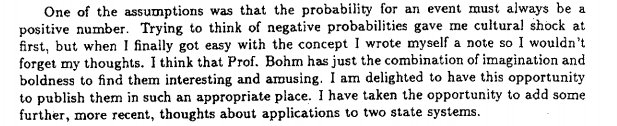

What's rational in paying someone to borrow money?

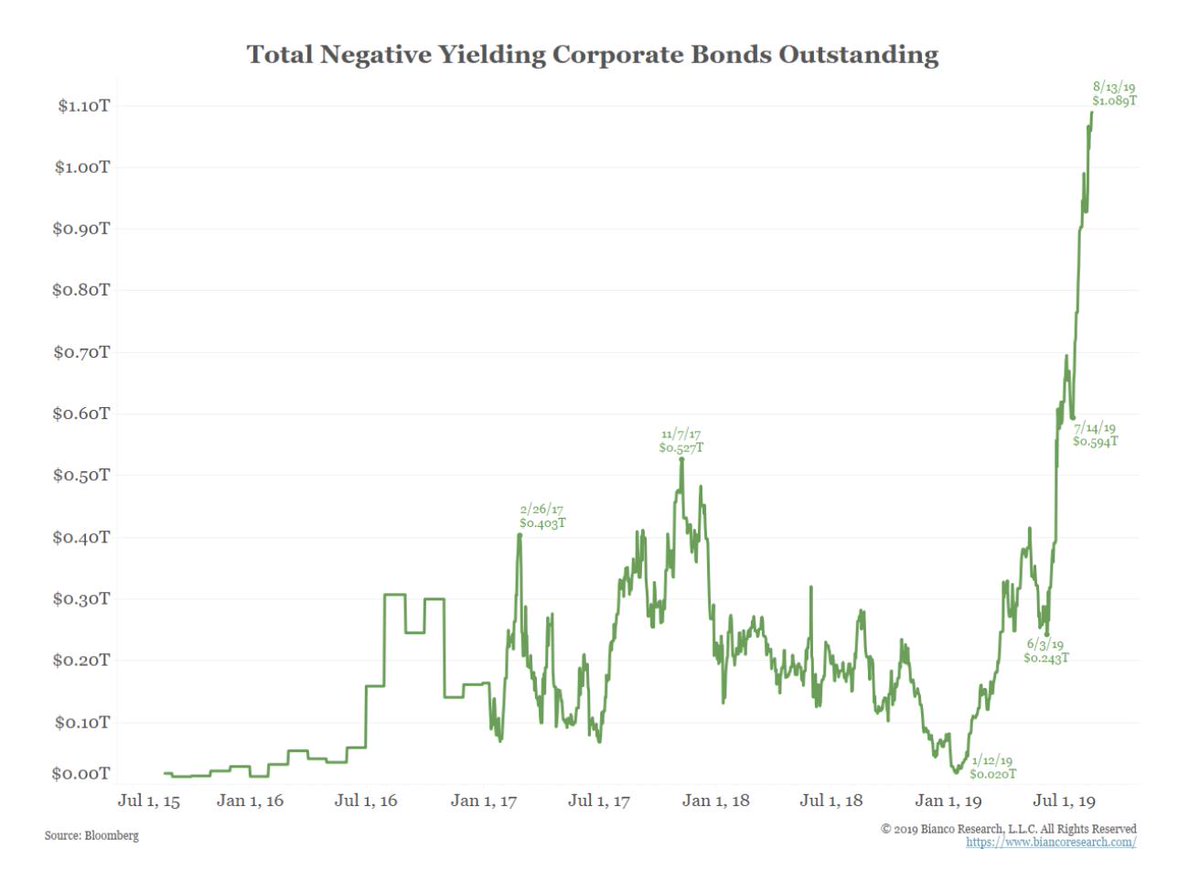

Yet, negative-yielding debt has spread to more than 30% of the world’s investment-grade bonds––uncharted territories.

