Get a cup of coffee.

In this thread, I'll help you understand 401(k)s -- and other portfolios that are continuously rebalanced between stocks and bonds.

Because your skills are in high demand, you get many job offers.

After much consideration, and many "Pros and Cons" lists, you finally decide to join Google.

Congrats! It's a great company, and you're poised to do great things there.

On your first day at Google, you attend an "orientation".

During this orientation, a HR person tells you about Google's 401(k) plan.

Up to this point, you've never had to worry about a 401(k).

To be honest, even after the HR person covered it, you still have some lingering questions.

Like, what exactly is a 401(k)? How does it work?

Now that you've graduated and landed a real job, you realize you need to figure out these things.

I can help you with that.

A 401(k) is a plan that helps you save for retirement.

Here's how it works. Every paycheck you get from Google is split into 2 parts:

Part 1 is deposited into your bank account. This is how you meet your expenses -- rent, groceries, etc.

Part 2 goes into your 401(k).

This money is not available for you to spend. It's set aside for your retirement.

It's usually invested in stocks and bonds. So it grows over time.

With luck, it eventually becomes a substantial sum -- that you can draw on when you retire.

It gets even better. Many employers "match" your 401(k) contributions -- up to a point.

For example, if you contribute $10K into your 401(k), Google may put in another $5K. This is a "50% match". It's like free money that Google is giving you, to help you retire comfortably.

So, here's the plan:

It's 2020 now. You've just started working at Google.

You'll continue at Google for the next 30 years.

During this time, you'll contribute regularly to your 401(k). Google will match your contributions at 50%.

At the end of 2050, you'll retire.

Now that you have a plan, the next thing to do is: pick a fund.

This is where your 401(k) contributions (and Google's 50% matches) will be invested.

Since you plan to retire in 2050, a reasonable choice may be Vanguard's Target Retirement 2050 Fund (VFIFX).

What exactly is this VFIFX?

Well, it's a low-cost retirement fund run by Vanguard for people who want to retire in 2050.

When you make contributions to this fund, the money goes into stocks and bonds.

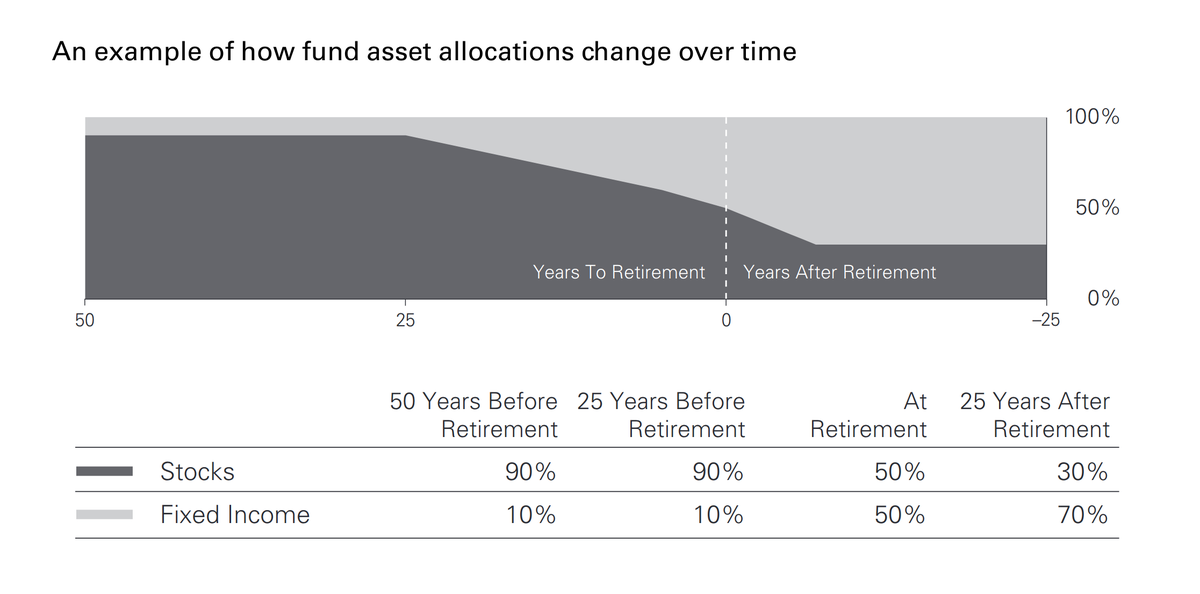

This continuous "stocks vs bonds" adjustment is called "rebalancing".

