But will it work?

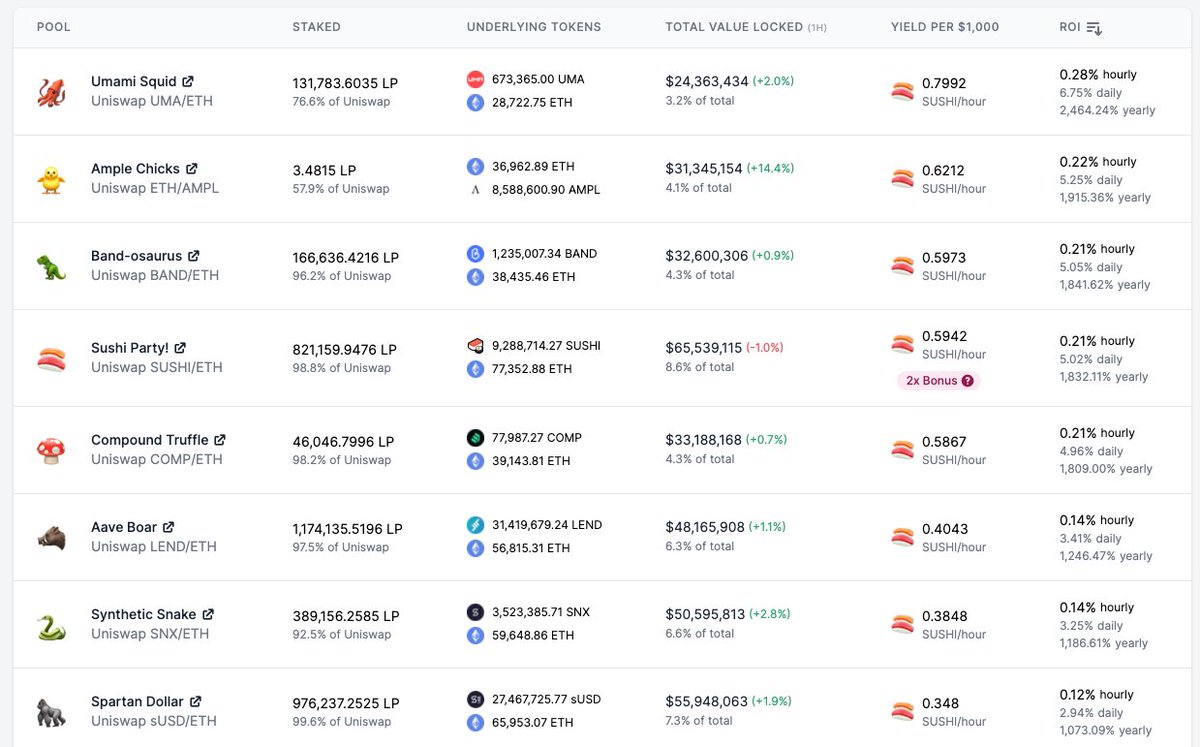

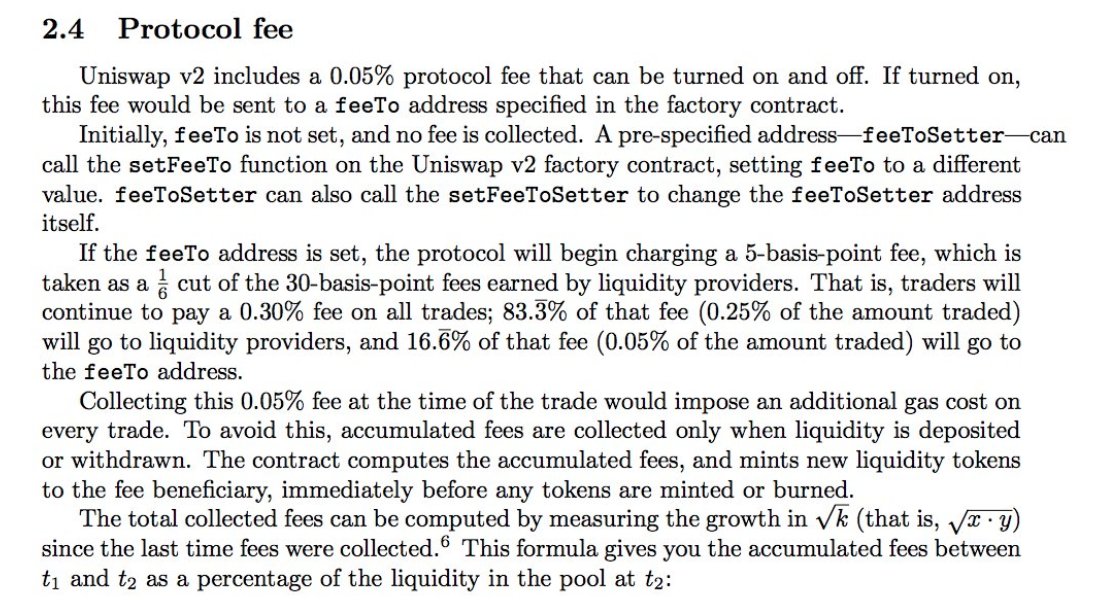

Trading fees are split between liquidity providers (LPs) and holders of $SUSHI, instead of between LPs & equity holders.

The remaining 0.25% goes to liquidity providers.

This means @UniswapProtocol traders essentially pay the same fee (0.3%) on Sushi as they would on Uni.

What does that look like?

