Get a cup of coffee.

In this thread, I'll help you understand why Warren Buffett's favorite holding period for stocks is forever.

Imagine you just became the proud father of a beautiful baby boy.

You are beside yourself with joy. You feel blessed.

Congrats!

The second thing is: you give your son a financial headstart.

You open a new @RobinhoodApp account.

You put $100K in it.

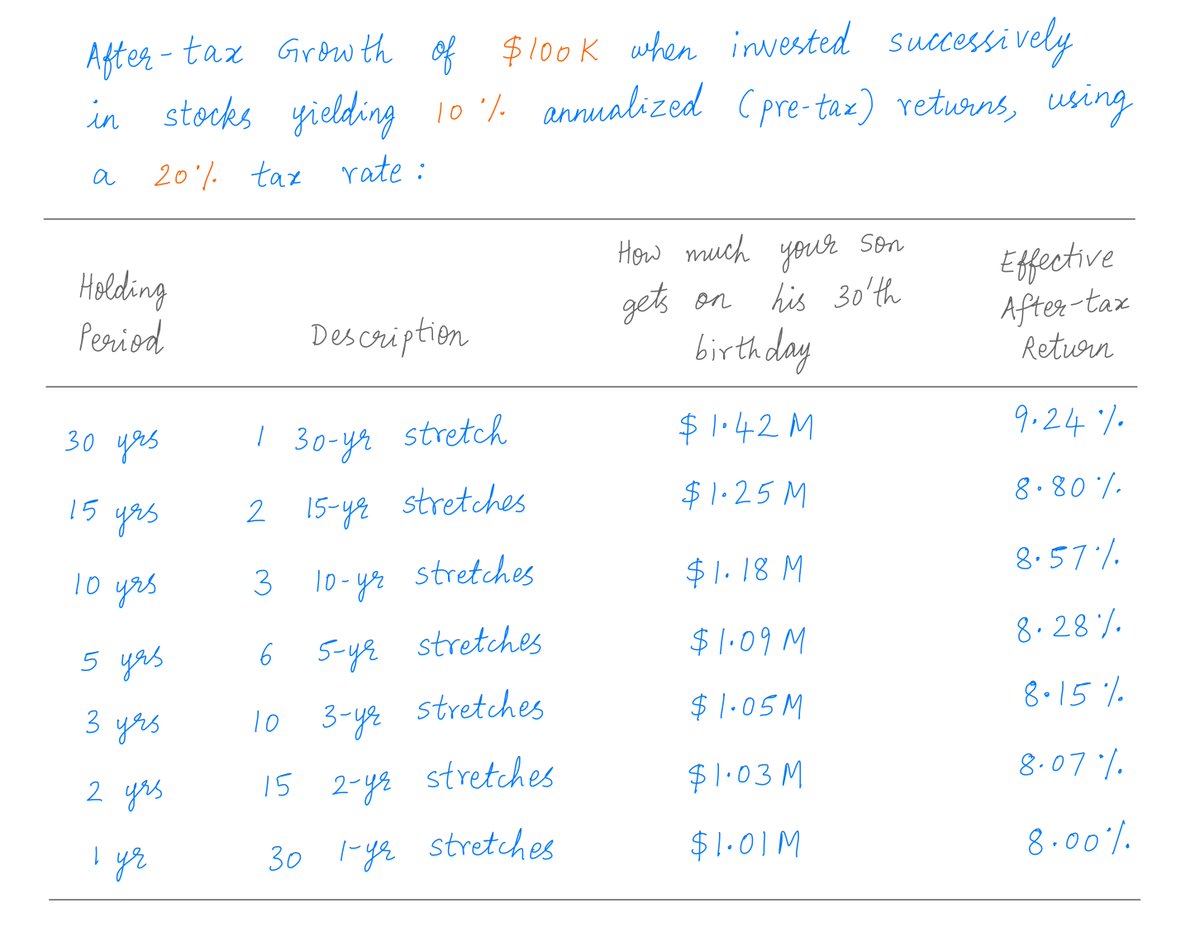

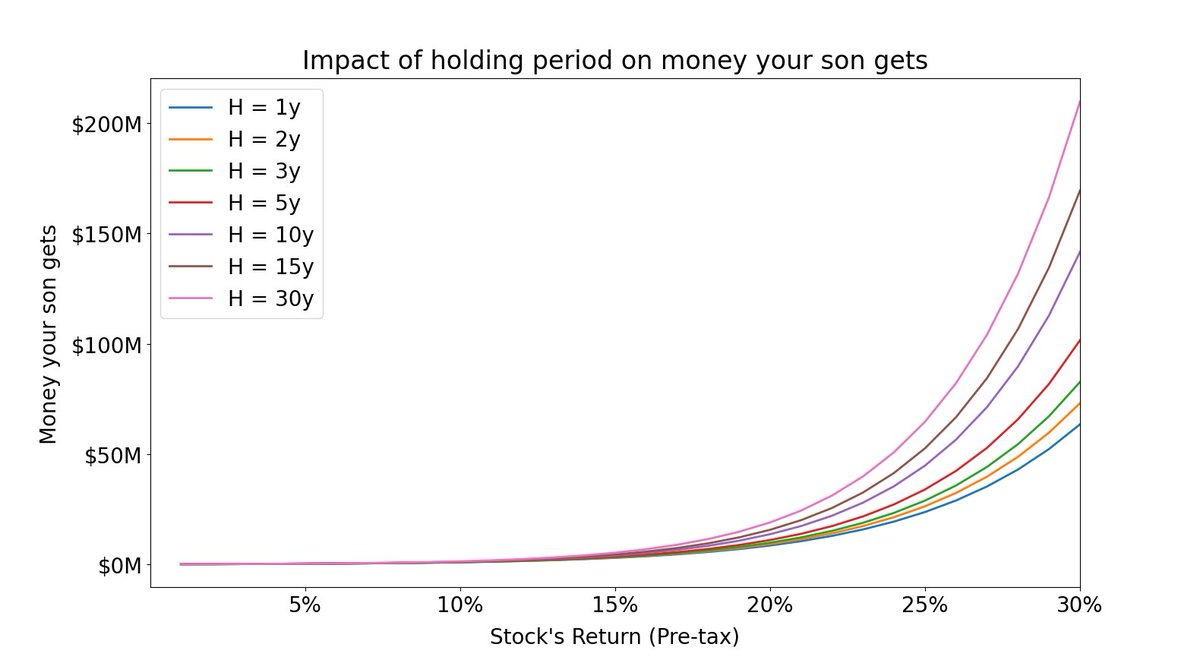

The plan is: you'll manage this account for the next 30 years. On your son's 30'th birthday, you'll liquidate the account and give him the proceeds.

Let's say you know a wonderful company -- with excellent long term prospects, a long runway for growth, and a management team you trust.

So you put the entire $100K into this company's stock, and hold it for the next 30 years.

As expected, the company does well over these 30 years.

The stock follows suit. It gives you a 10% annualized return during this time.