Why is rebalancing necessary? Because stocks tend to be more volatile than bonds.

As you approach retirement, your ability to withstand volatility decreases. So you keep more of your portfolio in bonds.

Let's say you designate all your 401(k) contributions to go into VFIFX.

Now, how much money will you have when you retire in 2050?

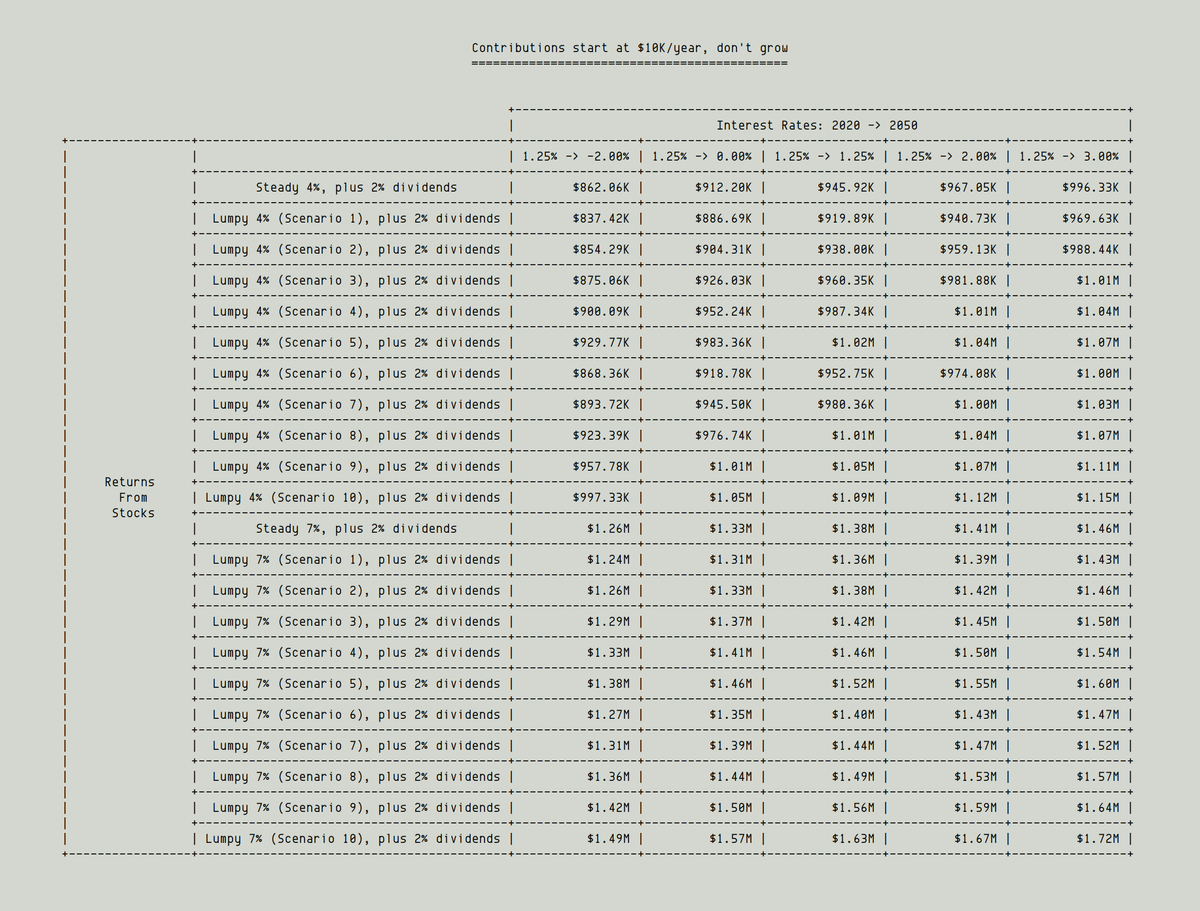

This depends on 3 factors:

1. Your contributions,

2. How stocks do over the next 30 years, and

3. How bonds do over the next 30 years.

Factor 1. Your contributions.

This is the *only* factor within your control.

It's very simple: the more you put in while you work, the more you'll be able to take out when you retire.

