*caveat that this should always align with what’s best for the customer

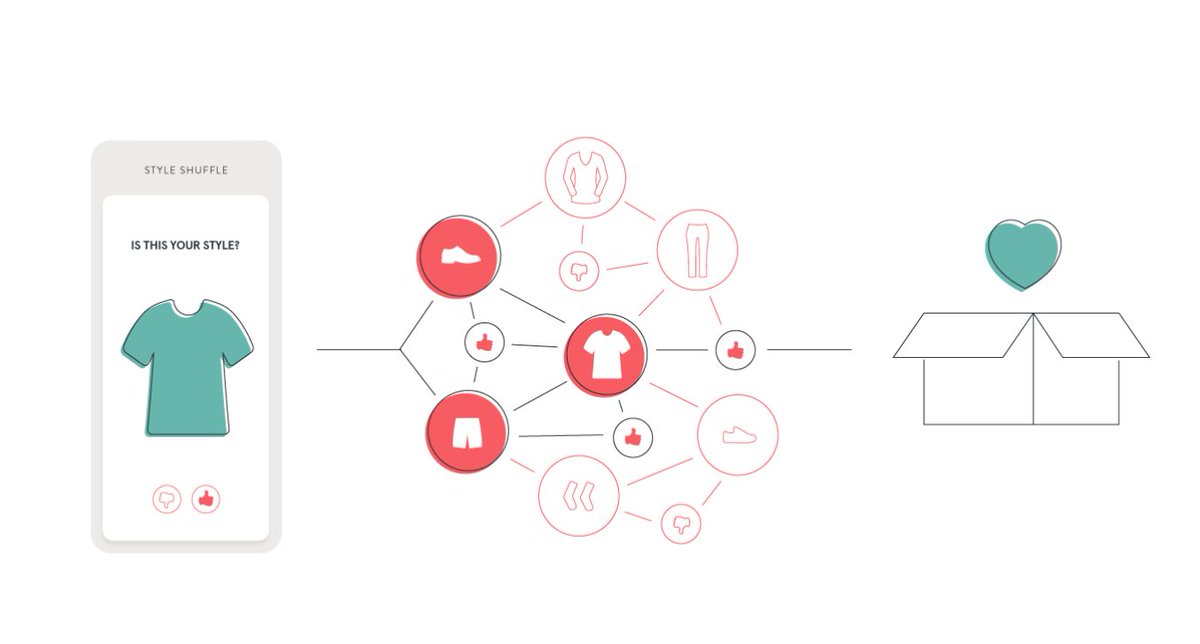

The beauty of non-intent purchases being made by Stitch Fix customers is that product selection and shipping speed doesn’t matter. It has a model that can realistically beat Amazon over time.

