Get a cup of coffee.

In this thread, I'll help you understand stock splits.

I was actually going to talk about DCF calculations this week.

But on Thursday, Tim Cook (Apple's CEO, @tim_cook) announced that Apple is going to split its stock.

Based on how people reacted to this announcement, I realized there's a lot of confusion around stock splits.

Stock splits are actually pretty simple. There's no need for so much confusion.

So let's try to clear this up!

Side note to @tim_cook: I love you man, but it's not easy to prepare a thread like this on short notice. Next time, a heads up would be nice.😉

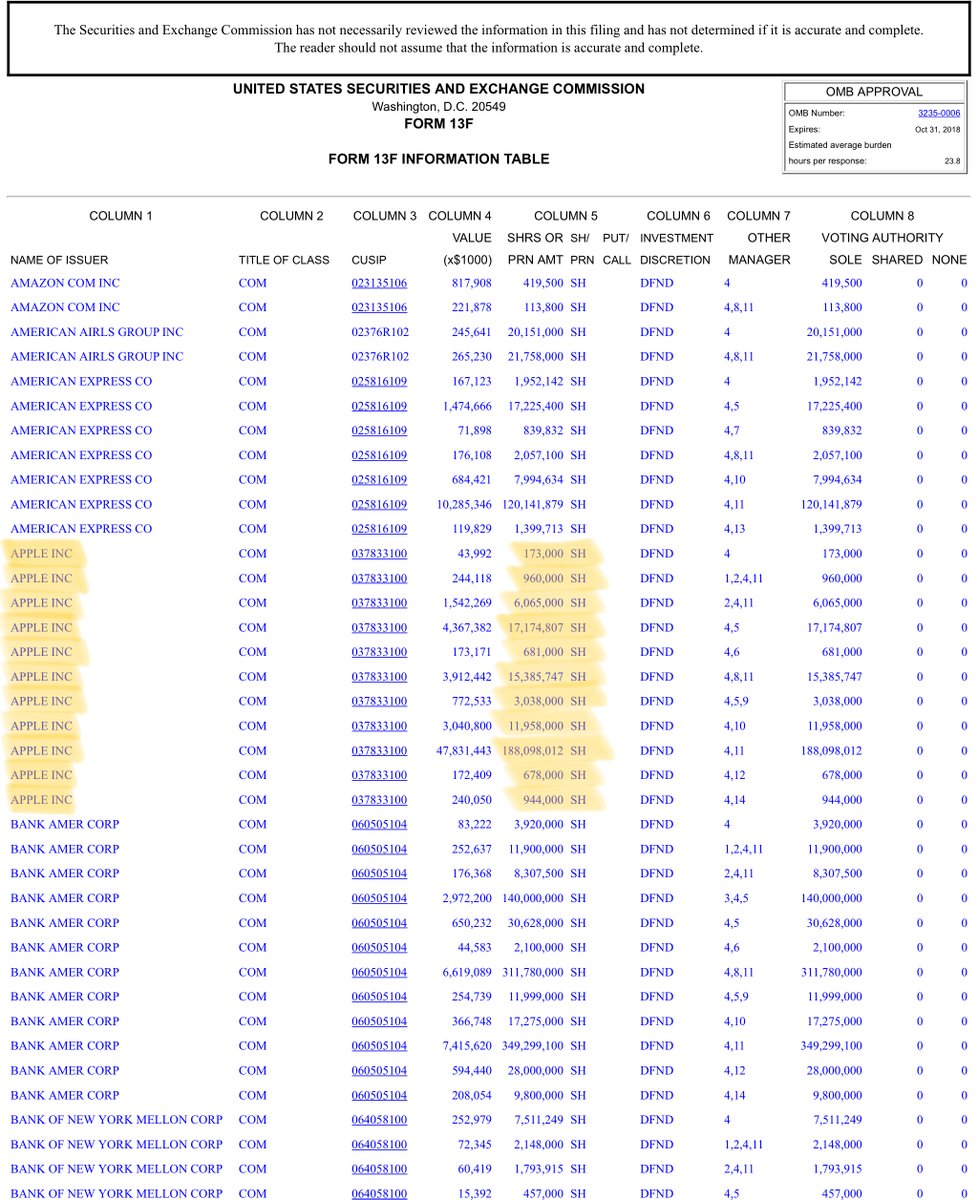

For example, if you own 100 Apple shares now, you'll own 400 Apple shares come Aug 31 (assuming you don't sell any shares between now and then).

