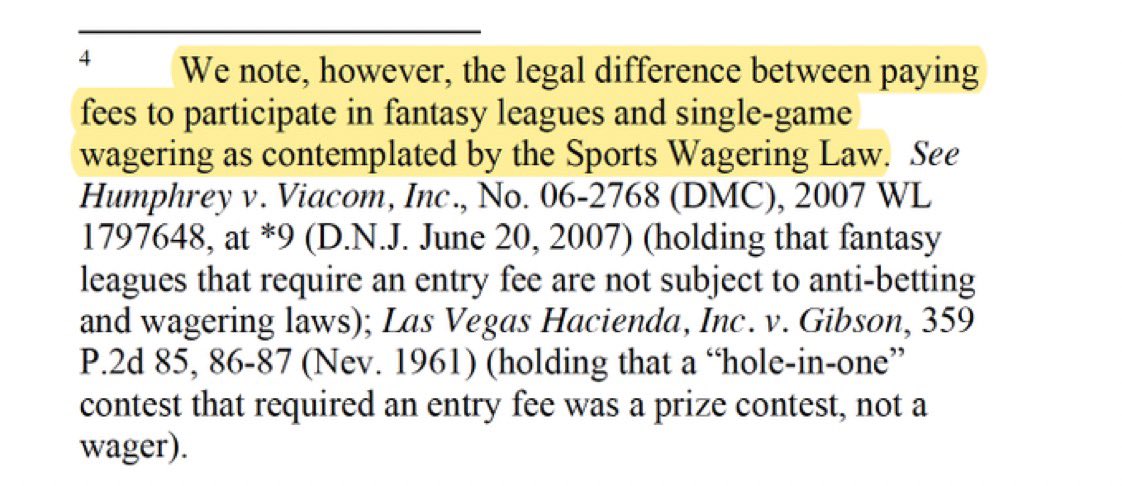

Las Vegas Hacienda, Inc. v. Gibson, 77 Nev. 25, 29, 359 P.2d 85, 87 (1961)

Brown v. Bd. of Police Comm'rs of City of Los Angeles, 58 Cal. App. 2d 473, 477, 136 P.2d 617, 619 (1943)

Coors Brewing Co. v. Stroh, 86 Cal. App. 4th 768, 777, 103 Cal. Rptr. 2d 570, 577 (2001)

Alvord v. Smith, 63 Ind. 58, 62–63 (1878)

(same). Many more cases too.

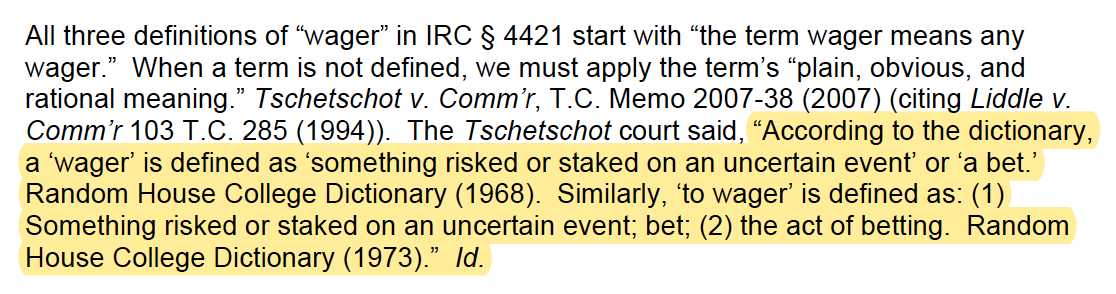

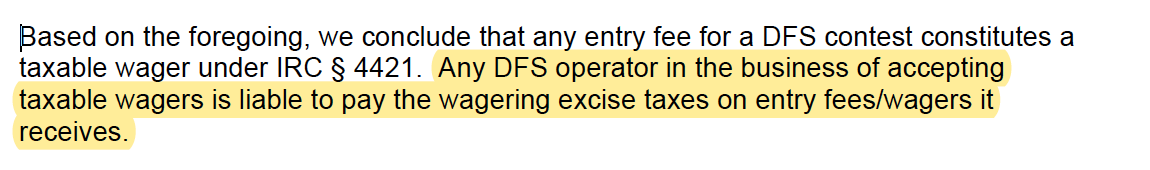

A wager is “a contract by which two or more parties agree that a certain sum of money or other thing shall be paid or delivered to one of them or that they shall gain or lose on the happening of an uncertain event."

*overlooked by IRS attorney

"A person is considered to be in the business of accepting wagers if he is engaged as a principal who, in accepting wagers, does so on his own account."

US v. Calamaro, 354 U.S. 351 (1957)

United States v. Calamaro, 354 U.S. 351, 360, 77 S. Ct. 1138, 1144, 1 L. Ed. 2d 1394 (1957)

H.R.Rep.No.586, 82d Cong. 1st Sess. 56 (1951); Sen.Rep.No.781, 82d Cong. 1st Sess. 114 (1951),

Hayes & Conigliaro, 57 Drake L. Rev. 445, 455–56 (2009)

The second half of this thread will continue shortly.

"A person is considered to be in the business of accepting wagers if he is engaged as a principal who, in accepting wagers, does so on his own account."

US v. Calamaro, 354 U.S. 351 (1957)

United States v. Calamaro, 354 U.S. 351, 360, 77 S. Ct. 1138, 1144, 1 L. Ed. 2d 1394 (1957)

Hayes & Conigliaro, 57 Drake L. Rev. 445, 455–56 (2009)

A wager is “a contract by which two or more parties agree that a certain sum of money or other thing shall be paid or delivered to one of them or that they shall gain or lose on the happening of an uncertain event."

*overlooked by IRS attorney

- Explaining the distinction between “authorized” and “unauthorized” wagers for purposes of determining the proper tax rate. (Note: it does not mean “expressly authorized.”)

- Explaining the importance of the state-level “skill vs. chance” analysis

+ More

"Under 26 U.S.C. § 4401, wagers illegal under state law are subject to a federal excise tax of two percent. Wagers not illegal under state law are subject to an excise tax of .25 percent."

Moser v. United States, 166 F.3d 1214 (6th Cir. 1998)

"The test, of course, of whether one is engaged in wagering, is whether he is risking his money in a game of chance in which he may win, or lose, depending on the eventuality."

Rahke v. United States, 180 F. Supp. 576, 578 (Ct. Cl. 1960)

Ben J. Hayes & Matthew J. Conigliaro, The Business of Betting or Wagering: A Unifying View of Federal Gaming Law, 57 Drake L. Rev. 445, 455–56 (2009)

"IRS internal memoranda are not binding on courts. Such informal, unpublished opinions of attorneys within the IRS are of no precedential value.”

Sierra Club Inc. v. Comm'r, 86 F.3d 1526, 1534 (9th Cir. 1996)