"People form opinions at their own pace and in their own way; the notion that new information could be instantly processed... /1

That is gold.

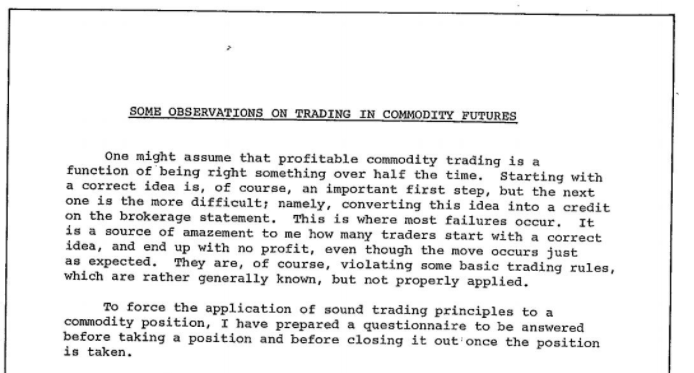

Trading and markets are filled with paradoxes where many of the most important things are counterintuitive to the extreme.

While at the same time, you have to remain INCREDIBLY humble if you want any chance at succeeding.

This is why you need to be wary of those who practice what I call "Vision Macro". These are the people that make bold (usually bearish) predictions about the future.

/fin

macro-ops.com/teachings-from…