investorfieldguide.com/katrina-lake-t…

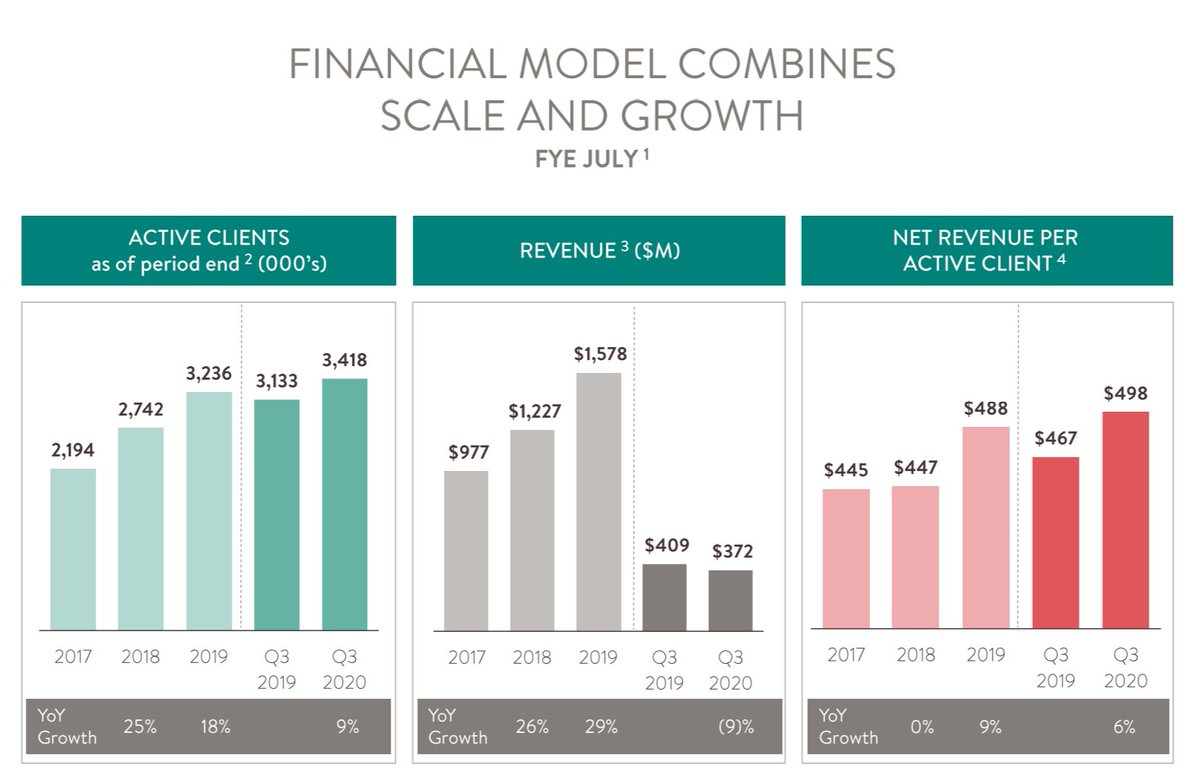

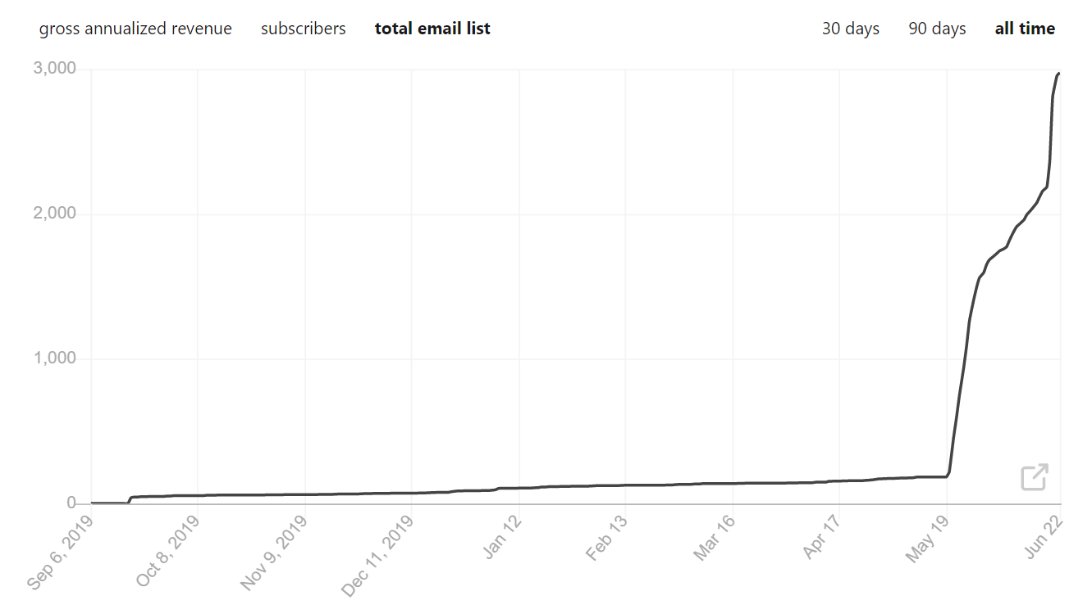

Ecomm likely grows 20%/yr over the next decade. As investors realize its strategic positioning and margin potential while growing ~25%/yr, we could see the multiple re-rate to 5-6x on $13-15b in 2029 revenue, or a $100b valuation.

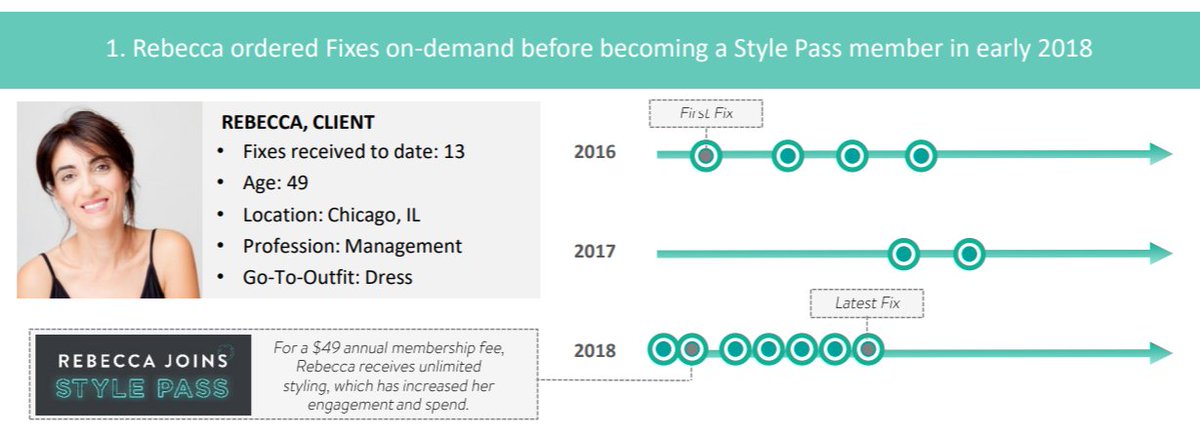

In the internet age, all that matters is owning customer demand at massive scale. SFIX is building this + now layering on subscription revenue. Will be fun to watch!