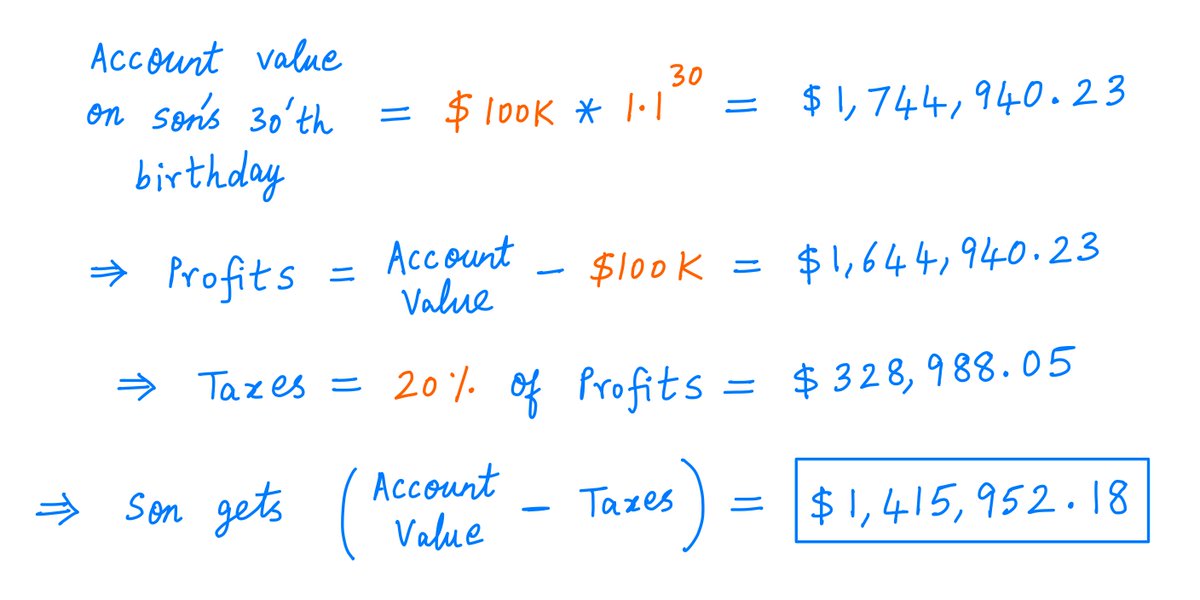

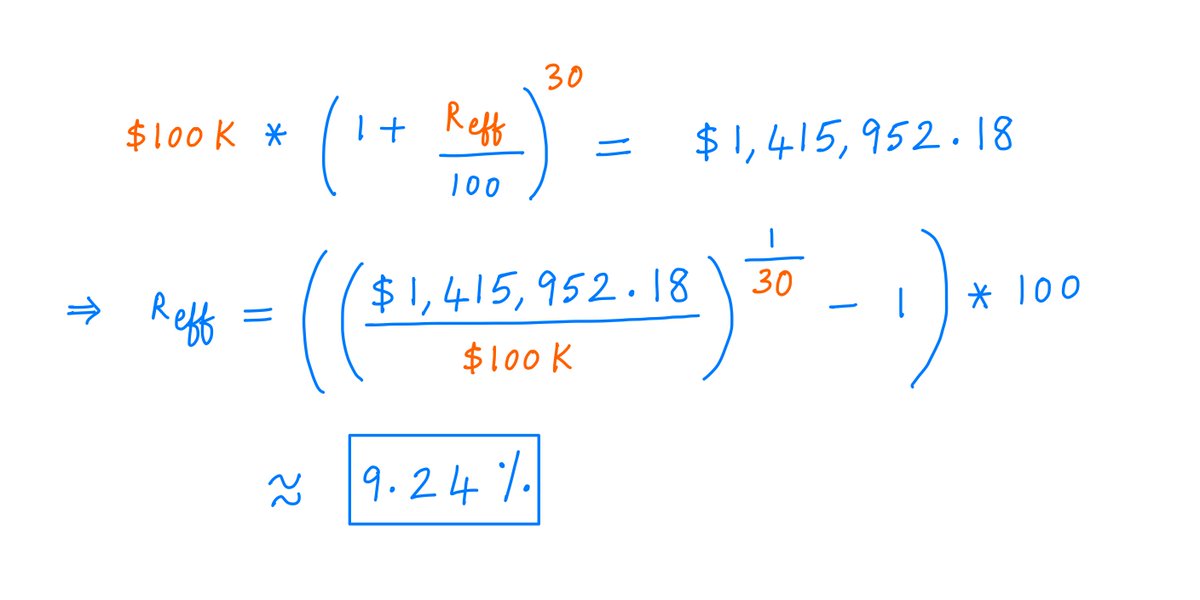

So, how much will your Robinhood account be worth on your son's 30'th birthday?

That's easy: $100K*(1.1^30) -- or about $1.7M.

But remember: your plan is to *liquidate* the account and give your son the *proceeds*.

When you do this, your son won't get the full $1.7M.

Why? Because taxes.

(You may be king of the jungle, but you're not exempt from paying taxes.)

