we believe bitcoin has a place in portfolios as an alternative, diversifying asset. Let’s dive in! 🤿👇

coinshares.com/research/a-lit…

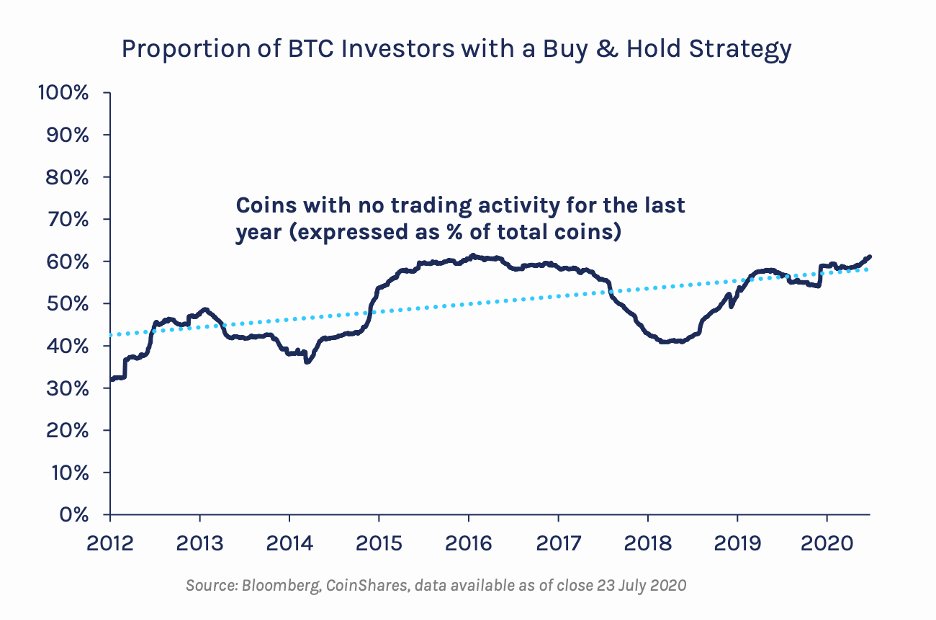

data from @glassnode shows that this year alone, 8.7% of bitcoin has been taken off exchange, presumably for long term storage 🏦

an investor survey by @DigitalAssets - 22% say they are currently invested and 47% say digital assets have a place in their portfolio.

fidelitydigitalassets.com/articles/insti…

our @CoinSharesCo Ventures team covered this trend in Q2

coinshares.com/insights/the-f…

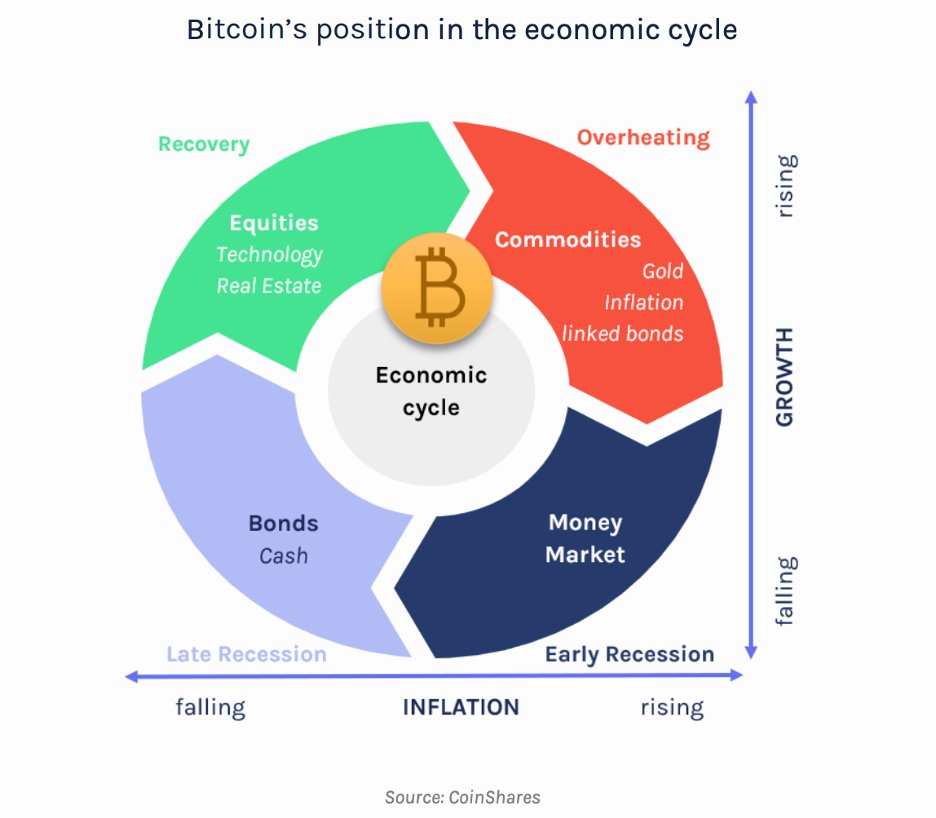

during periods of economic uncertainty and dollar weakness, #Bitcoin is likely to benefit in the same way as gold.

If bitcoin’s financialization continues, it will be unable to remain insulated from the financial system.

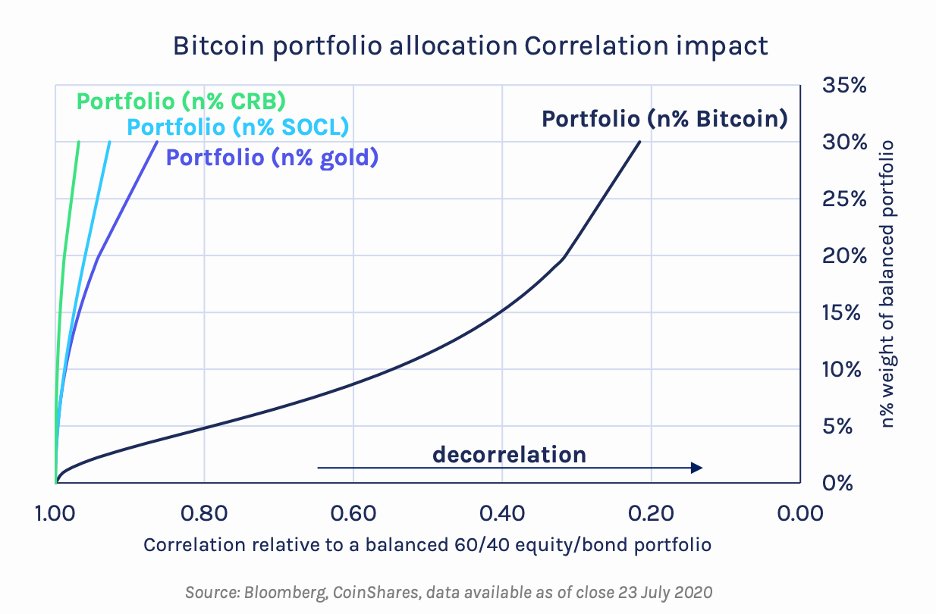

this show that even a SMALL addition of bitcoin has a BIG impact.

*#Bitcoin is a unique asset*

we found it to be an effective diversifier in multi-asset portfolios, as indicated by the results below 👇

- a driver of returns, and

- a portfolio diversifier

compared to other alternatives, Bitcoin delivers outsized positive impacts even at very low allocation sizes!

coinshares.com/research/a-lit…

we'd love to hear what other types of research would be helpful for all the RIAs, wealth managers, and allocators out there