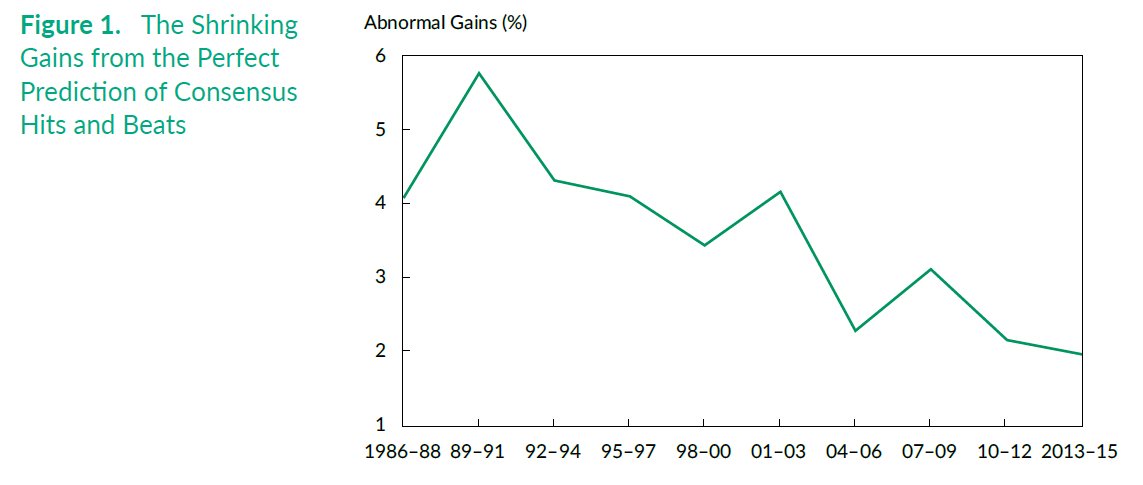

Imagine there's a genie who comes to you two months before the next quarter ends and tells you whether the stocks you own will meet, beat, or miss consensus estimates.

How much would you pay to have access to this genie?

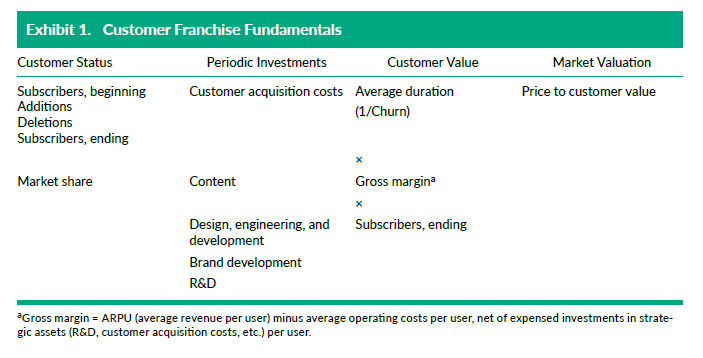

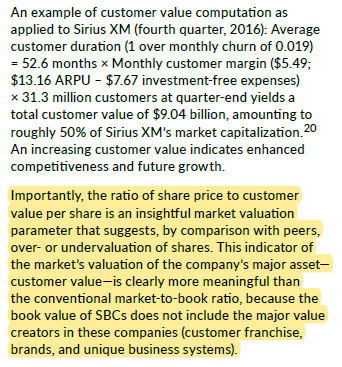

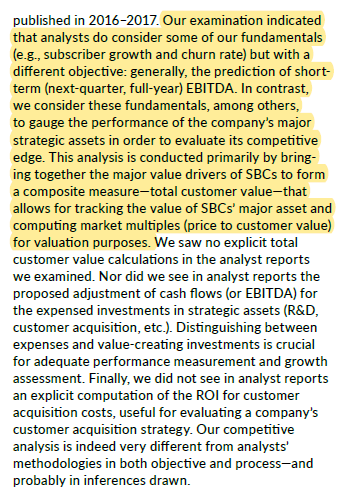

The argument made by the authors of this paper was earnings just do not have as much explanatory power of how the business is doing as they used to have!