You don't have to do anything. Just log in to your brokerage account on Aug 31, and you'll see those extra 300 Apple shares.

This applies to all shareholders, not just you.

On Aug 31'st, all Apple shareholders will see the number of shares they own quadruple.

Now, what happens after the split?

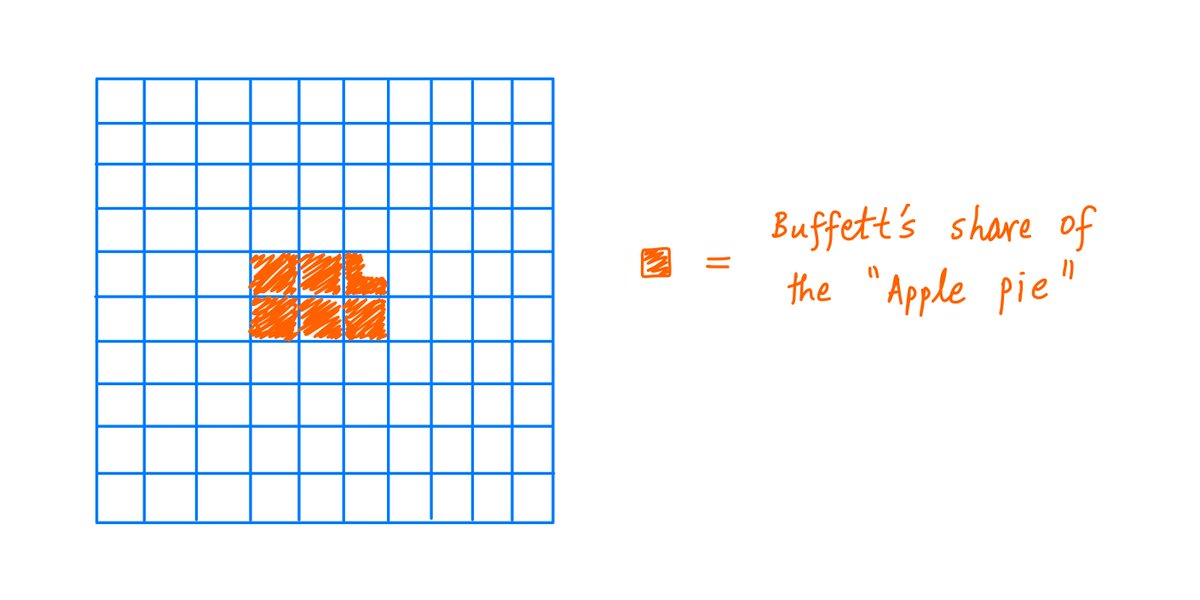

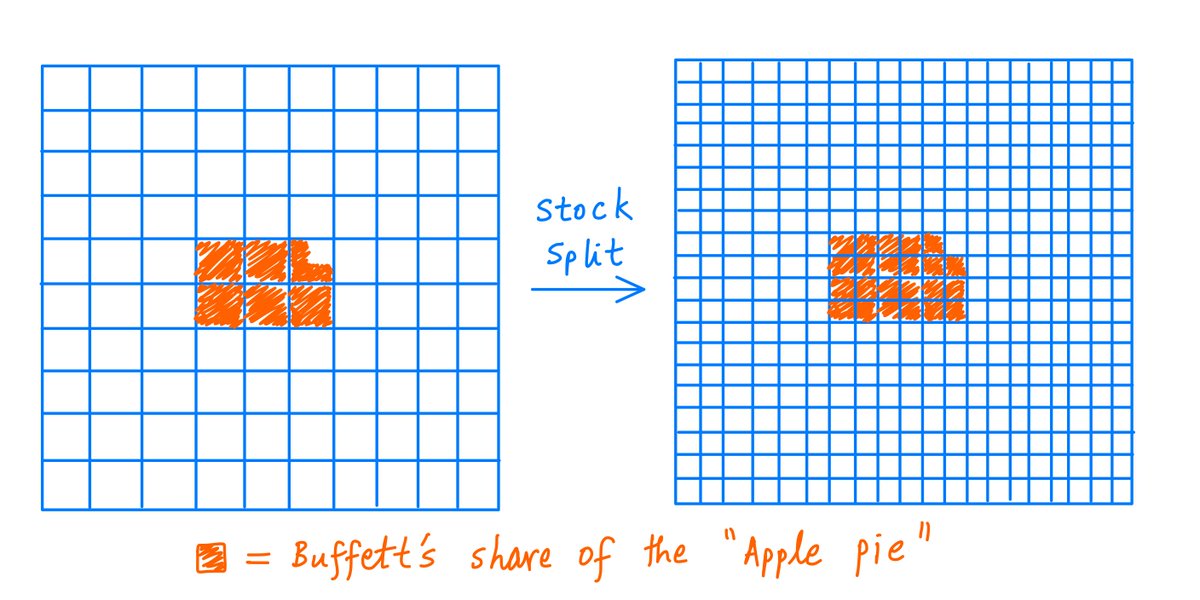

Well, after the split, the number of shares owned by Buffett will quadruple. So he will suddenly own 4*245,155,566 = 980,622,264 Apple shares.

But the number of shares owned by everybody else will also quadruple.

