One of my favorite professors once asked in class: "What do you think about the time horizon of Sovereign Wealth Funds?"

The answer seemed pretty obvious. SWFs, of course, have a very long term horizon.

A SWF, as an institution, may have a very long-term mandate. But what happens when managers working for the fund underperform their benchmark? How long before they get fired for underperforming the benchmark?

The answer is perhaps no.

While SWFs have a very long term horizon, their managers are likely to experience the similar performance pressure the rest of institutional managers do.

Lack of tolerance for underperformance can lead to what the Professor called "cascading myopia", in which everyone is just focused on saving their jobs.

Then again, what is YOUR tolerance level for your own underperformance? How long before you give up and start indexing?

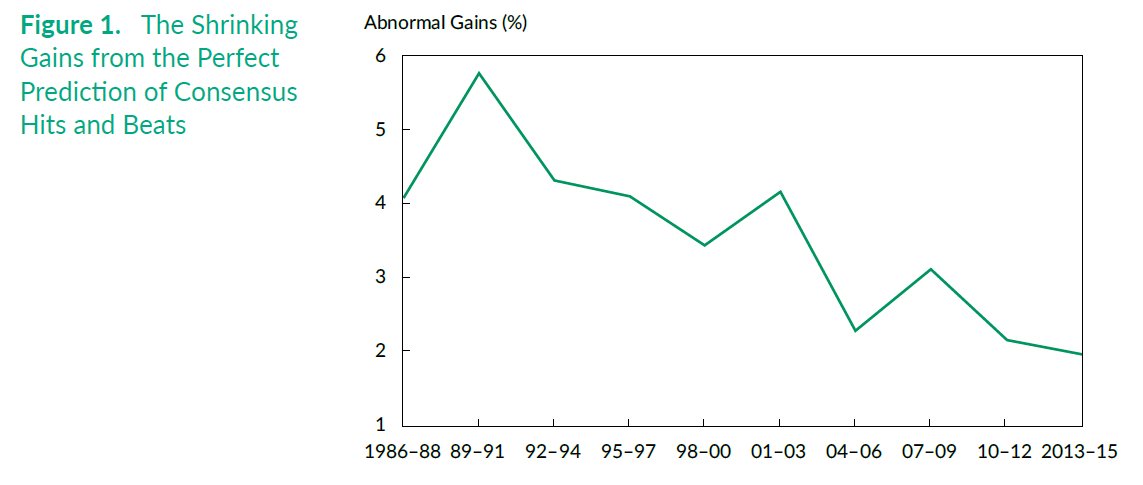

If we are honest with ourselves, very few of us have greater tolerance, and therefore, it's always going to be a tiny minority that beats the market!