Rebalance Timing Luck: The (Dumb) Luck of Smart Beta

Available at:

- epsilontheory.com/rebalance-timi…

- papers.ssrn.com/sol3/papers.cf…

Lots of systematic equity strategies (such as "smart beta" ETFs) rebalance on a fixed schedule (e.g. every June and December).

Does the choice of "when" matter?

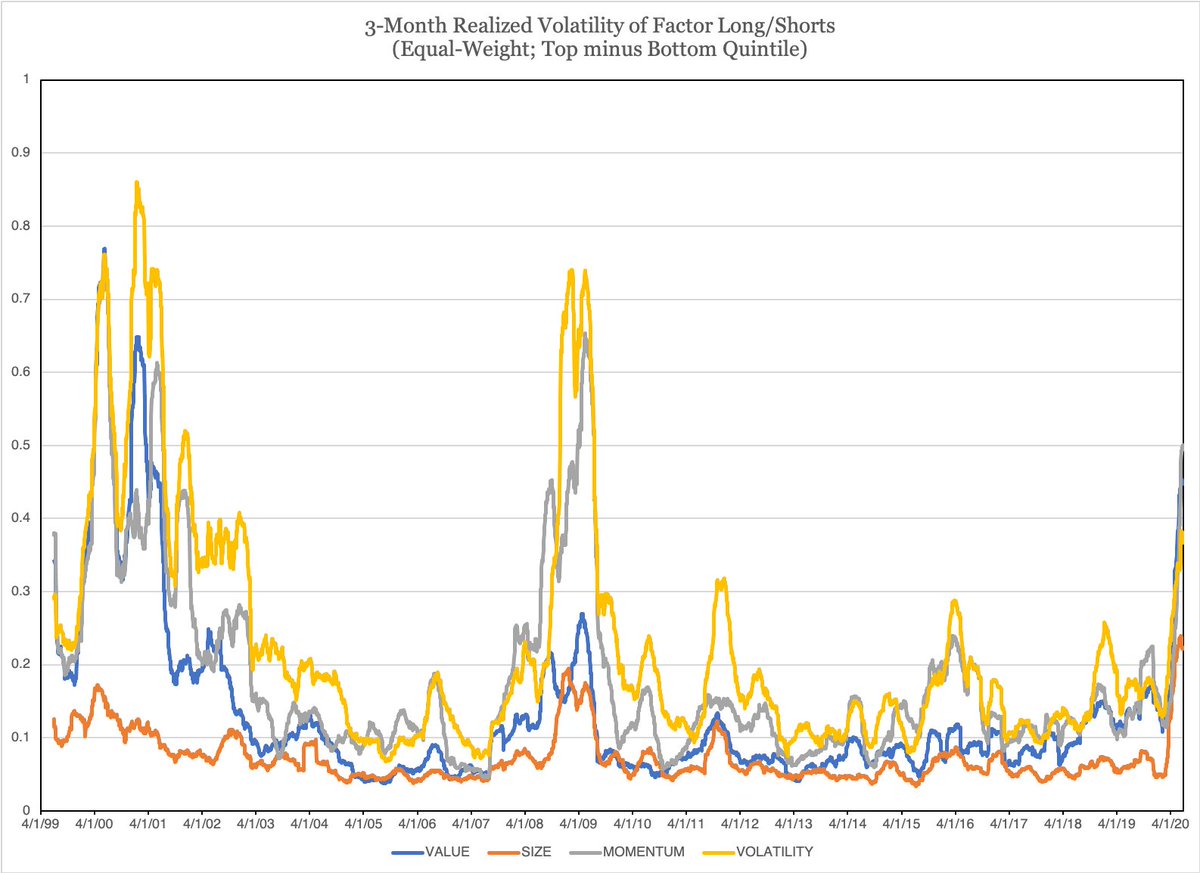

To measure the impact of rebalance timing luck ("RTL"), we construct the same strategy, rebalanced at the same frequency, but on different schedules.

1. JAN-APR-JUL-OCT

2. FEB-MAY-AUG-NOV

3. MAR-JUN-SEP-DEC

1. How frequently the portfolio is rebalanced

2. How much turnover the strategy exhibits

3. How constrained the implementation is

papers.ssrn.com/sol3/papers.cf…

Or, at the very least, skim the pictures and read the conclusion like the rest of us usually do.

Feedback (very) welcome.

FIN.