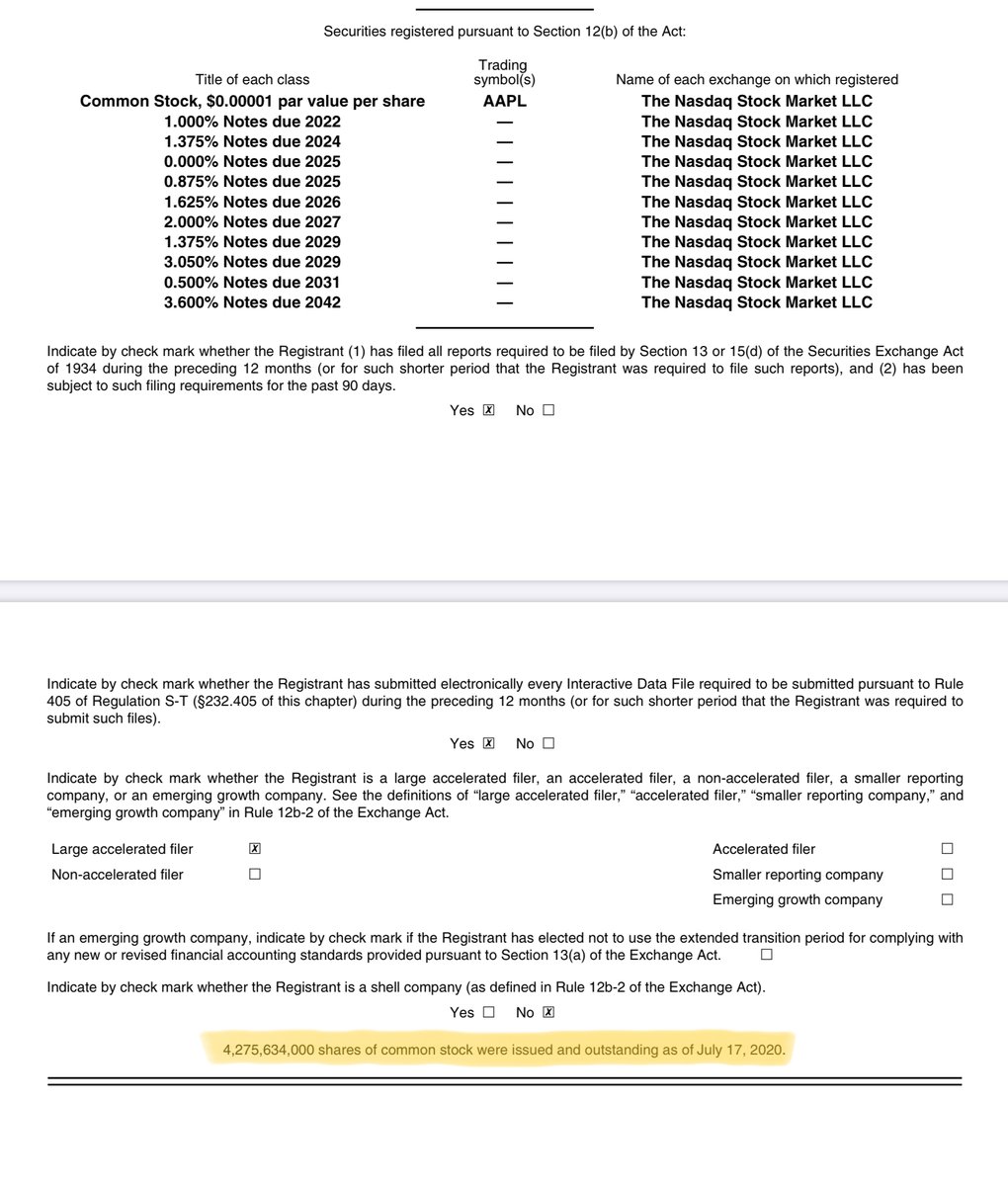

So, the total number of Apple shares outstanding will become 4*4,275,634,000 = 17,102,536,000.

Buffett's share of the post-split Apple pie will be 980,622,264/17,102,536,000 -- exactly the same 5.73%.

Key lesson: A stock split does not change your ownership interest in a company. Your share of the company's assets, cash flows, earnings, etc., remains exactly the same both before and after the split.

In stock price terms, Apple currently trades at about $400/share. So Buffett's stake is worth about 245,155,566 * $400 -- roughly $98B.

After the split, Buffett will own 980,622,264 shares, but the shares will trade at only ~$100 each. So his stake will remain at ~$98B.

But if stock splits don't really leave any shareholder better off, what's their point?

Why does Apple want to split its shares so badly?

The answer has a lot to do with human psychology.

Rationally analyzing the situation (as we have done above), stock splits should not create any value.

But human beings are rarely rational.

We suffer from all kinds of psychological biases.

One such bias is "sticker shock".

1 share of Apple costs $400? For that price, you can buy 2 shares of Microsoft!

