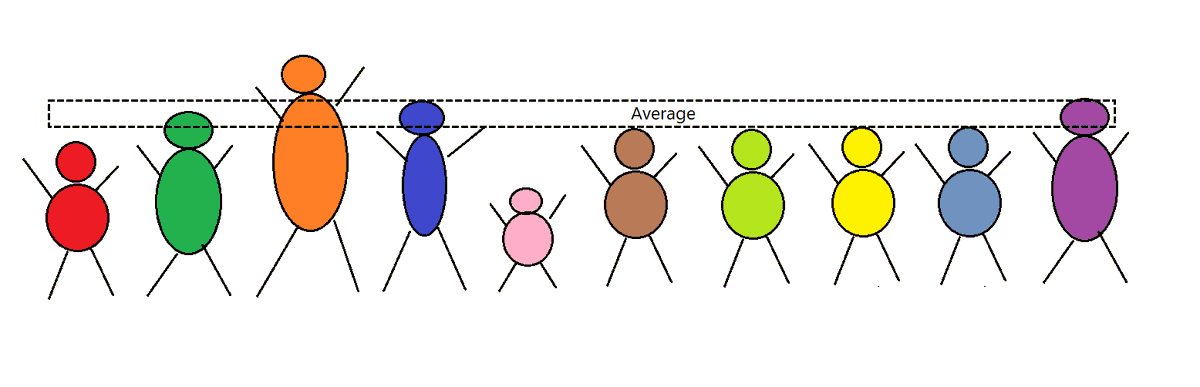

Number of stocks trading above 200-day ave:

Nifty 50: 66%

Nifty 500: 90%

Mid-Small 400: 70%

For Nifty 500 and Mid-Small 400, this happened last time in Jan 2018

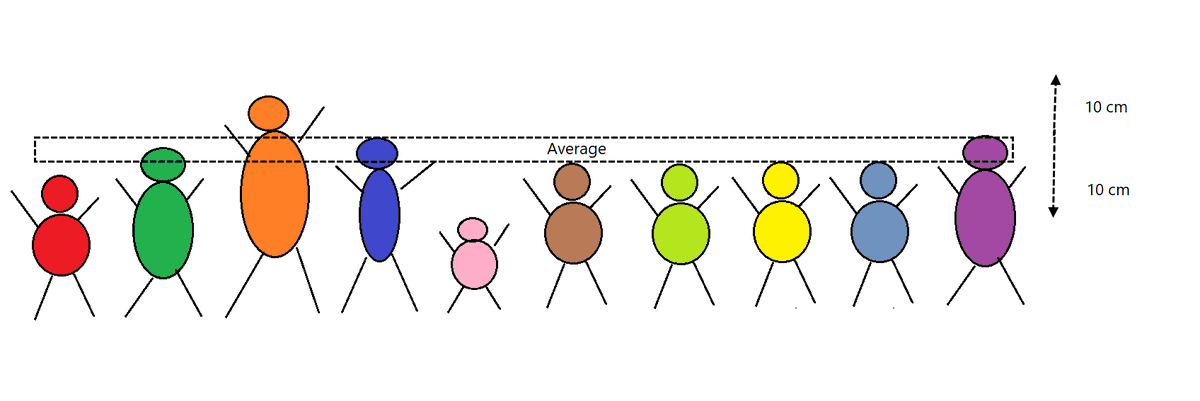

Stocks trading above RSI 70. This shows stocks in strong momentum:

Nifty 50: 12%

Nifty 500: 26%

Mid-Small 400: 30%

Nifty 500 and 400 number are at historical high.

Stocks trading above 3% 14-day ATR for Nifty 50 and 5% for 500 and 400:

Nifty 50: 20%

Nifty 500: 18%

Mid-Small 400: 20%

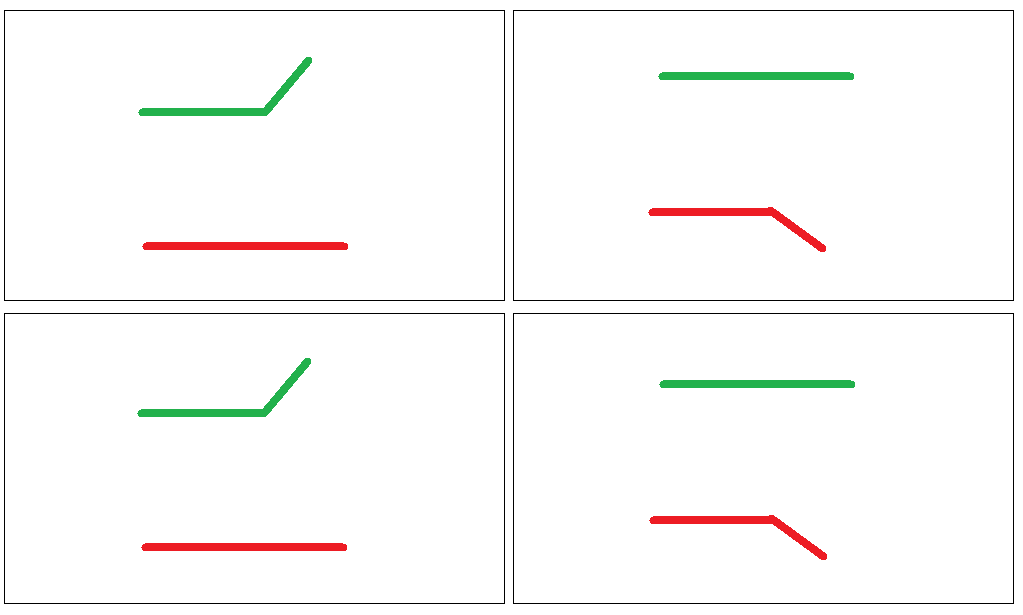

Volatility is falling in all indices. Trend is stronger than volatility.

Trend > volatility & there is a broad participation.

Currently, Nifty is outperforming Gold, Currency, Bonds. Strong participation by Mid & Smallcaps. The ratio is at historical high but bullish.

At this participation, portfolios are doing good. Breakouts are working.

Short-term reversal or consolidation is possible. If volatility increases, then there is a possibility of correction in these numbers – go slow in breakout if that happens.

Overall trend is bullish.