- sebuah utas 1/n

Like & RT tweet ini s/d 12.01 AM Rabu 19/8/20 utk chance #giveaway buku Graham.

"We like to put a lot of money in things that we feel strongly about. And that gets back to the diversification question.

You know, we think diversification is — as practiced generally — makes very little sense for anyone that knows what they’re doing. 27/n

I mean, if you want to make sure that nothing bad happens to you relative to the market, you own everything." 28/n

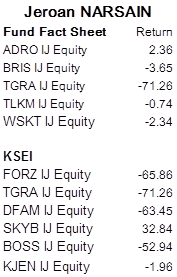

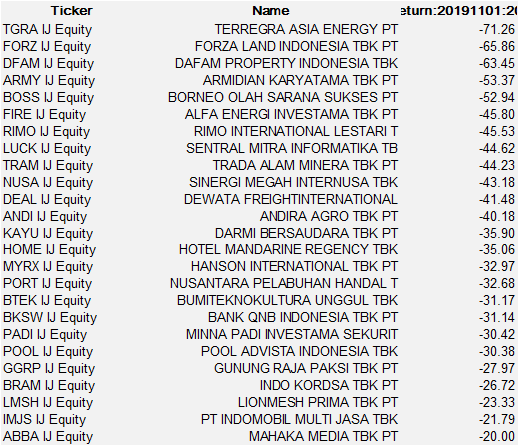

Jadi kalau pasar dgn proxy IHSG -1.74%, sementara portfolio anda loss 48% atau 73%, that's bad. 30/n

...karena engkau tidak tahu malapetaka apa yang akan terjadi... bad happens to you kalau kata Buffett... 41/n

One's money should always be ready to hand, for it is written, and thou shalt bind up the money in thy hand.

One should always divide his wealth into three parts: a third in land, a third in merchandise, and a third ready to hand. 42/n

