Having bought $250M of bitcoin, NASDAQ-listed MicroStrategy’s opening gambit says so.

Let’s analyze what it means for Wall Street, corporate treasuries and Bitcoin.

Thread! ✍️

blog.knoxcustody.com/bitcoin-safest…

Only 978 companies can do the same, before supply technically “runs out”, though in practice most of it isn't for sale

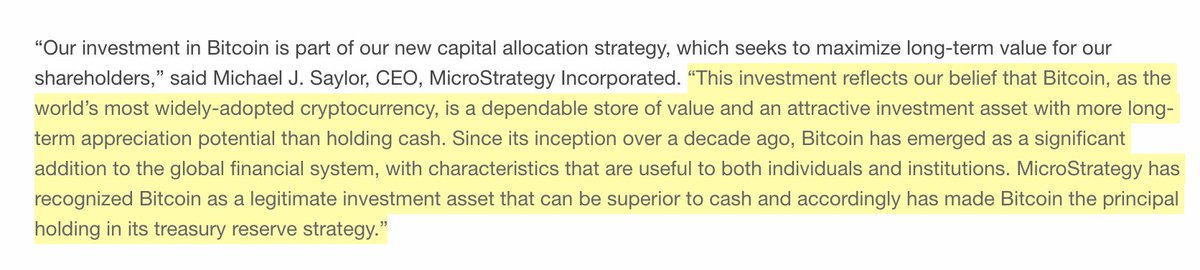

Argument was built around the potential for the deterioration of real value in fiat currencies, and a belief that Bitcoin represents a safer store of value.

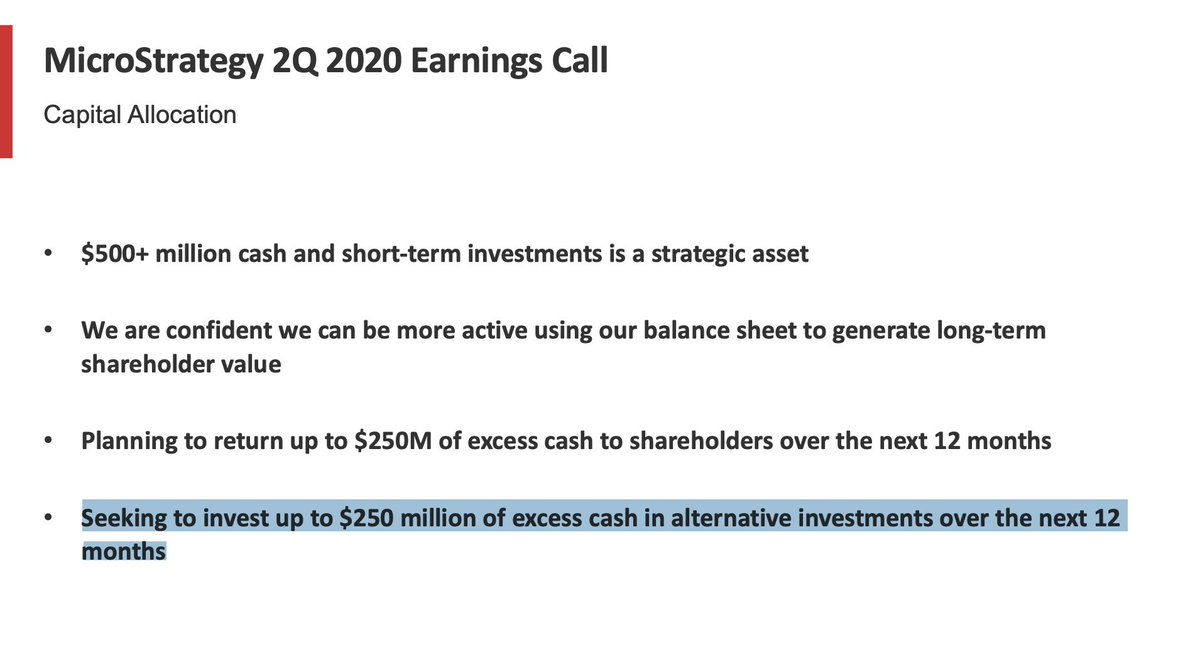

Should CFOs of other firms reconsider their allocation plans?

What does bitcoin as a corporate reserve asset mean for Wall Street’s balance sheets modelling?