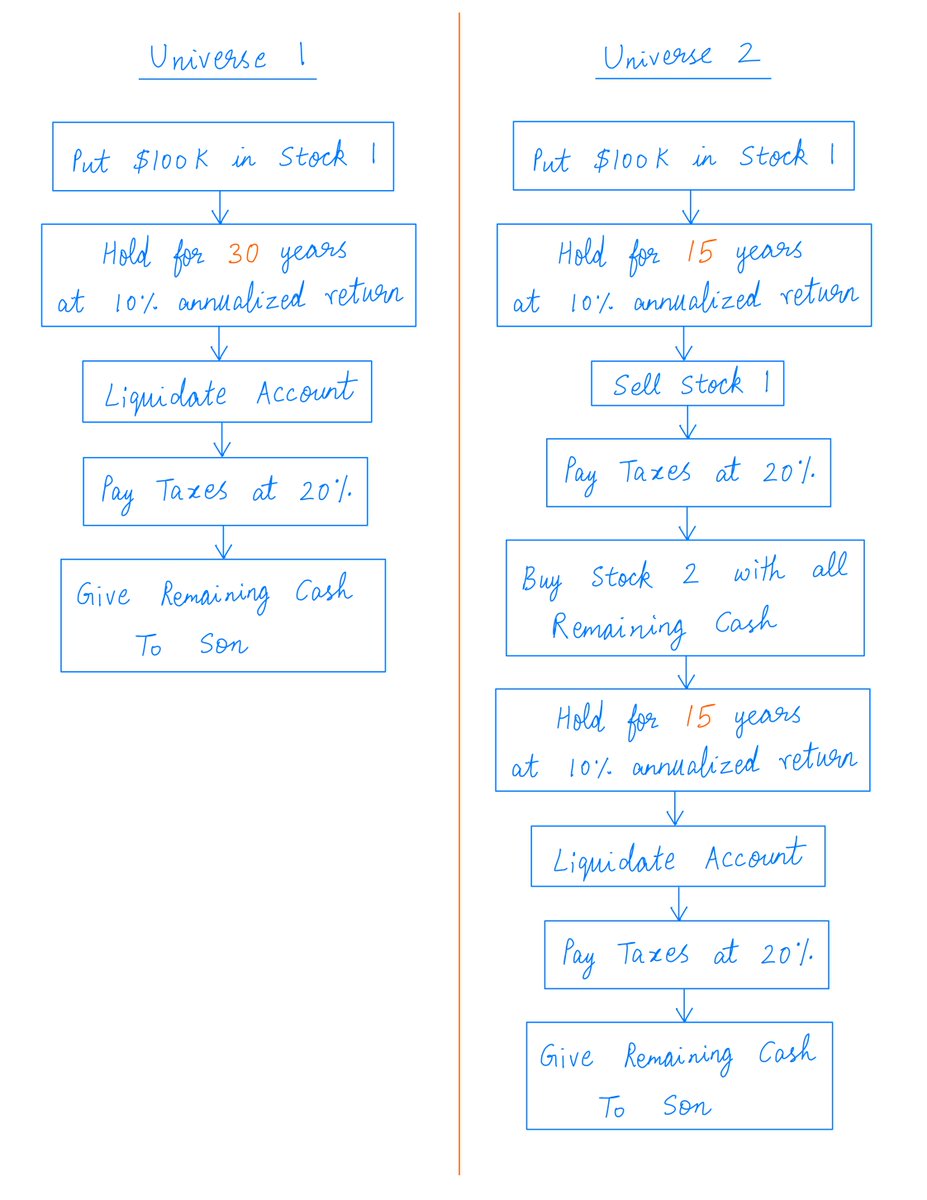

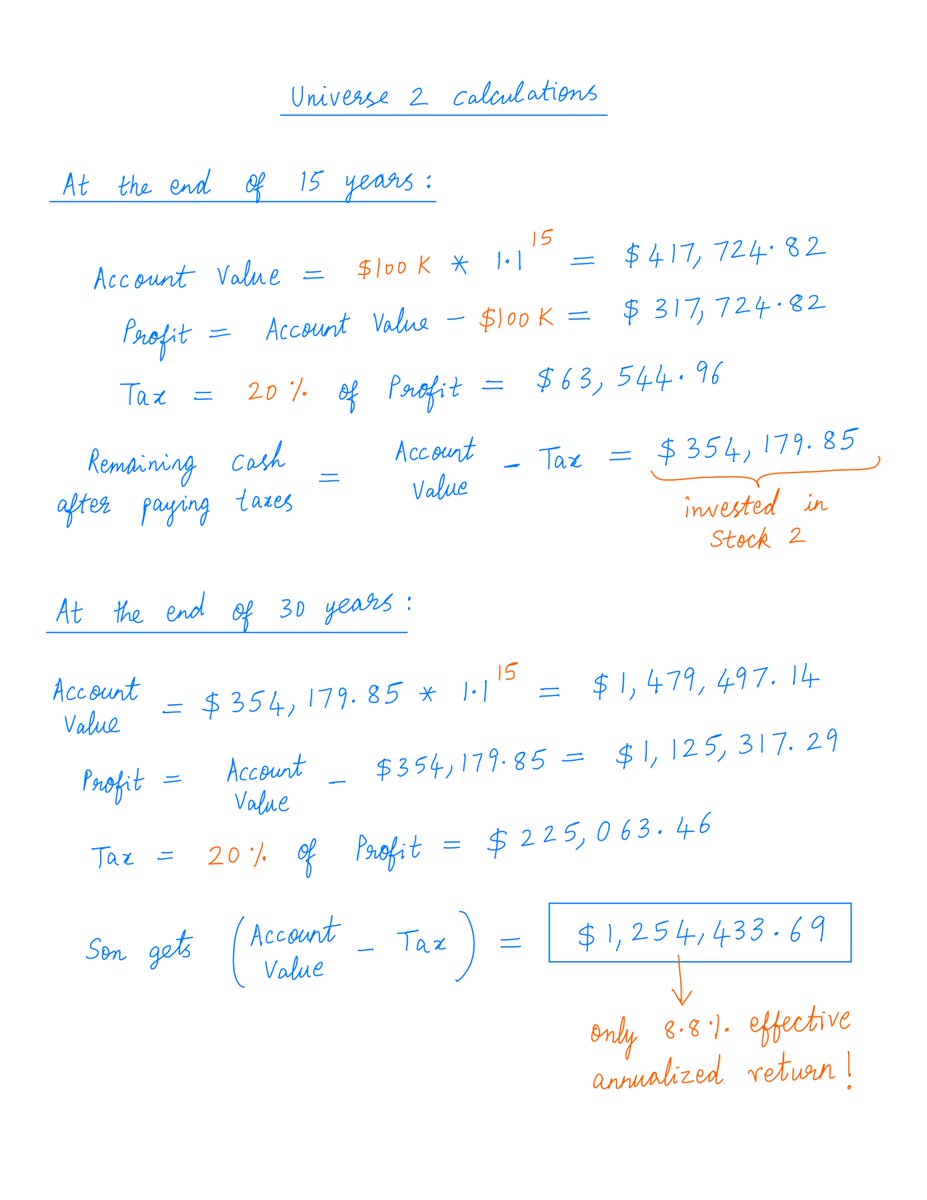

The only difference between these two universes is your holding period: 30 years in Universe 1 and 15 years in Universe 2.

The shorter holding period in Universe 2 makes you pay taxes twice -- but on smaller profits each time.

Longer holding periods work better because they take advantage of *deferred taxes*.

Taxes, of course, are a fact of life. You can't get away from them.

But the next best thing you can do is *defer* them.

For example, suppose you invest $100K into a stock, and the stock doubles. Now your position is worth $200K.

But this $200K is not fully yours. The minute you try to cash it, the proverbial tax man will come knocking.

At a 20% tax rate, the tax bill on your $100K profit will be $20K.

So, of the $200K in your brokerage account, only $180K is *truly* yours. You owe the remaining $20K to the government.

This $20K you owe is called a *deferred tax*.

It's "deferred" because the $20K tax is *not* due right now. It comes due *only* when you sell your stock.

*Until* you sell, this $20K will remain invested in the stock -- right alongside the $180K of capital that's "truly" yours.

This means, if you've chosen the stock well, this $20K will grow over time -- same as the other $180K.

In effect, this $20K is a loan from the government. You have it invested in a stock. And you can leave it there -- growing -- for as long as you like before repaying it.

Part of the growth will be yours to keep. The rest will have to be paid back to the government -- but only at a time of *your* choosing.

Thus, deferred taxes have a "float-like" aspect. And we all know how much Buffett loves float!

The "float power" of deferred taxes works best when you hold stocks forever.

For example, Buffett bought Coca-Cola in 1988. As the stock rose, he's racked up billions in deferred taxes. But he's yet to pay a single cent -- because he hasn't sold a single share of Coca-Cola.