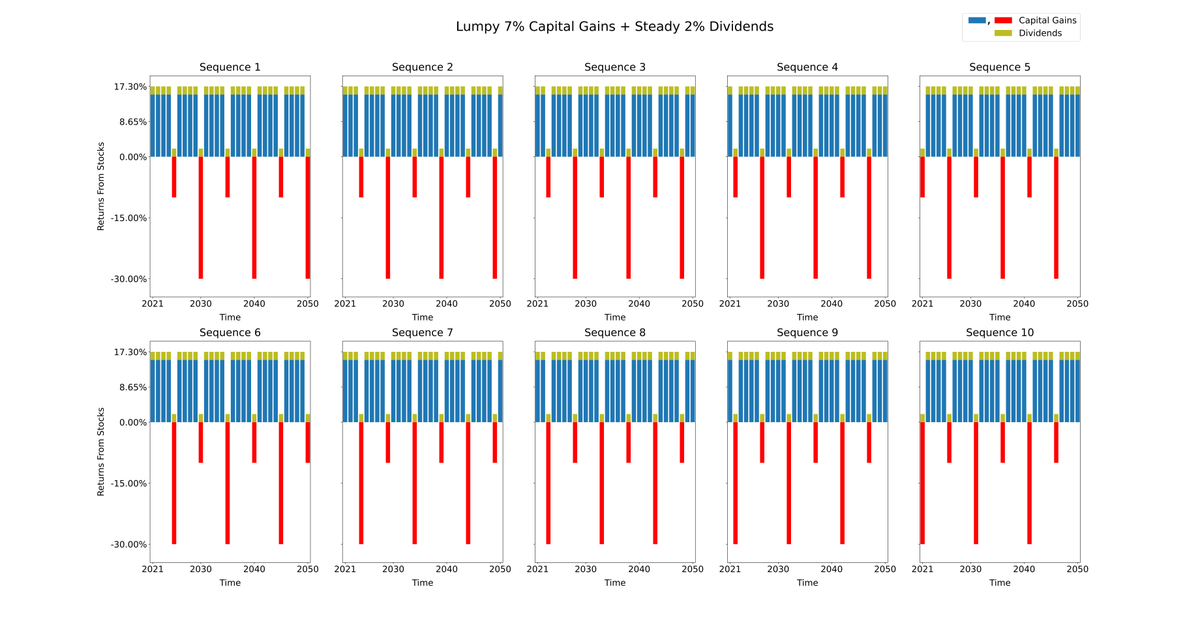

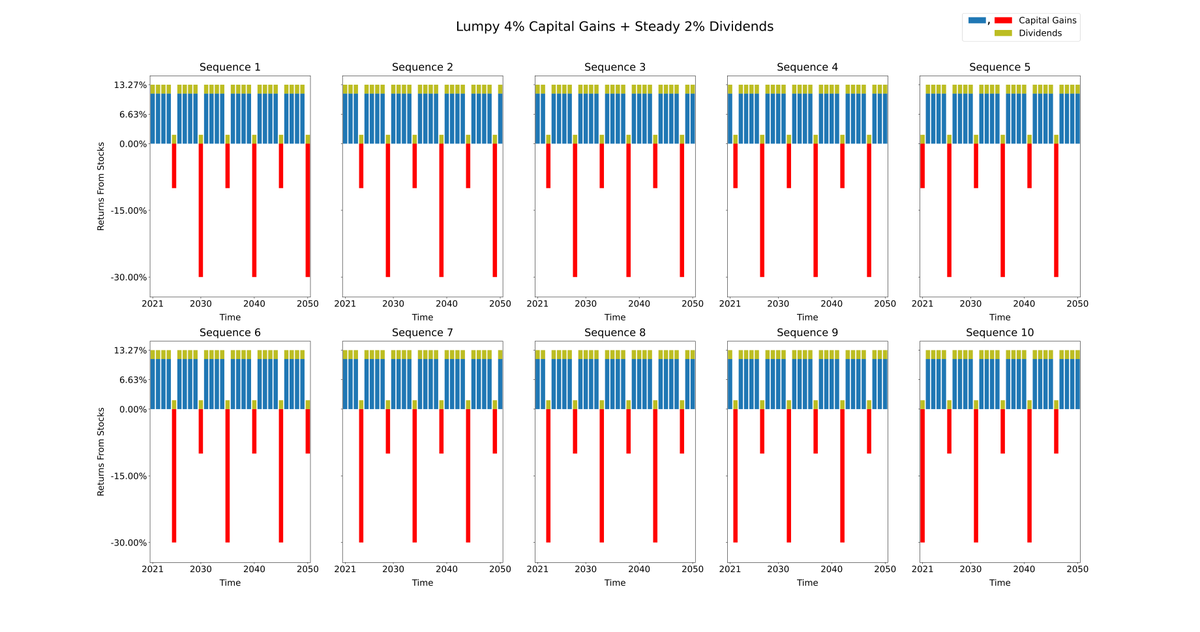

Factor 2. How stocks do over the next 30 years.