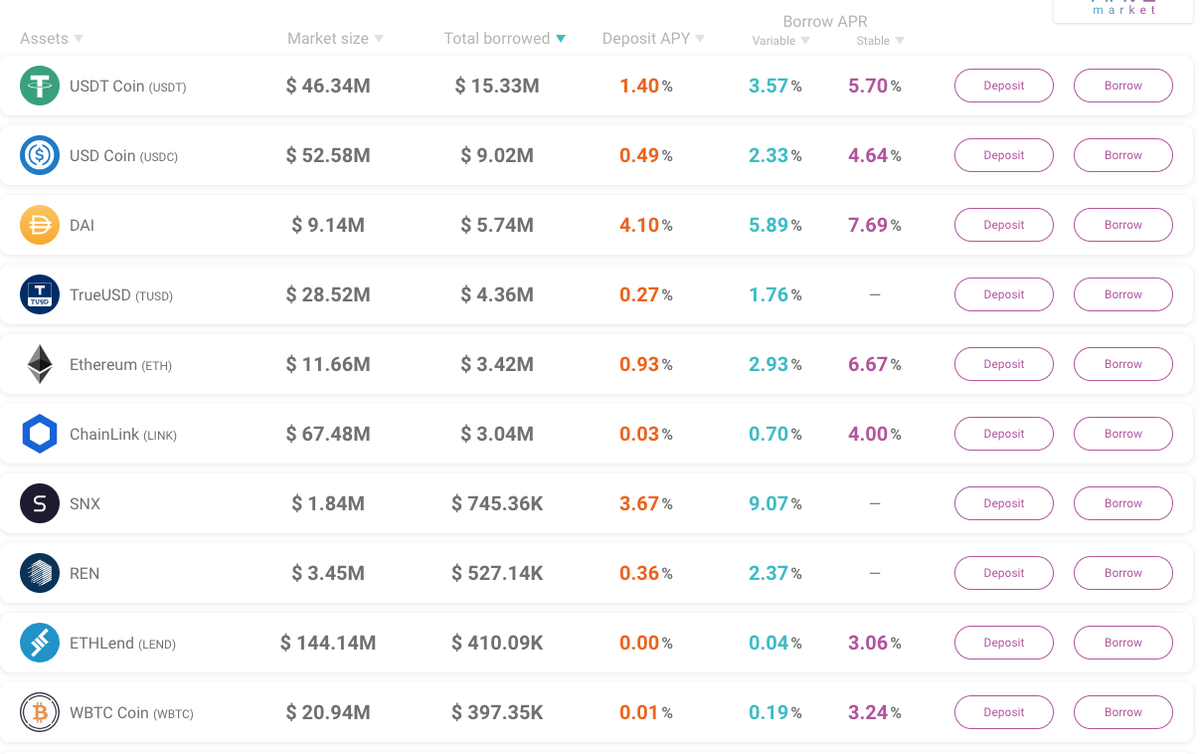

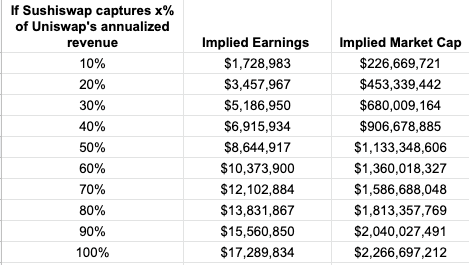

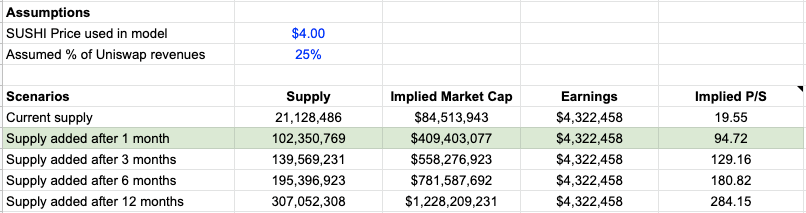

Taking into consideration the fee split to $SUSHI holders, assuming the median P/S from @tokenterminal for the 6 major dex protocols, the following scenarios are possible.

Token price is also highly sensitive to inflation. Feel free to play with the quick & dirty model below and lmk if anything's off.

docs.google.com/spreadsheets/d…

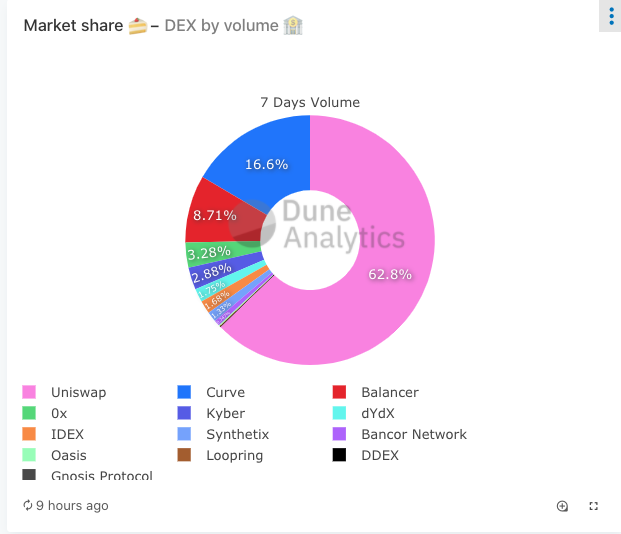

It reinforces my thesis that liquidity is a transient moat; the real moat is mindshare. Here, @UniswapProtocol is by *far* the strongest.

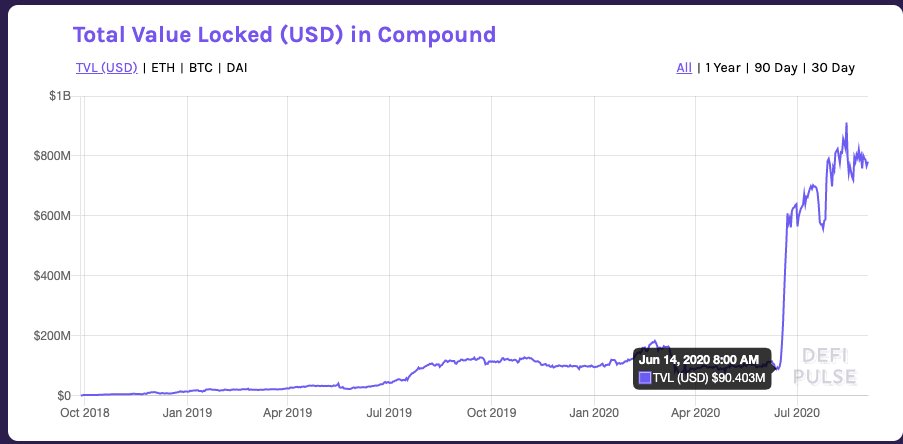

My guess is that a lot of the capital will leave to greener pastures for farming, unless @SushiSwap can drastically differentiate its platform (besides token).

Why?

Fees are split between LPs and $SUSHI holders.

This means the end result may not be that different from current version of @UniswapProtocol (LPs earning most fees).

My guess is most everyday users likely also prioritize a safe, battle tested product and are okay with progressive decentralization. But I've been wrong before.

- Vertical-specific feature differentiation

- Another product with traction

Profitable Uni LPs probably won't give up fat fees to join a new AMM, so this will probably only work on thinly traded pairs first.

If you can earn comparable fees to be an LP and get paid extra to do it, why not?

This challenges my assumptions around first mover advantage, and highlights the fact that liquidity is not a moat.

AMMs will become highly competitive, and users will benefit.