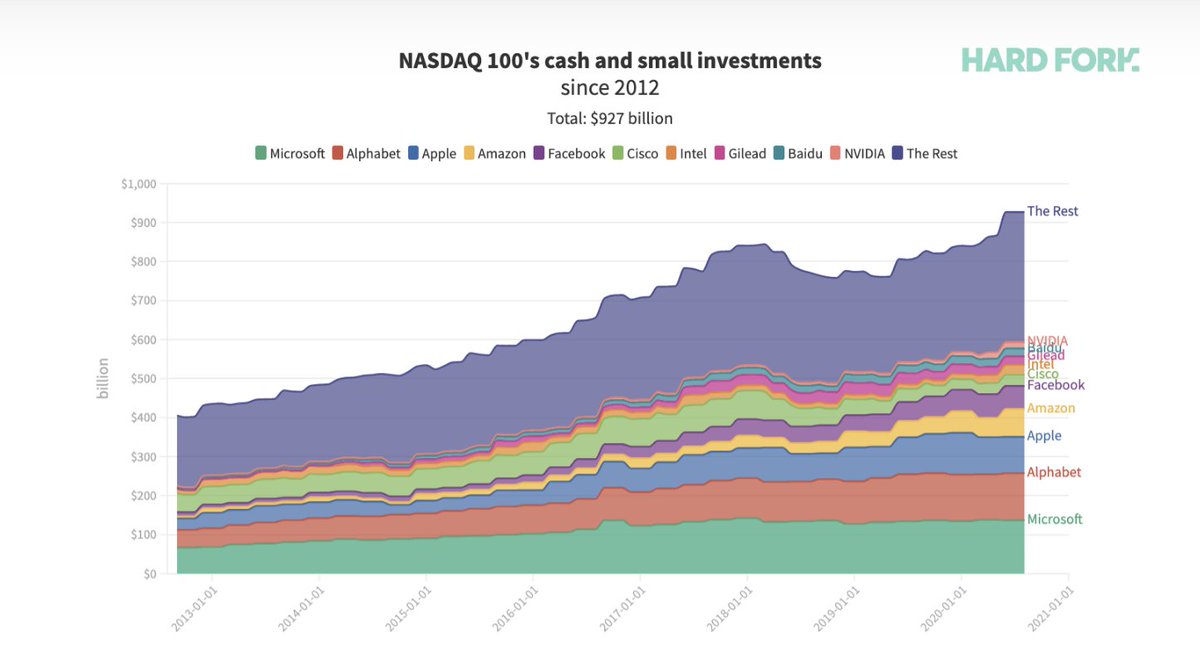

Amid the recent downturn, NASDAQ 100 co's are piling cash, driven by globalized uncertainty, lockdowns & supply chain disruptions

Nearly $1 trillion in cash w/ US tech moguls like @Microsoft, @Google and @Apple stocking more cash than ever.