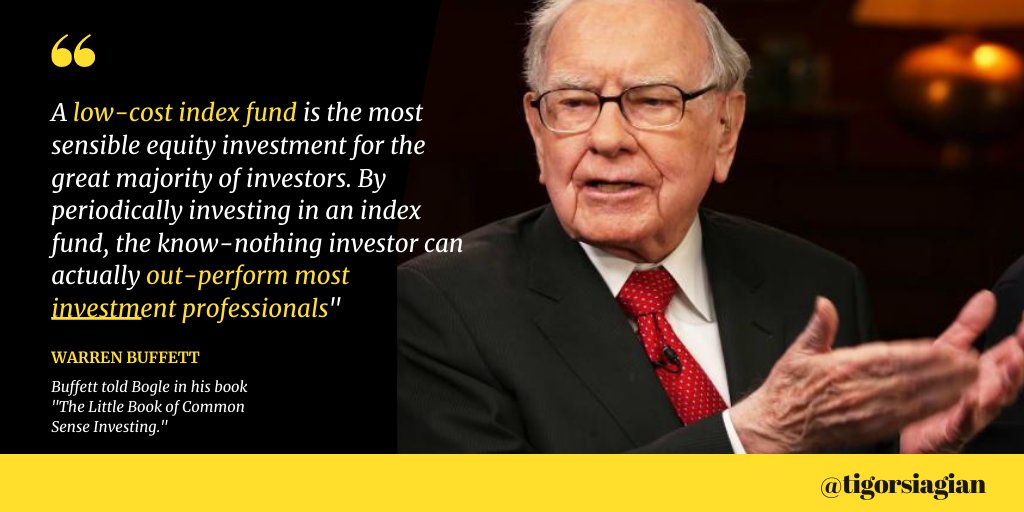

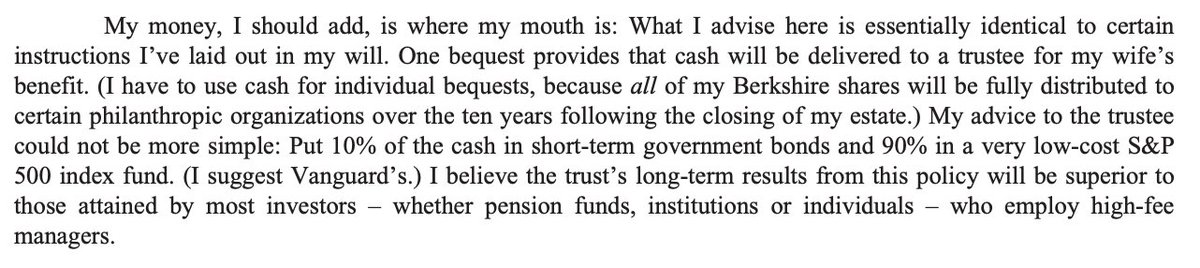

Jadi pada dasarnya interpretasi kegunaan #diversifikasi bagi mayoritas orang itu benar adanya. Seperti yang dia katakan kepada Bogle (founder Vanguard) di bukunya, "The Little Book of Common Sense Investing." Mayoritas beli index fund aja. 44/n

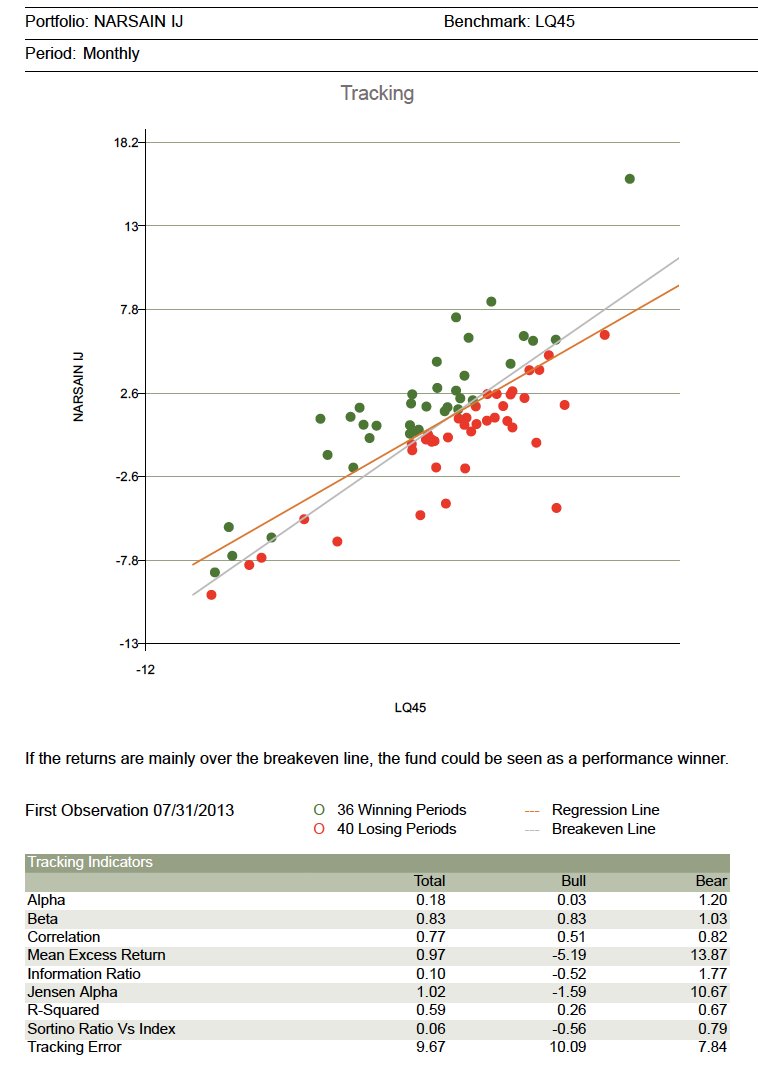

Nih untuk mudahnya kita bikin aja jadi grafis. 45/n