Bollinger Bands® is a wonderful invention of John Bollinger.

#Bollingerbands #Indicators #Definedge

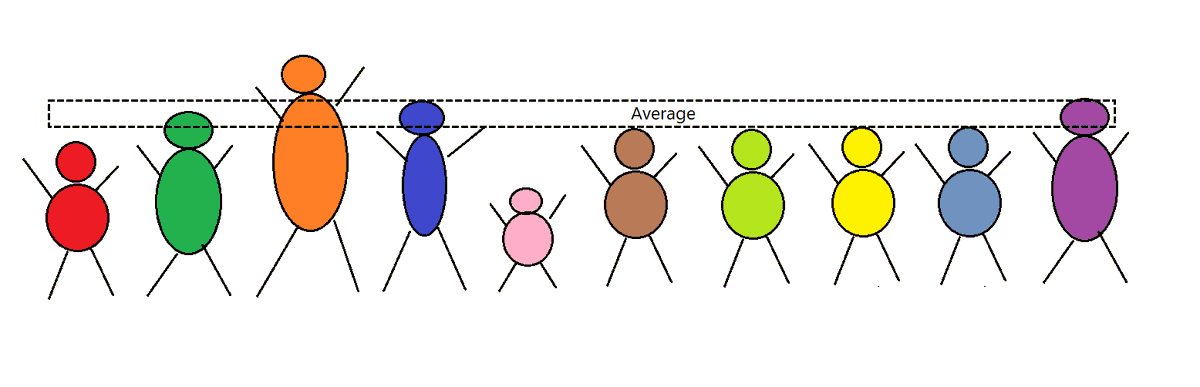

Statistically, around 68% of numbers are covered within one standard deviation from average. Around 95% is covered within the 2-standard deviation and 99% in the 3-standard deviation.

SD number would depend on the variation from average in the data.

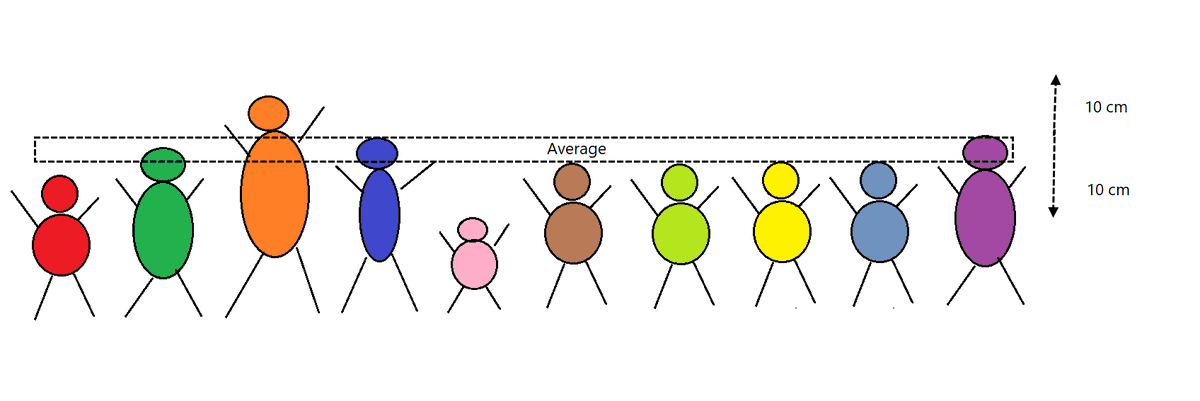

We can calculate ave price (moving average) on price chart.

For example, average price of Nifty over last 20 bars is 11000. But there would be sessions with wide range, narrow rage etc during that period. We can calculate SD.

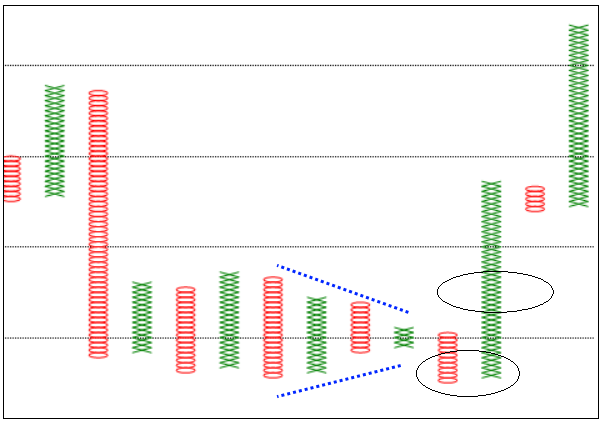

Meaning, 20-bar moving average and 2 standard deviation away bands from moving average, so it covers most of the data. Settings can be changed for experiment.