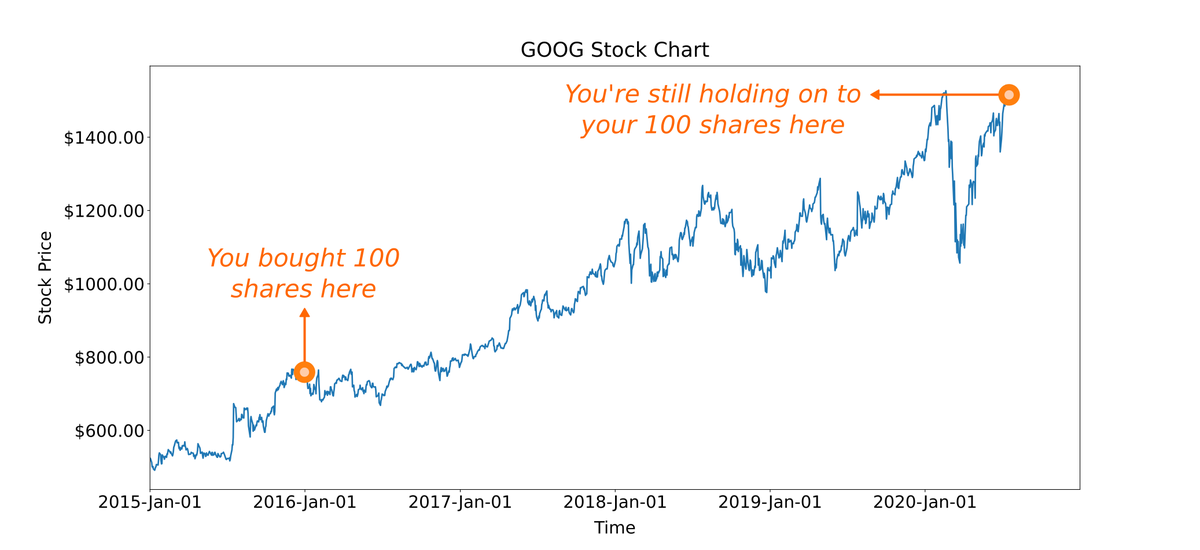

Google is already at $1500. So expensive. How much higher can it go? But look at Facebook. Even after yesterday's run up, it's only at $250. Lots of room to grow.

Many people think like this.

Another powerful bias is "anchoring".

We've seen Apple trading at $300 and $400. We're anchored to those prices.

If we see the price drop to $100, a part of us can't help but think the stock is a bargain at this new level -- even if we know all about stock splits.

For such psychological reasons, Apple shares may very well attract more buyers at ~$100 than at ~$400 -- even if the ~$100 shares represent only one-fourth the fractional ownership of the company.

And guess what happens when there are more buyers? The price goes up.

In this way, Apple's stock split may end up benefiting shareholders like Buffett -- if only thanks to the psychological shortcomings of people who don't bother to correctly understand stock splits.

But that won't be you -- as you're taking the time to read this thread.😀

Apple's stated reason for doing the stock split is that it will help small investors.

This argument is not without merit.

Many investors have only a limited amount of capital. A lower post-split sticker price can help such investors own a piece of Apple too.

For example, when I first started, I had only $2000.

A single share of Apple bought at $400 would have been a 20% position for me at the time, which may have been too big for comfort.

But at the post-split ~$100, the risk would have certainly seemed more tolerable.

Yes, some brokers offer fractional shares to help investors with limited capital.

But many brokers don't.

And many investors may not know about fractional shares, or may not trust their broker to handle fractional dividends, etc.

A stock split may be a cleaner solution.