Another reason to prefer long holding periods: good investment ideas are hard to come by.

If you hold a stock for 1 year and then sell, what will you do with the money? You need another stock idea to put it into.

And these stock ideas not only have to keep coming; they must also be really good.

For example, with a 1 year holding period at a 20% tax rate, you have to generate 18.75% pre-tax to get 15% after tax.

You're not just on a treadmill. The treadmill itself is on an incline.

But if you hold on to stocks for a long time, you don't need very many investment ideas.

You can go for quality over quantity. You can improve your odds of success by researching a few ideas really deeply, and being very selective about what you invest in.

So, what kind of ideas make the cut?

Well, to hold a stock for a long time, we should first make sure the company will continue to *exist* for that long.

That is, the company must enjoy some kind of protection against competitors -- what Buffett calls a "moat".

It also helps if the company has lots of reinvestment opportunities.

That is, the company should be able to repeatedly reinvest its earnings back into its own business -- to grow these very earnings, at high rates of return (ROIIC), for a long time to come.

I want to stress: "long holding period" does not mean "never sell".

For example, if you come across new information and realize that you made a mistake investing in a stock, it's perfectly OK to sell.

Forever is Buffett's *favorite* holding period, not his *only* one.

This investing style -- holding stocks for a long time -- also goes by "Coffee Can Investing".

Contrast this to "Cigar Butt Investing" -- repeatedly buying stocks cheap and flipping them quickly for fair value.

Now you know why I say get a cup of coffee, not a cigar!