Quick take on a brief dive 👇

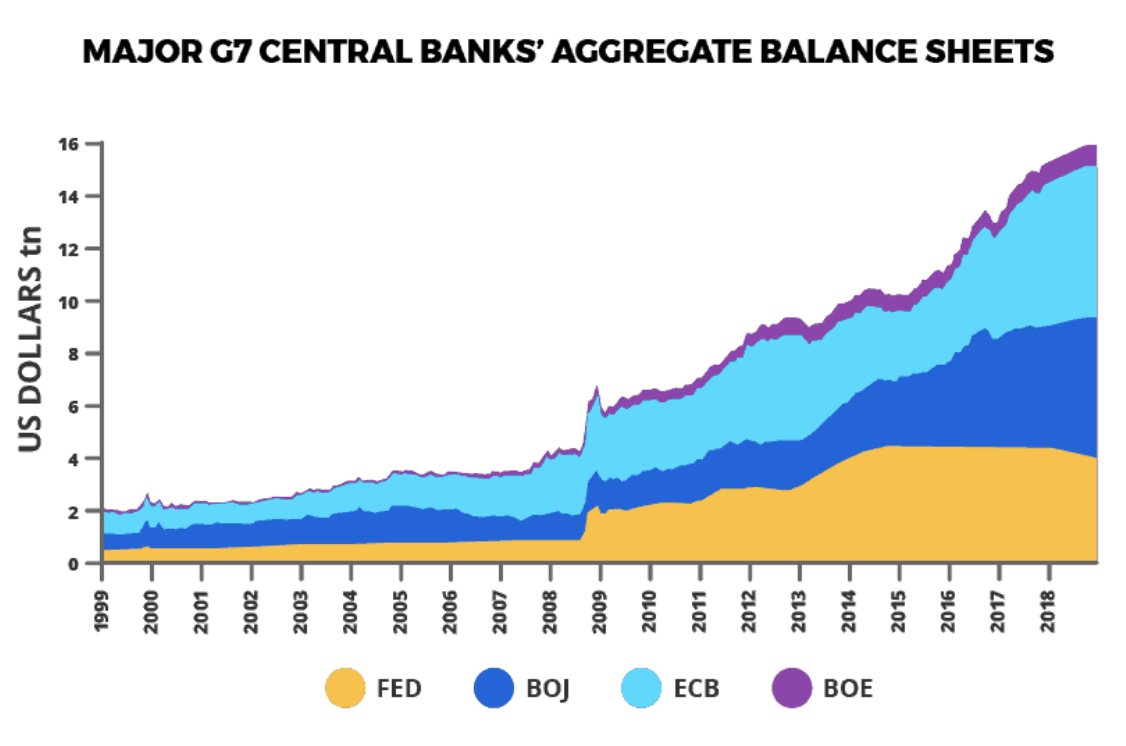

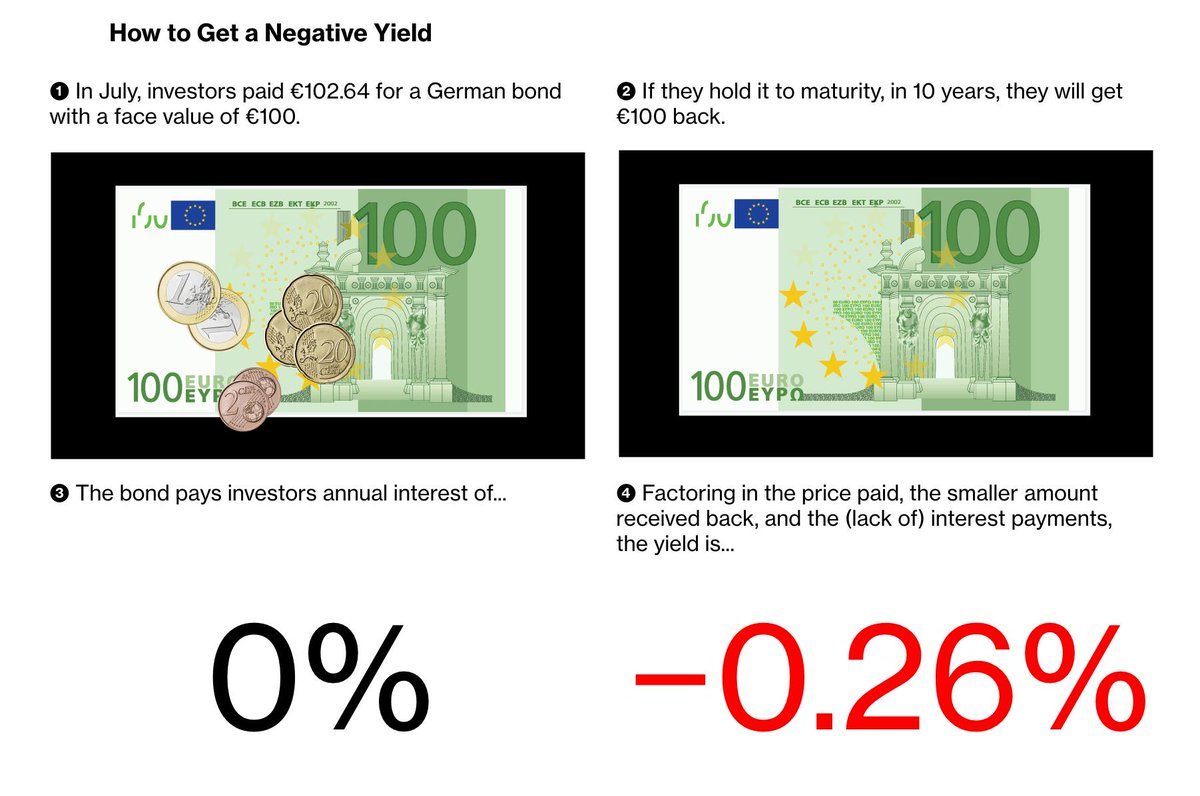

First, they tell us that CBs––in times of economic crises––usually need to lower interest rates by 3 to 6 points to bring back growth.

Most countries today are under 2% already

"Without cash, depositors would have to pay the negative interest rate to keep their money with the bank, making consumption and investment more attractive."

It's essentially institutionalized theft.

Introducing a dual currency system with e-cash and physical cash.

"E-money would be issued only electronically and would pay the policy rate of interest, and cash would have an exchange rate—the conversion rate—against e-money."

