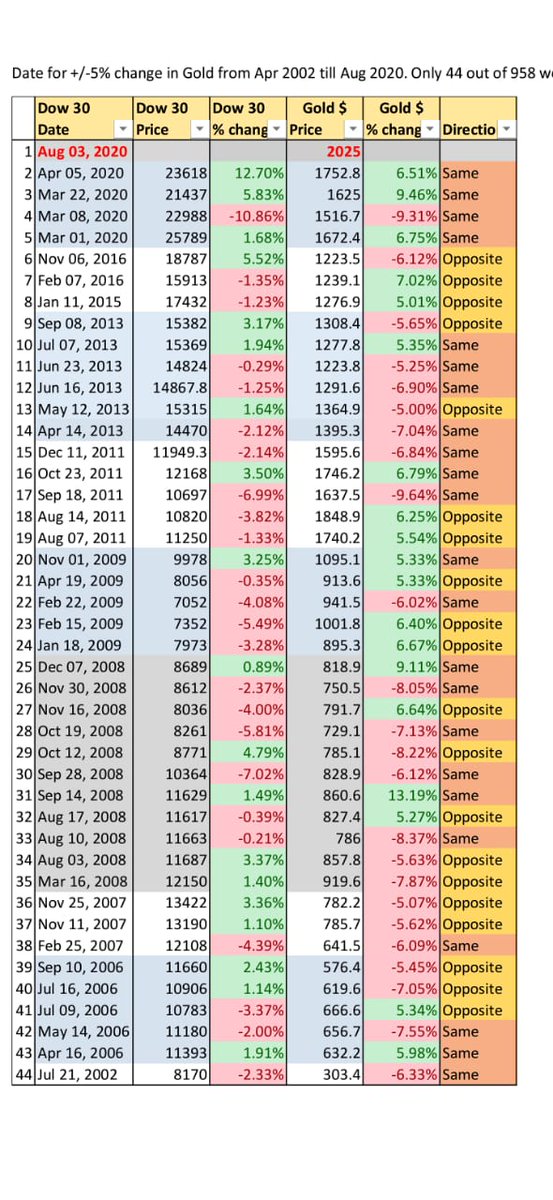

Data of 958 weekly close from Apr 2002 to Aug 2020 analysed. (18 years, 958 Wks)

Of 958 Wk, only 44 Weeks have given + / - 5% move in #GOLD

Plotted Dow Jones move 4 same week as +/- 5% move in #GOLD

Data as below.

@DEVENDRACHATUR1

Observations:

1)Out of 43 times, 11 times in 2008, 5-6 times in 2007 /09/13

2)#EPIC2020, happened 4 times already, this week potential ? 2025 ?

3)Dow and Gold hv been same direction of move for 23 times & opposite direction 20 times of the 43 outcomes. NO trend.

(FED BS / US GDP was ~20% in 2011/12) (FED BS went from 0.5 Trillion to 2.25 Trillion)

2020 high 1930 taken out (back after 9 years)

FED BS / GDP ~35% (FED BS went to 3.5 Trillion to 7.3 Trillion)

Possibilities:

1)Gold can be at least $ 4000 - $ 5000 in time to come if same history playbook repeats.

2)Key difference from history is Interest rate is ZERO which is UNIQUE to today ? Impact of that on any financial asset / liability is anybody’s guess ?

3)Death of MMT? FOR SURE ! It’s a matter of when versus whether it will die now?

4)Is d abv sustainable? Yes, USA having $ as Reserve Curr, zero rate, largest economy & military, space, internet, technology, far ahead of RestofWorld, it is possible to repeat the history!

5)While trend in 2-3 years is upwards, rough and bumpy ride is guaranteed. Need stoned heart and frozen stomach to handle this Volatality - GOLD FLASHBACK 2005-2011

Jan 05 - $410 (1985 - 20 YR lvl)

May 06 - 723 (+76%)

Oct 06 - 560 (-23%)

Sep 07 - 745 (+33%)

Mar 08 - 1014 (+36%)

Oct 08 - 681 (-33%)

TARP - 750 Bn

Aug 09 - 980 (+18%)

Dec 09 - 1225 (+25%)

Dec 10 - 1431(+17%)

Aug 11 - 1909 (+33%)

June 13 - 1225 (-36%)

End of Thread... @vinitrahtod

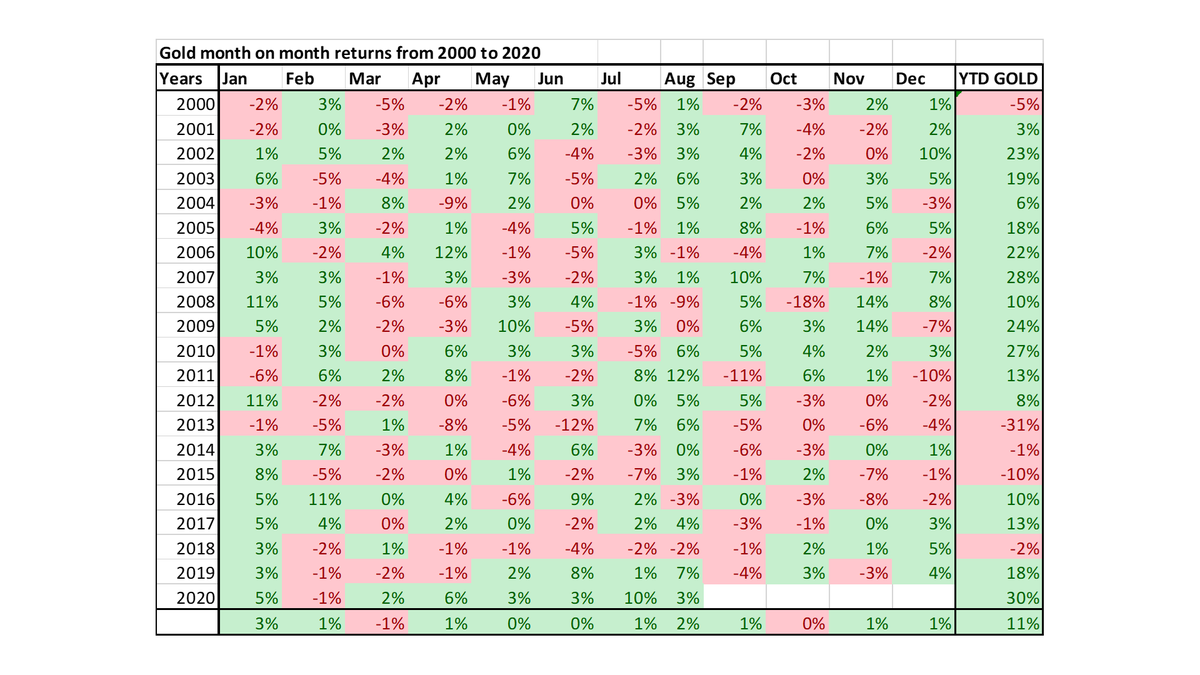

Observatn:

1) Gold +ve YTD returns in 15 out of 20 years. Out of 5 -ve yrs, 3 years (2000, 2014,2018 : -5%, -1%, -2%)

2) Thr4 only 2 big -ve YTD years.

2013 : -31%

2015: -10%

Both years were exceptional. EM FxCrises!

@DEVENDRACHATUR1

4) M pleasantly Surprised ! Wonder why not published much by mainstream Fin Pundits!

5) Gold is way better than Fixed Deposits, Tax benefit too!

End. TY

Are we done for the year ?

Or will #EPIC2020 break the record ?

@vinitrahtod