Let's look past the Yams, Sushi, Kimchi, Spaghetti ... and let's see yield farming for what it is:

Permissionless incentive distribution

This enables projects to incentivize any type of user behavior it wants.

@synthetix_io rewarded users who mint synthetic assets with $SNX tokens, leading to explosive growth in 2019.

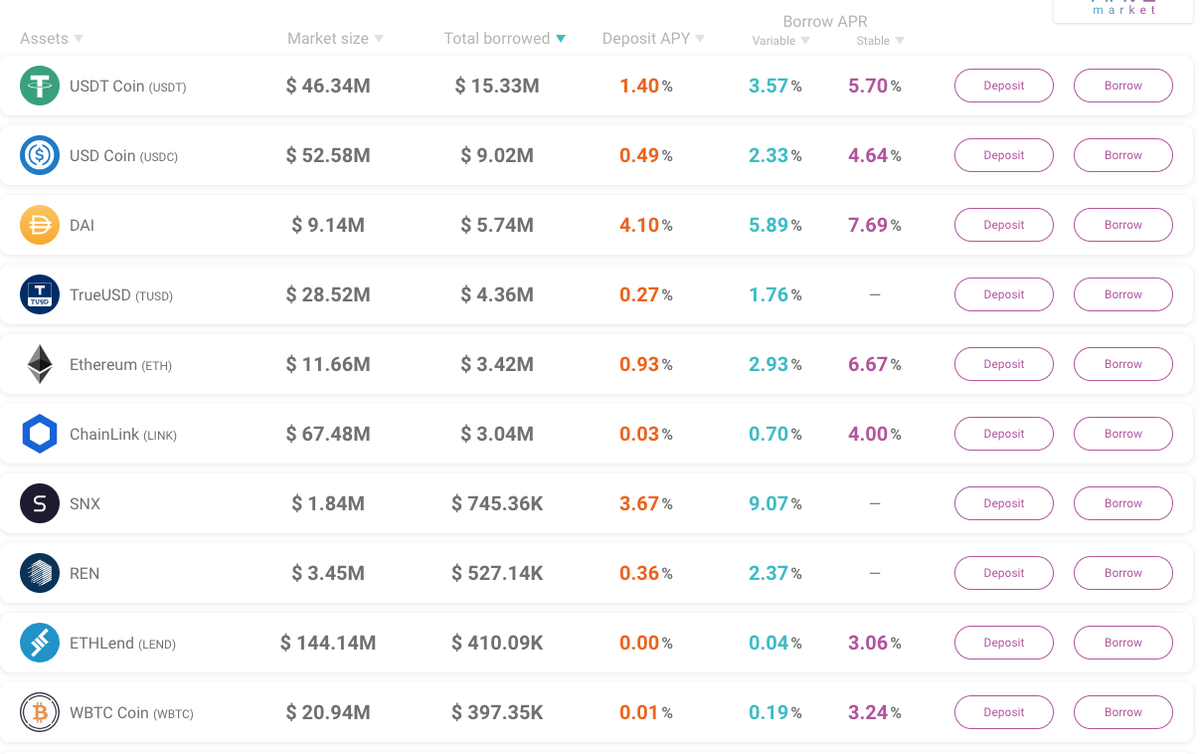

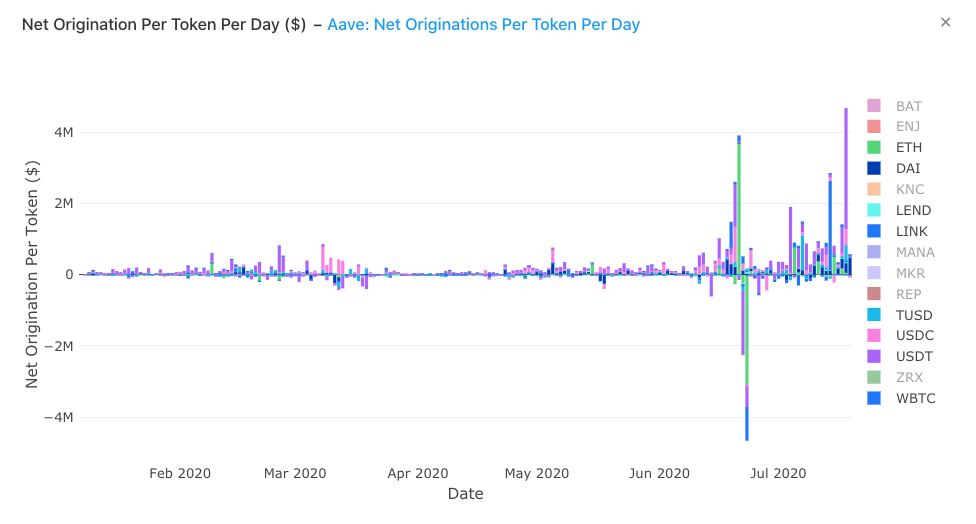

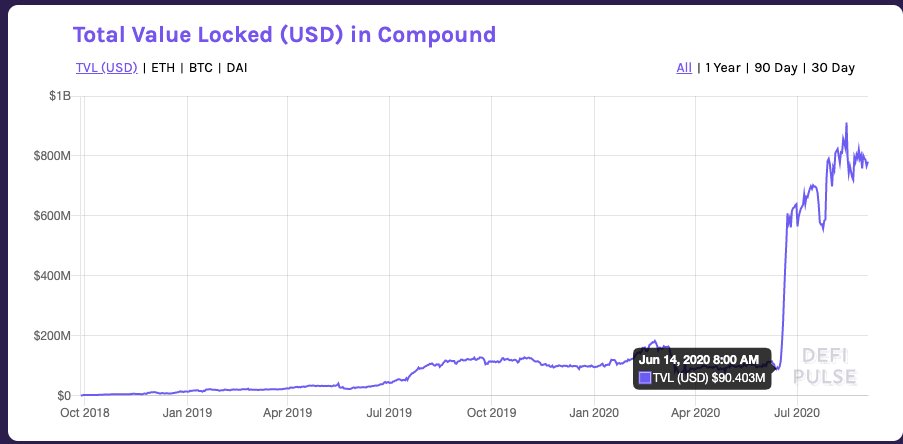

@compoundfinance rewarded lenders and borrowers with $COMP, leading to a 6x growth in collateral!