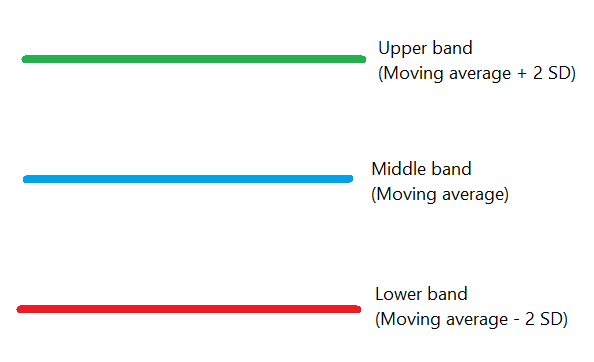

Moving average = trend

Standard deviation = volatility

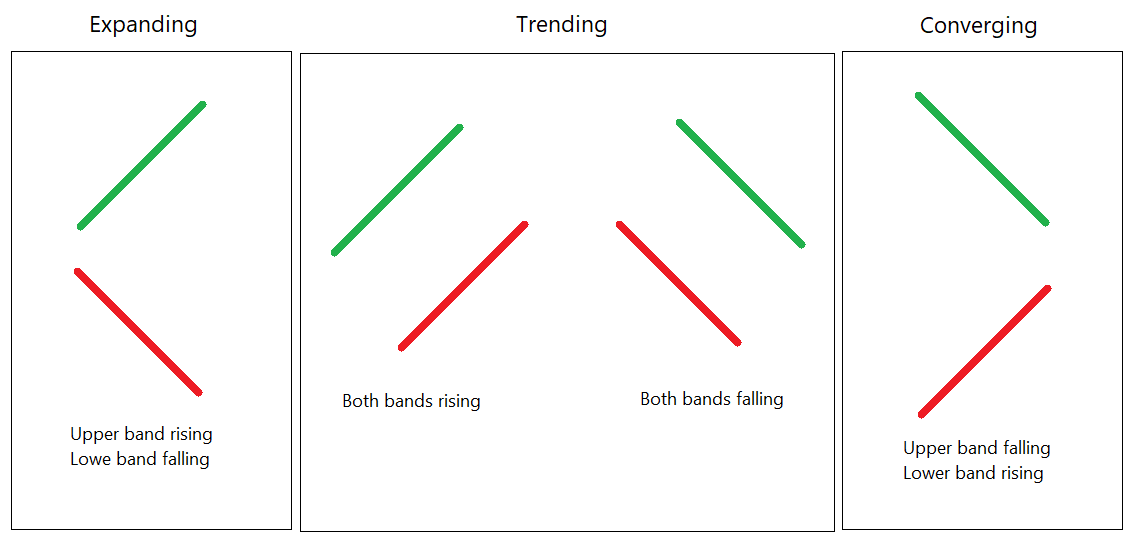

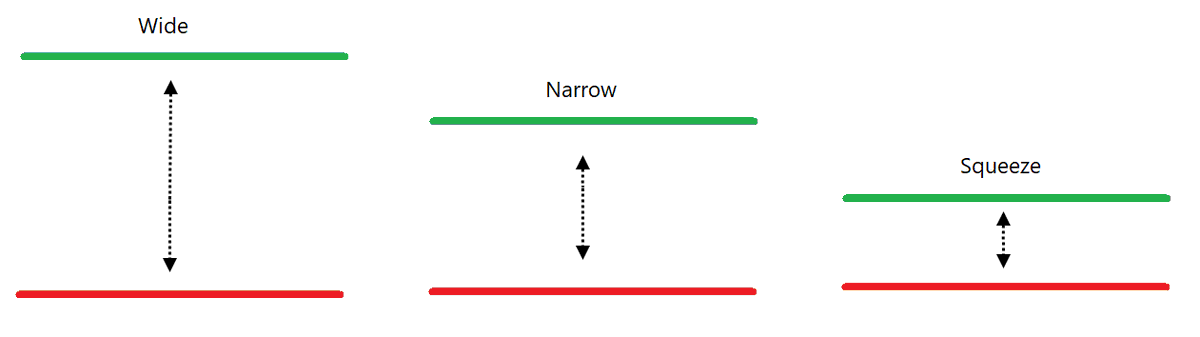

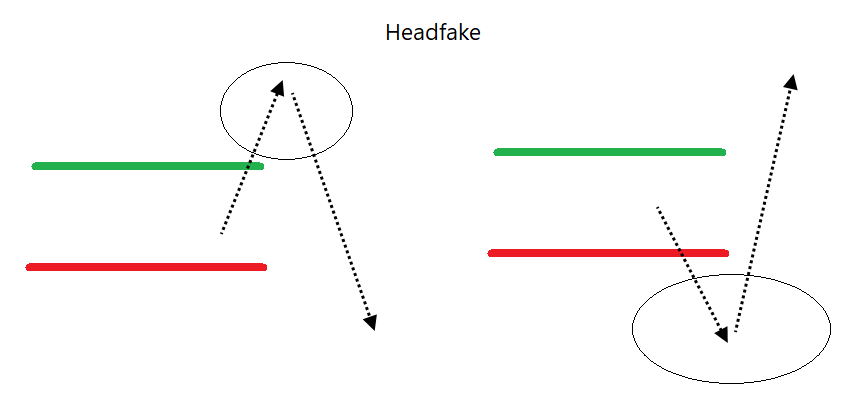

Narrow range is expected to be followed by high volatility or trend (Volatility cycle). Extremely low