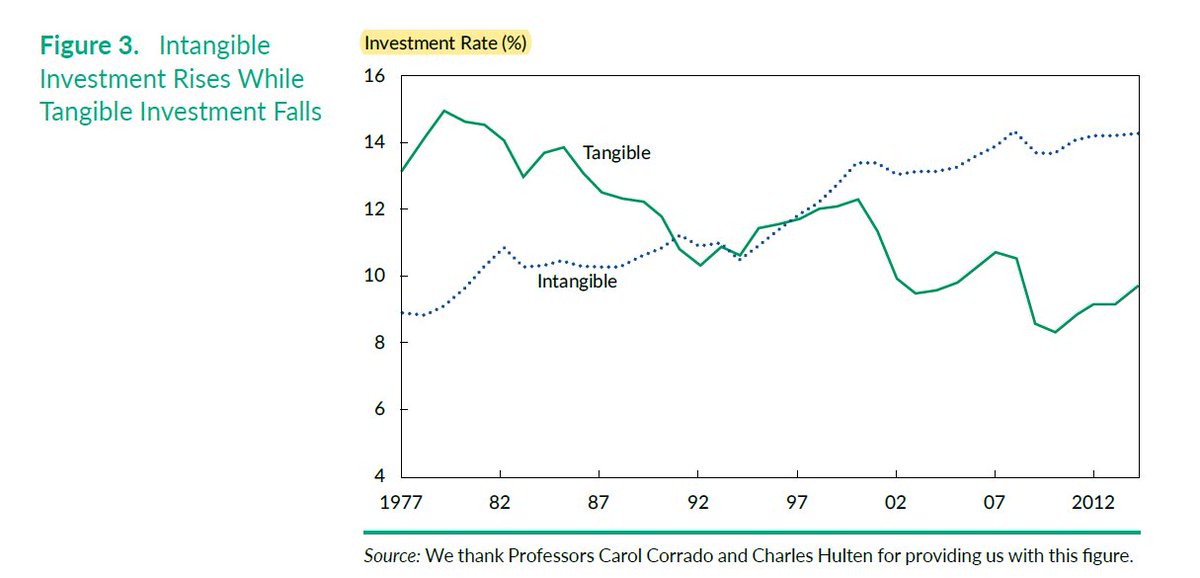

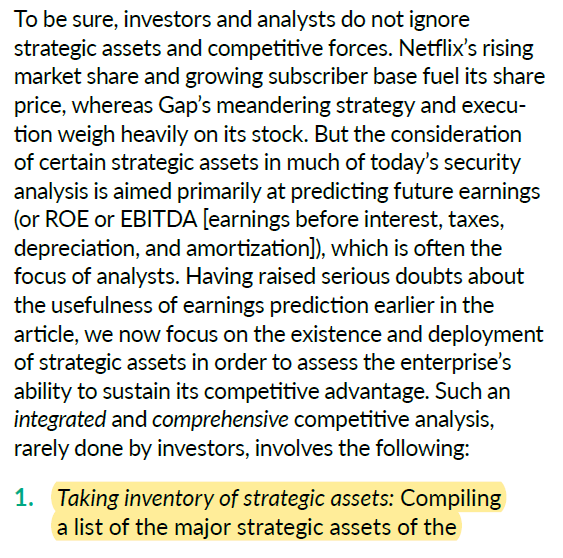

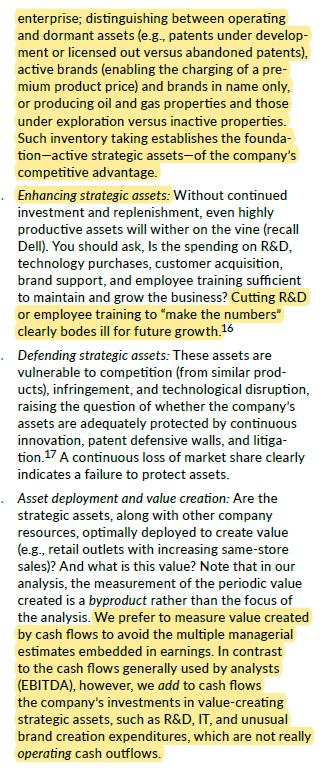

But when you generate intangibles internally, there is no reflection of that in your balance sheet, and in fact, it depresses your short-term earnings.

But that's true for every model out there, especially for DCFs.

Link to the paper discussed: fundresearch.de/fundresearch-w…