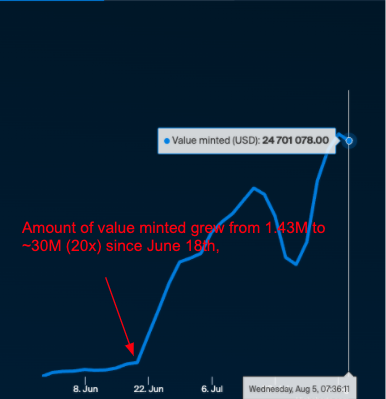

@synthetix_io & @renprotocol wanted liquidity for their synthetic BTC (sBTC & renBTC).

So they rewarded liquidity providers on @CurveFinance's synthetic BTC pool with $SNX & $REN tokens.

As a result, renBTC:

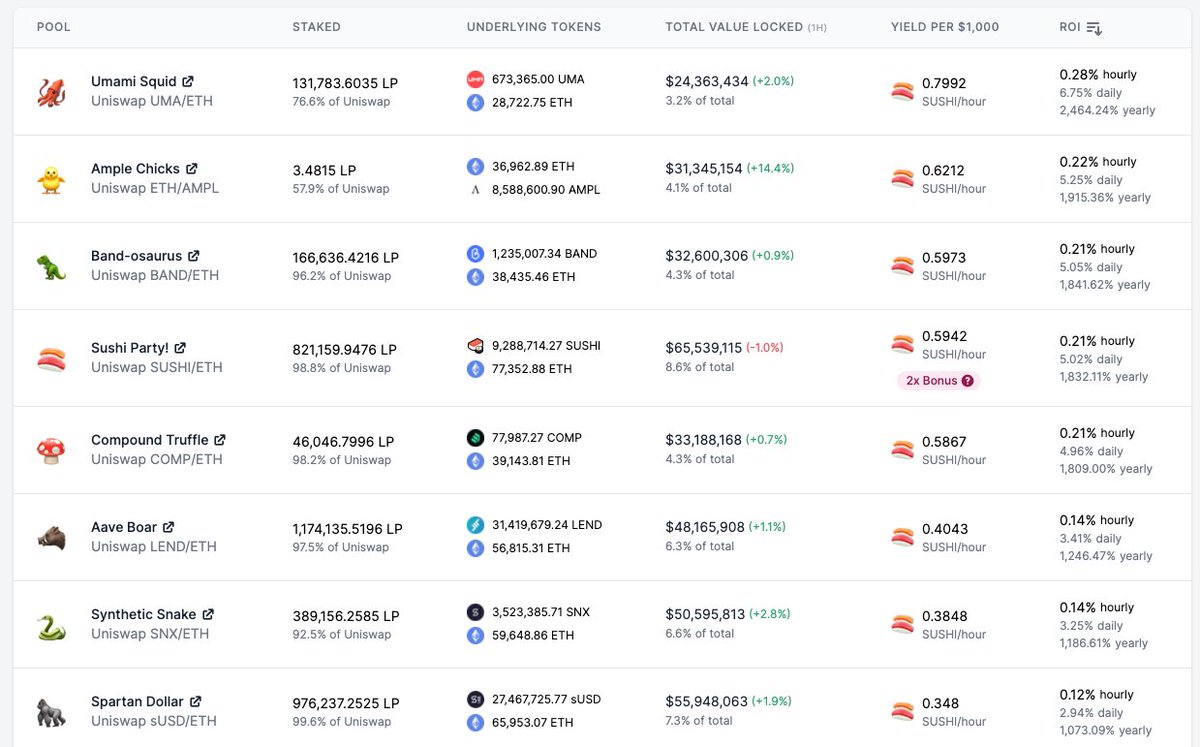

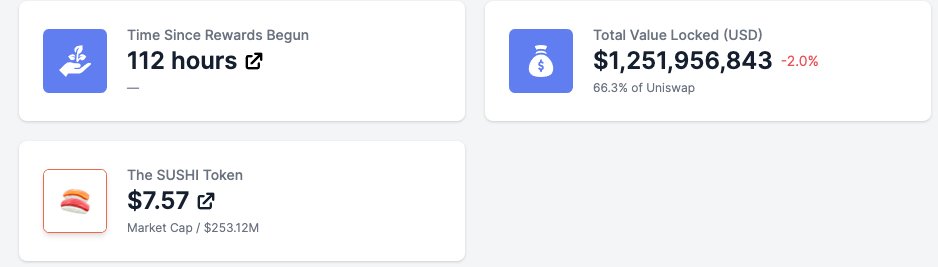

@SushiSwap is rewarding Uniswap liquidity providers who stake their pools on Sushi with $SUSHI tokens. The plan is to migrate this liquidity in ~a week from Uniswap to Sushiswap.

Within a few days, Sushiu attracted $1.25B+

A few forward thinking projects are exploring this, and I believe they will take significant market share by offering safer experiences for users.

We're now seeing more complex incentive designs up the stack - a departure from 2017's "let's mint a random coin & throw it on Binance"