volatility (Squeeze) is precursor to high volatility. Look for the breakout after a Squeeze.

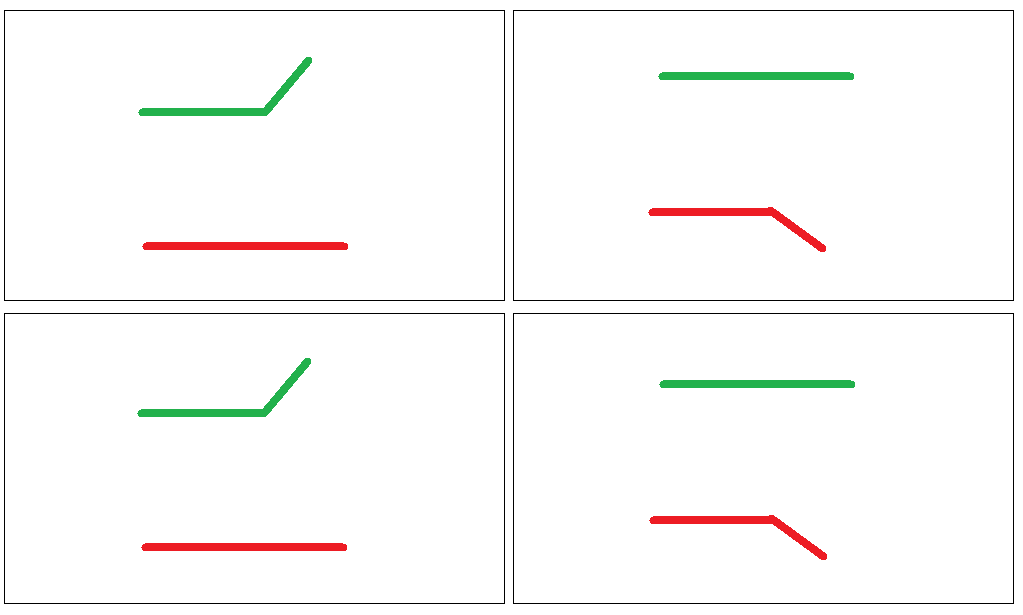

My pref would be a price pattern confirmation. It helps in planning the trades, placing the stops and managing the trades

Remember, the Bollinger bands are calculated on closing price.

<End of thread>