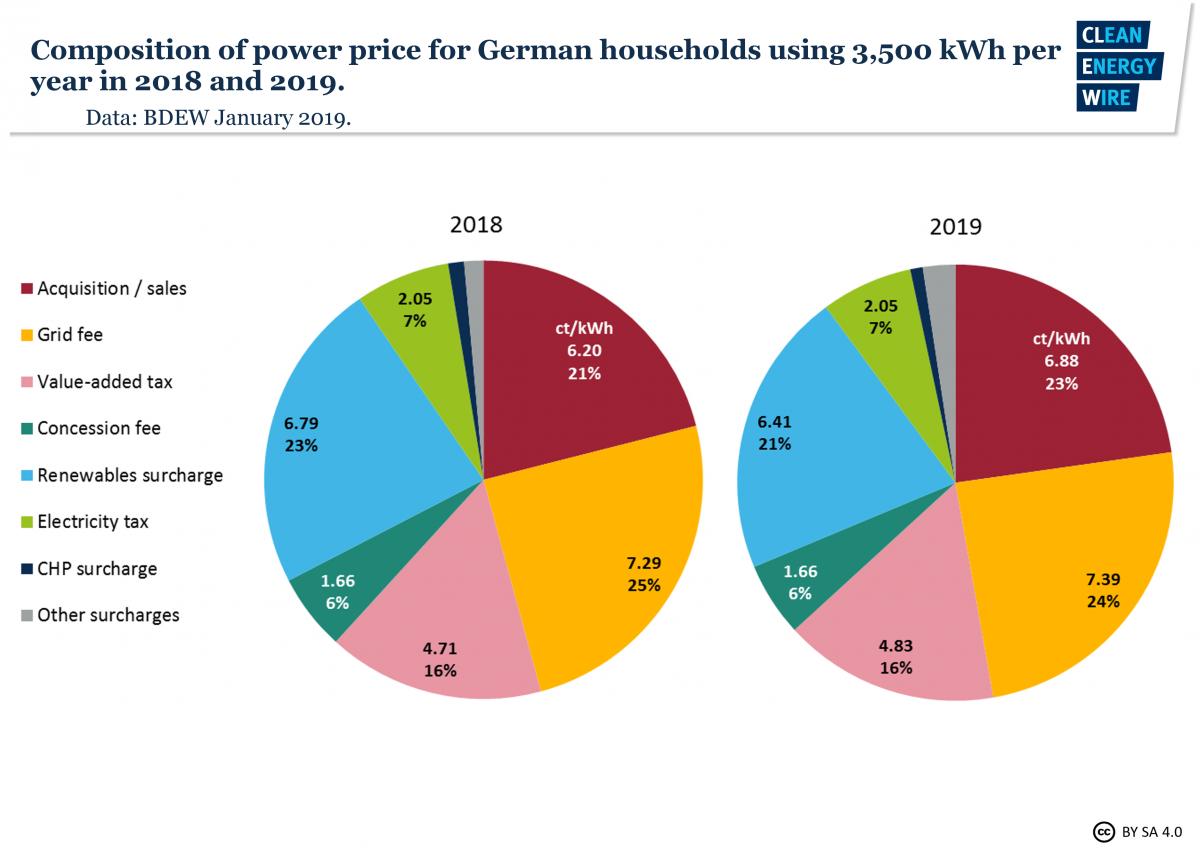

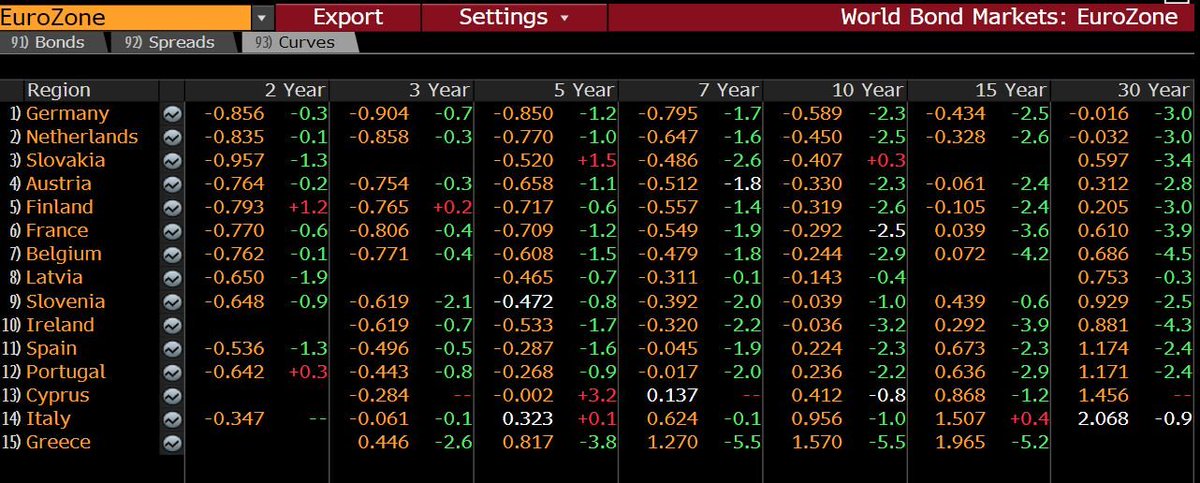

The massive subsidies of the Energiewende green plan have not improved CO2 emissions (Germany will likely miss its own 2020 target) and cost up to €500 billion so far.

The massive subsidies of the Energiewende green plan have not improved CO2 emissions (Germany will likely miss its own 2020 target) and cost up to €500 billion so far.