This, of course, is completely outside your control.

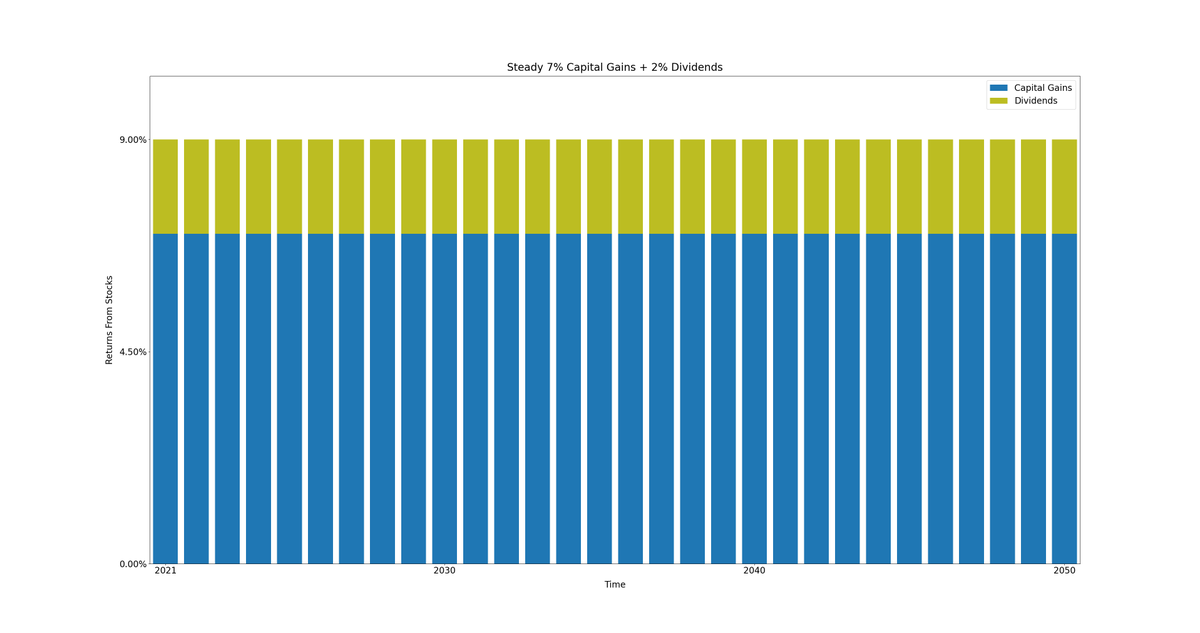

Historically, in the US, stocks have returned about 7% via price appreciation (capital gains) and 2% via dividends each year.

But this is far from guaranteed.