Stock splits also help options traders.

Options contracts almost always specify 100 shares of the underlying company. This can tie up a lot of capital if the underlying shares are priced high.

For example, if your strategy is to buy Apple shares and sell covered calls, you need at least ~$40K of capital pre-split, but only ~$10K post-split.

For more details, here's my thread covering the basics of options trading:

A stock split can also help a company get included in an index.

For example, in the US, the Dow Jones Industrial Average (Dow for short) is a price-weighted index. Adding a high-priced stock to it can seriously overweight the index towards that stock -- so they won't do it.

For example, in 2014, Apple was trading at ~$700/share. This was way too high for the Dow.

Then Apple did a 7-for-1 stock split, which brought the stock price to ~$100/share.

Then, and only then, was Apple added to the Dow.

To me, the most interesting part of this thread is how stock splits cause people to succumb to their psychological biases and behave irrationally.

So I'll leave you with some super-interesting resources to learn more about human psychology and its many failings.

"Nudge" is an excellent and readable book about human psychology as it applies to financial decision making. It was written by Nobel Prize winning economist Richard Thaler (@R_Thaler).

amazon.com/Nudge-Improvin…

In the same vein, I also very much like the book "Predictably Irrational", by Dan Ariely (@danariely).

amazon.com/Predictably-Ir…

And of course I have a Charlie Munger reference!

His speech, "The Psychology of Human Misjudgment", is simply wonderful.

YouTube link (~1hr, 16min):

If you'd rather read than watch, @ShaneAParrish has you covered: fs.blog/great-talks/ps…

That's all, folks!

Thanks for reading. Enjoy your weekend.

/End