No escaping into actual cash

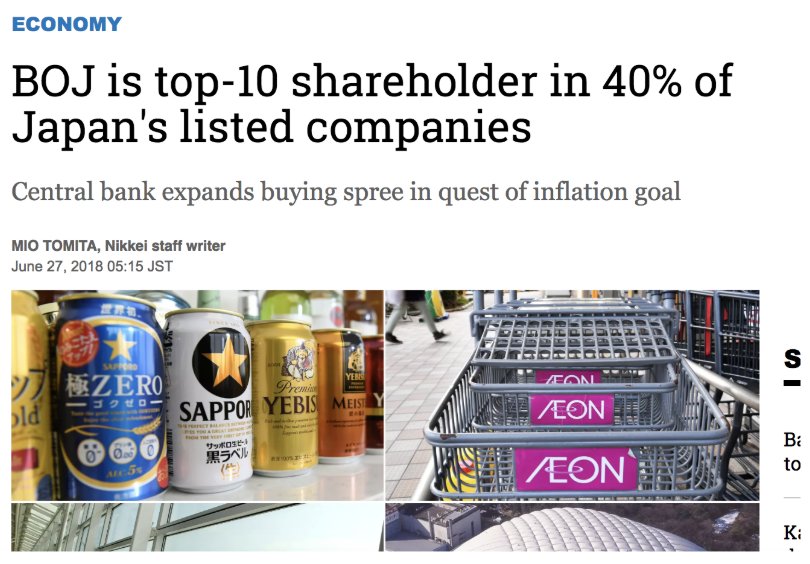

"The level of buybacks to free cash flow hit 104% for the 12 months ending in the first quarter of 2019."

cnbc.com/2019/07/29/buy…

This mechanism is further widening the wealth inequality: making stocks holders cash out on overly-leveraged positions.

With a large amount of boomers going to retirement soon, and unfunded liabilities of pension funds that are on the raise, NIRP is quite bad.

Anyone interested to share what they've learned, please do so! This is a rabbit hole I'm trying to understand from a first principles approach as it makes ZERO sense intuitively.

Oh, and buy bitcoin!