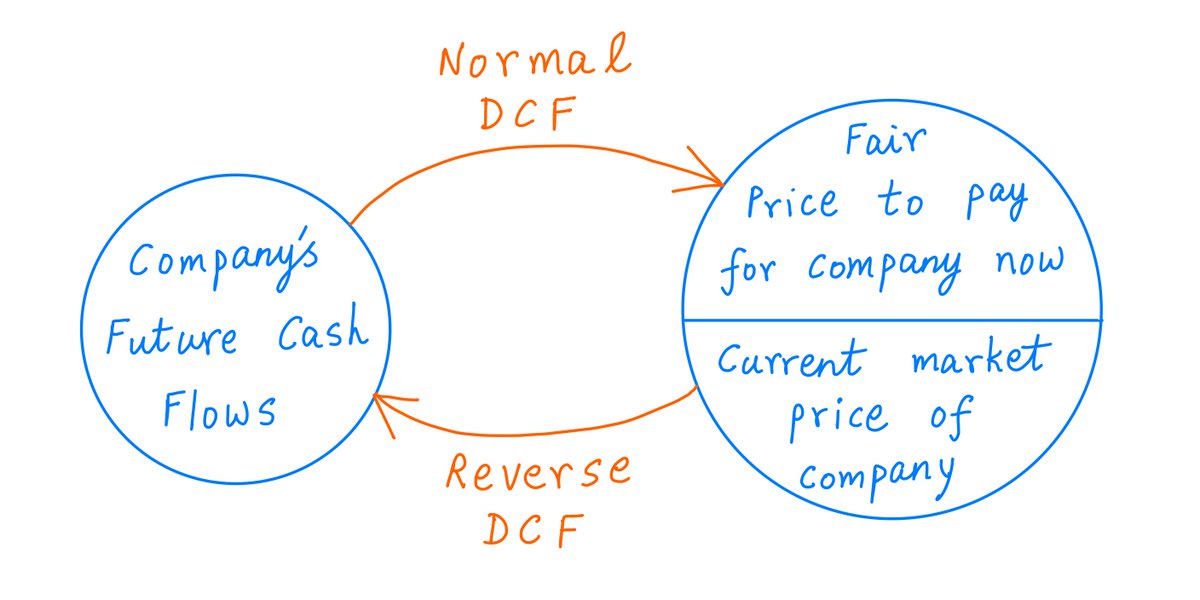

A simple assumption is that bonds are worth the present value of all future interest and principal payments, discounted at the current interest rate.

For more details, here's my thread on DCFs -- which also covers the concept of present value:

It boils down to this:

If interest rates rise, we get higher returns on *future* bond purchases -- but our *currently* held bonds lose value.

And if interest rates fall, it's the other way round.