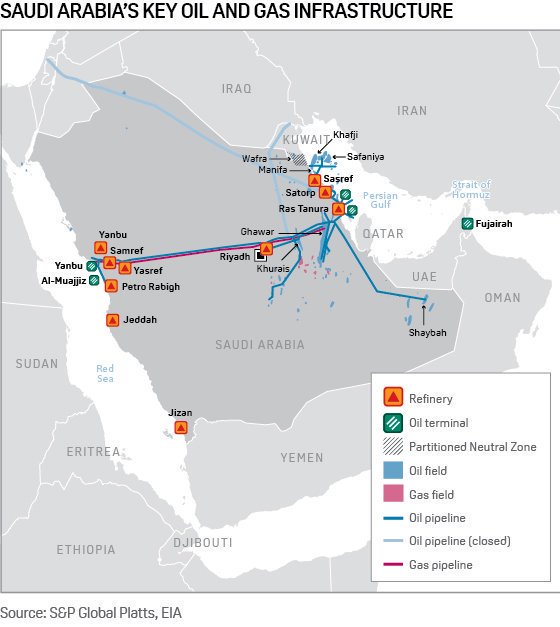

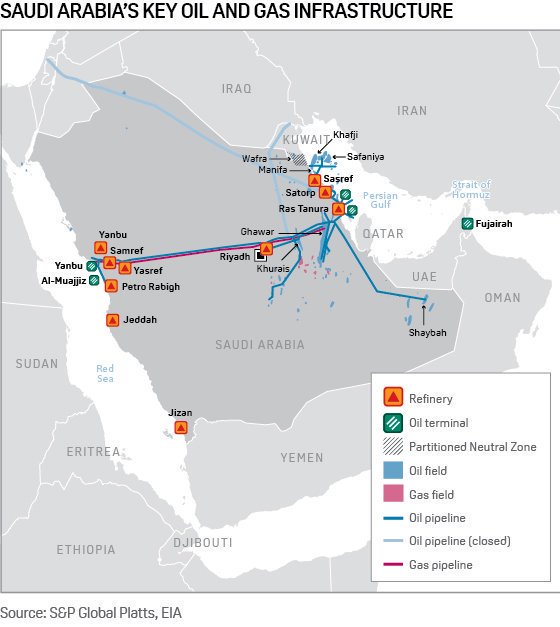

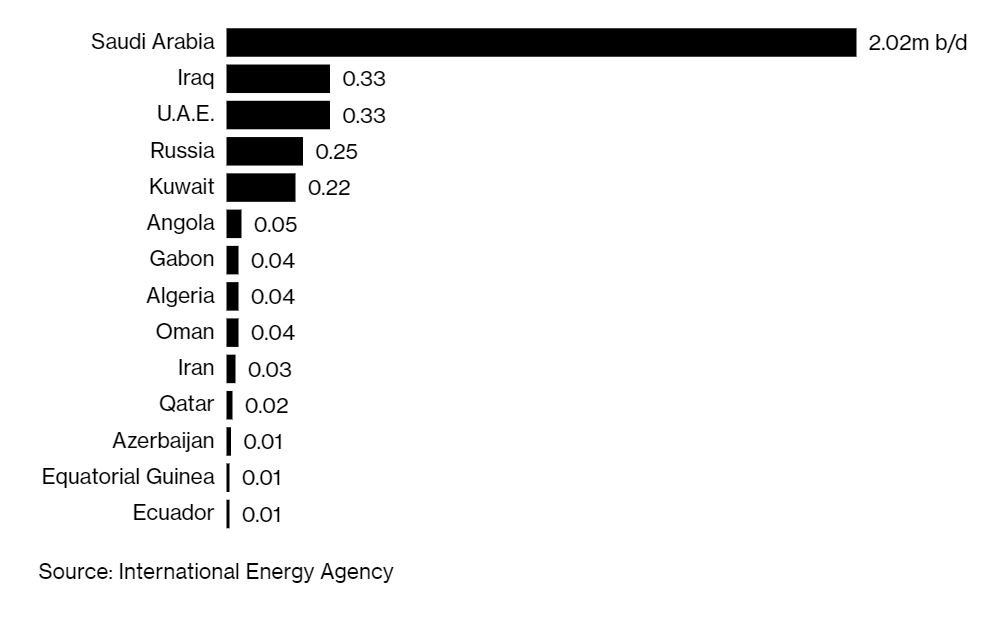

1) Saudi Arabia is the OPEC country with the largest spare capacity. Although the drone attack impacts 5% of global supply, it also comes at a time when supply glut was evident, global inventories are large and substitution is relatively easy.

1) Saudi Arabia is the OPEC country with the largest spare capacity. Although the drone attack impacts 5% of global supply, it