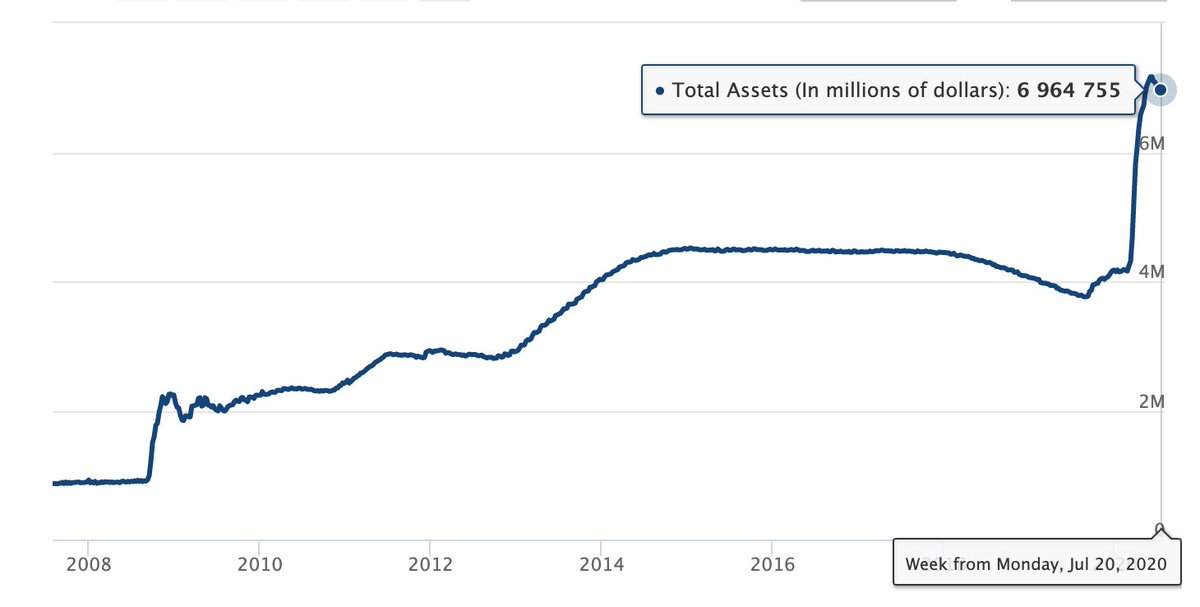

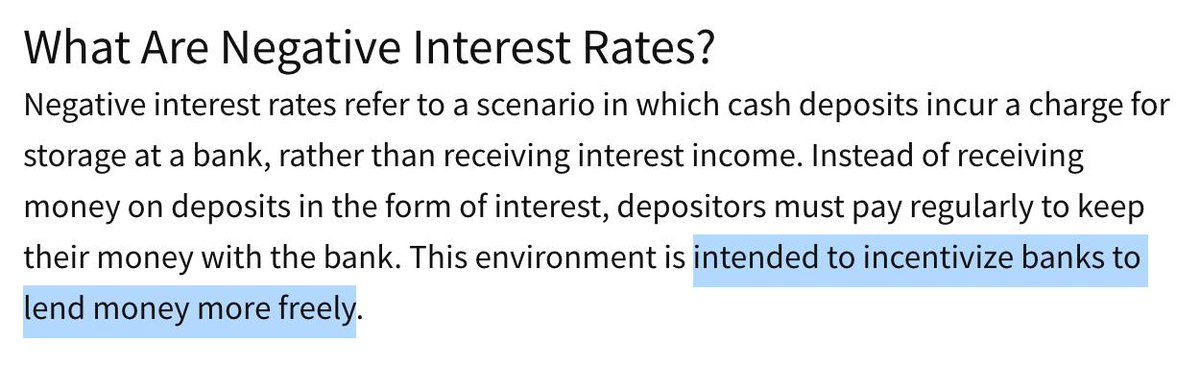

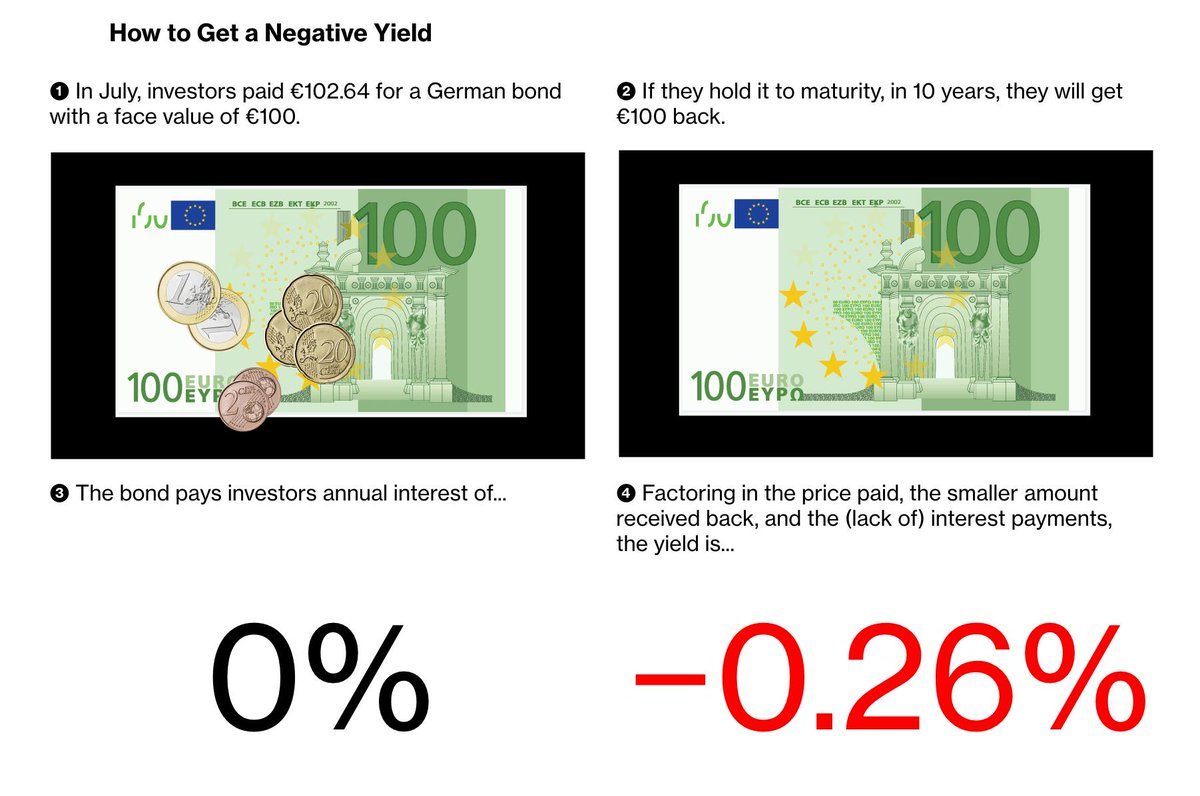

Near-zero interest rates led to an $840M surge in corporate debt in the first half of 2020.

As business ops sell assets and cut costs to manage the slowdown they end up raising cash reserves, but must also battled value loss due to QE.

