I respectfully disagree with Tom. Square will remain the leader for next gen POS and SMB services. But Fiserv, and Visa and MC may have a new threat. Thread below.

As a Square shareholder, I almost shit my pants.

Two years later, and Square is still chugging along and growing. So what gives?

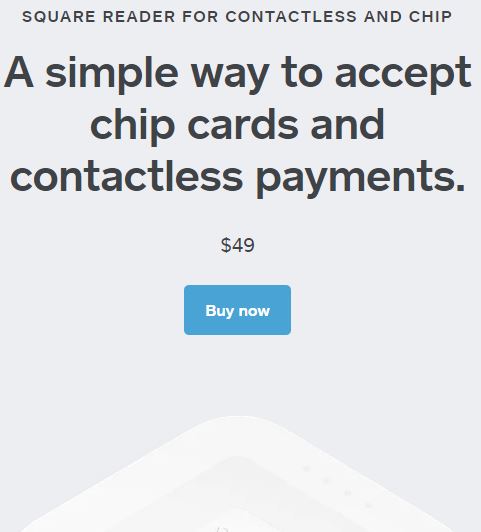

Square has market-leading risk tooling, based on years of losses and near losses, and years more of heavy investment to make “Risk” a first-class product within Square.

wowt.com/content/news/P…

Apple doesn’t have to compete with Square head on - maybe they just enable the banks to do it.

Apple now makes a few cents on each ApplePay transaction thanks to tokenization and processing fees.

Onboard your bank to Apple’s card acceptance wallet. Bank uses Apple to auth/capture with the networks. Bank holds all the funds and manages SMB customer experience.

Wells Fargo Merchant Services? Actually First Data.

Bank of America Merchant Services? Actually First Data.

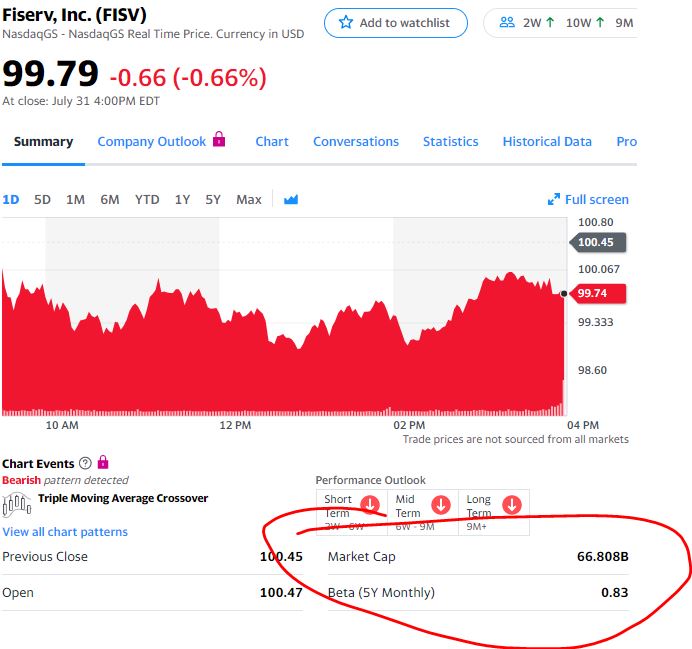

Why is First Data special? Because they help banks directly connect to, and manage data with, Visa and MC. FD also sells this as its own acquiring business. Now part of Fiserv.

BBPOS deftly does not disclose rack rate pricing on its Website, but some sleuthing shows a range of costs.

And I didn’t forget.

But in the future, what’s stopping Apple from cutting out V or MC? Why can’t this turn into a Chasenet-like offering?

But it’s why I don’t think Apple’s purchase makes Square a loser.

Remember, banks have been ignoring SMBs for a while. That’s why Square, PayPal, Stripe, Kabbage, BlueVine and others exist.

(Yes - I know - cue the DMs about needing a blog)