also comes at a time when supply glut was evident, global inventories are large and substitution is relatively easy.

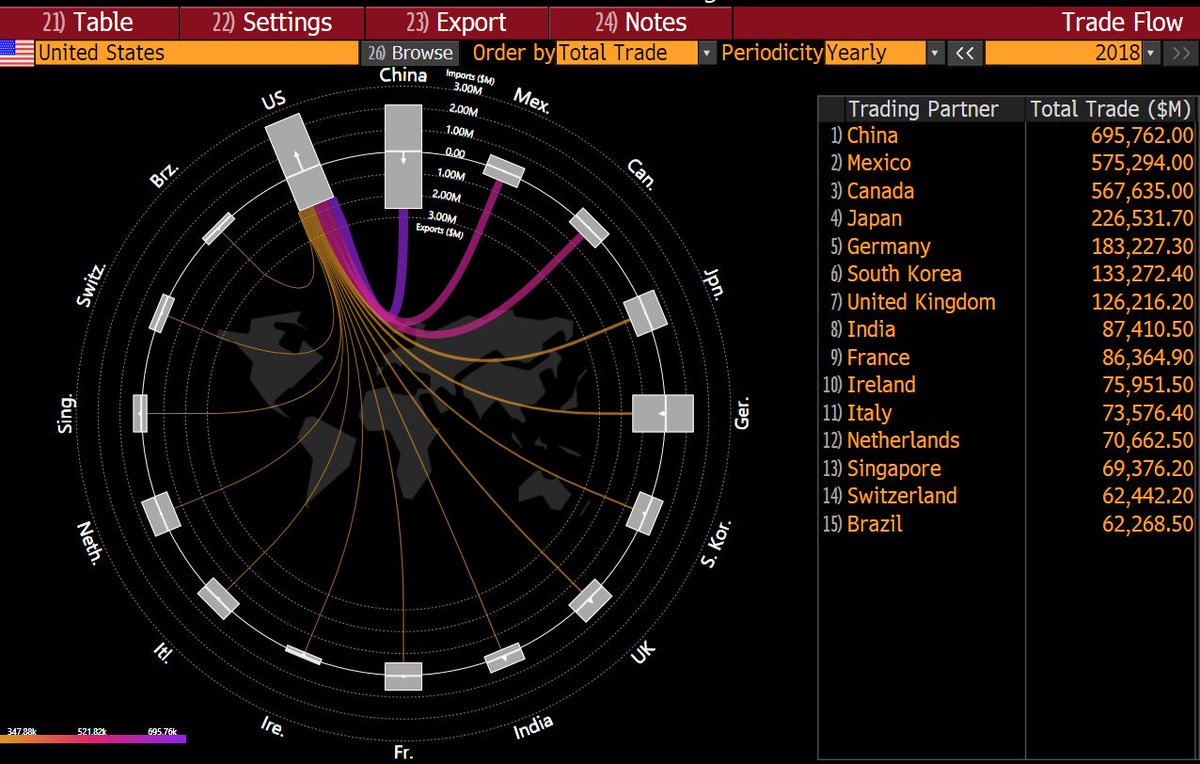

2) China depends on the US trade more than the US on China. China's trade surplus is mostly all with the US while it enters a trade deficit with most other partners.

2) China depends on the US trade more than the US on China. China's trade surplus is mostly all with the US while it enters a trade deficit with most other partners.