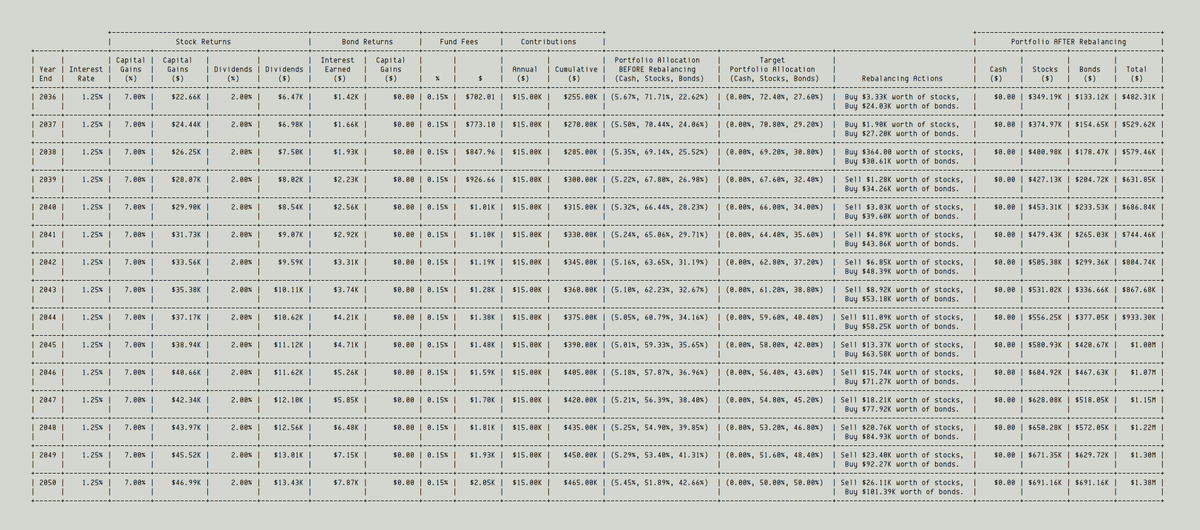

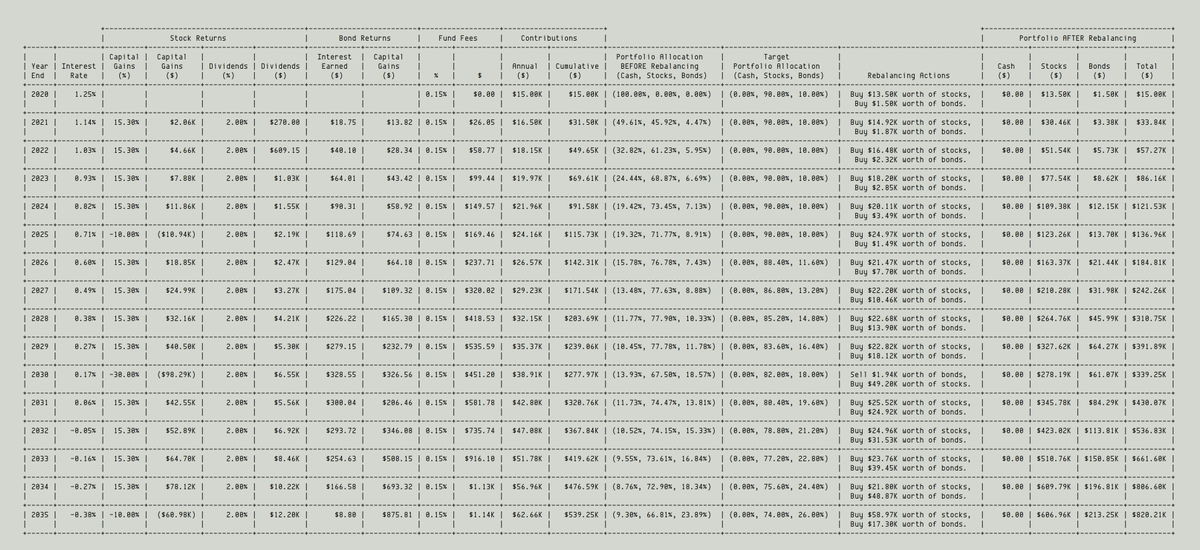

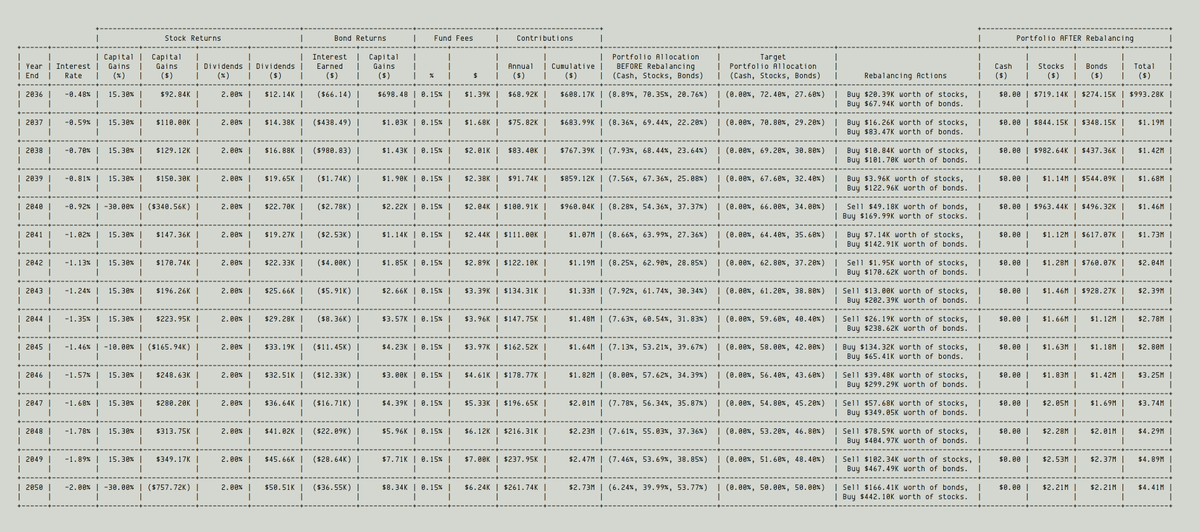

So that's how you simulate a portfolio that's continuously rebalanced between stocks and bonds.

For each year, you simulate the stocks and bonds by making assumptions about the lumpiness of their returns, interest rates, etc.

Then you account for fees charged by the portfolio manager.

Then you add in annual contributions and company matches.

Finally, you simulate rebalancing the portfolio according to a target allocation -- which in this case depends on the number of years until retirement.

Key lesson: There are many factors outside your control when building a retirement portfolio. The best you can do is position yourself so that you'll retire in comfort even if the portfolio doesn't get you great returns. This means saving and contributing as much as you can.

Many people in the US haven't set up their 401(k)s yet.

This may be because the only time people are confronted with 401(k) choices is when they begin a new job -- when there's usually a million things to do. So the 401(k) takes a backseat, and remains that way for years.

One caveat: the simulations I showed are all pre-tax. If I discussed taxes, Roth 401(k)s, etc. -- this thread would be even longer!

But taxes are super important. You should definitely account for them while planning your retirement.

So far, we've discussed how much money you will *have* when you retire.

Equally important is how much money you will *need* to retire. I have a separate thread on this if you're interested:

Thanks for reading!

I hope this was useful.

Have a great Labor Day weekend!

/End