The dollar may not see inflation right away but responsible firms such as @MicroStrategy are taking preventive measures to protect their balance sheets and shareholders.

A good and reliable holding in a reserve asset should be dependable over the long term whether it be for price stability, liquidity or long term value creation for shareholders.

CFOs managing corporate treasury programs may be in breach of their fiduciary duty if due diligence and adequate capital allocation strategies are not developed for bitcoin.

Plus, the career risk is now removed as @ahkyee pointed out.

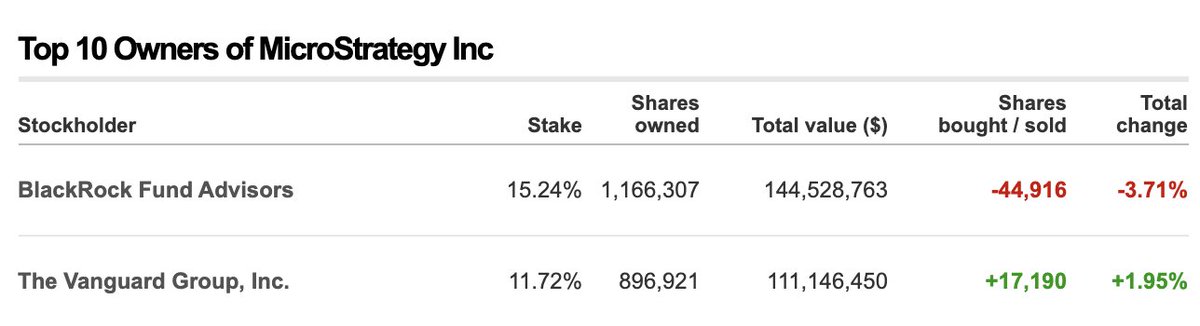

MicroStrategy's ownership structure is mostly institutional, which accounts for 466 firms representing 97% of total shares. @BlackRock and @Vanguard, two leading institutional fund and wealth managers own more than 25%.

What happens if MicroStrategy’s bitcoin holdings appreciate substantially in the coming years? How does management handle this exposure and decide to rebalance their risk?

Just getting started for other firms! Competition will be rude.

Holding $BTC may be a capital-efficient way to strengthen corporate balance sheets in times of financial turmoil.

While nocoiner competitors suffer from bad economic conditions, bitcoin holders may thrive.

Competitive landscape may be completely reshaped.

They’ve allowed the firm to become an indirect vehicle for public bitcoin price exposure.

At what point does MicroStrategy become a bitcoin ETF, rather than a software firm?

As part of an inescapable Monetary Darwinism, CFOs and executive teams will gradually, then suddenly (wink @parkerlewis) add bitcoin to their books in an effort to protect their cash reserves for productive use later on.

Eventually, everyone gets it. Oh, and congrats for this act of leadership @michael_saylor.

What if companies start to denominate their margins and ROIs using Bitcoin, not dollars?

Holding Bitcoin in corporate treasury may become a standard for Wall Street as it obsoletes all other money

Cash flow priced in $BTC is the ultimate monetization point leading to sustained global deflation—the root of an abundant future.

One thing is certain: this number can no longer be zero.

#GetOffZero @APompliano 👊

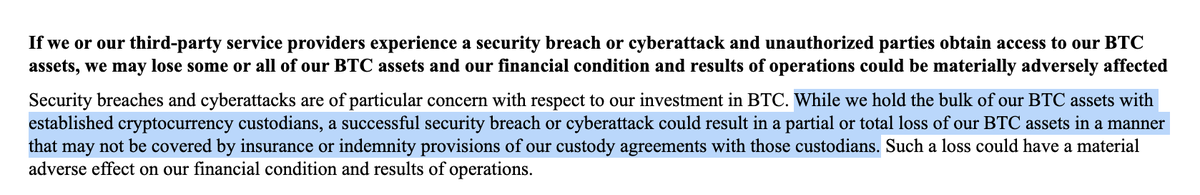

Should they be using custodians such as @knoxcustody or @DigitalAssets or sovereign multisig with @unchainedcapital? Hybrid model?

Also, will auditors and securities regulators demand that NASDAQ-listed companies' bitcoin be fully insured?

@Michael_Saylor’s Bitcoin dismissal in 2013 juxtaposed against @MicroStrategy’s attitude today speaks volumes.

Will CFOs still be able to meet their fiduciary obligations if they don’t hold bitcoin in their corporate treasury within the next 10 years?

(wink @jeffbooth)

@stephanlivera

@parkeralewis

@JeffBooth

@MartyBent

@daskalov (thanks for edits)

@matt_odell

@ArthurCSalzer

@FossGregfoss

@_benkaufman

@flip_btcmag

@PrestonPysh

@saifedean