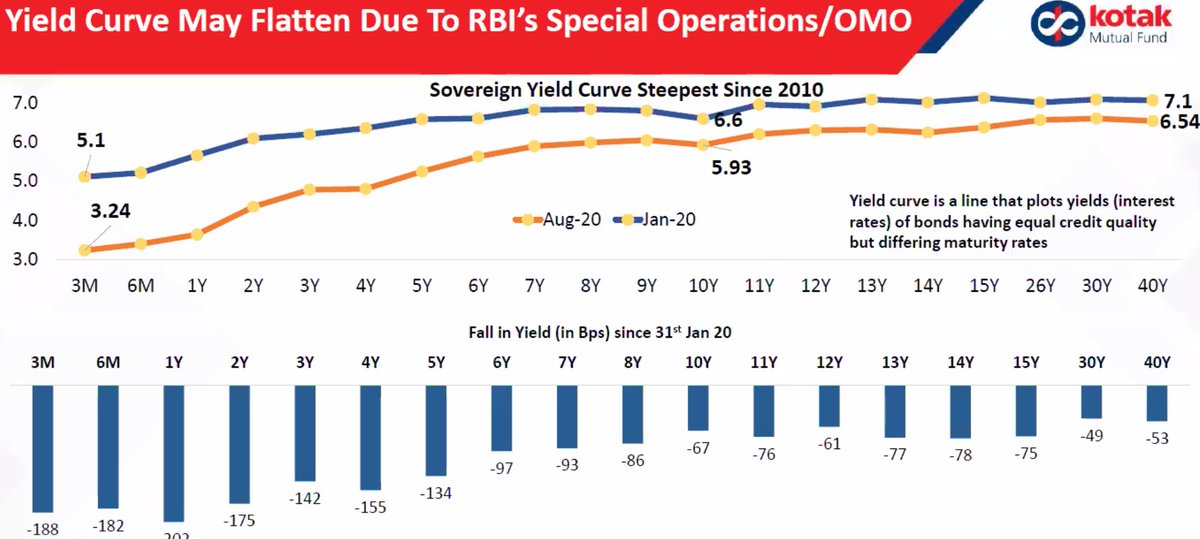

Longer term rates have yet to come down meaningfully. Shorter duration rates have come down materially. Orange line is for Aug 2020 vs the blue line of Jan 2020.

Returns across different credit curves, from Govt Securities to AA and below ratings, across different time horizons.

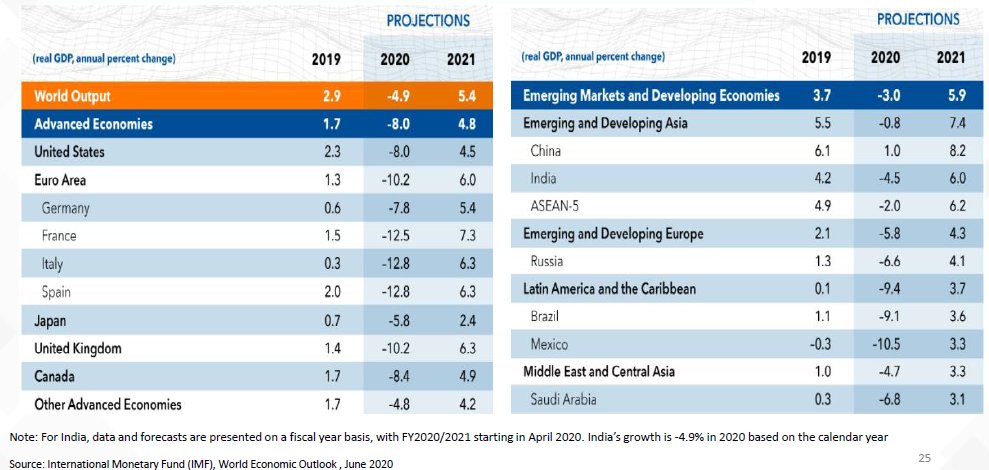

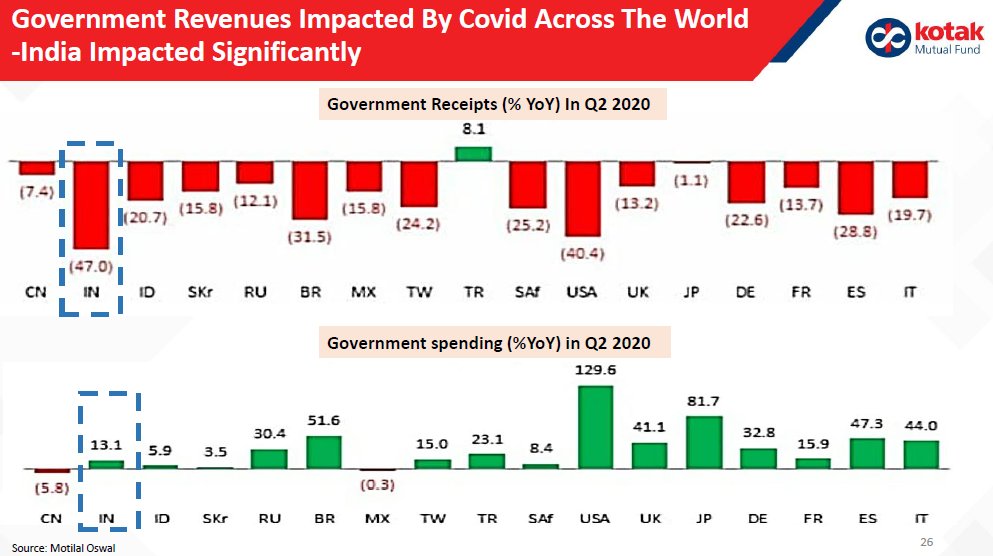

Govt spending Year on Year has increased across the board except for China. This is as high as 129% for US. This is not supported by increasing Govt revenues which have declined materially.

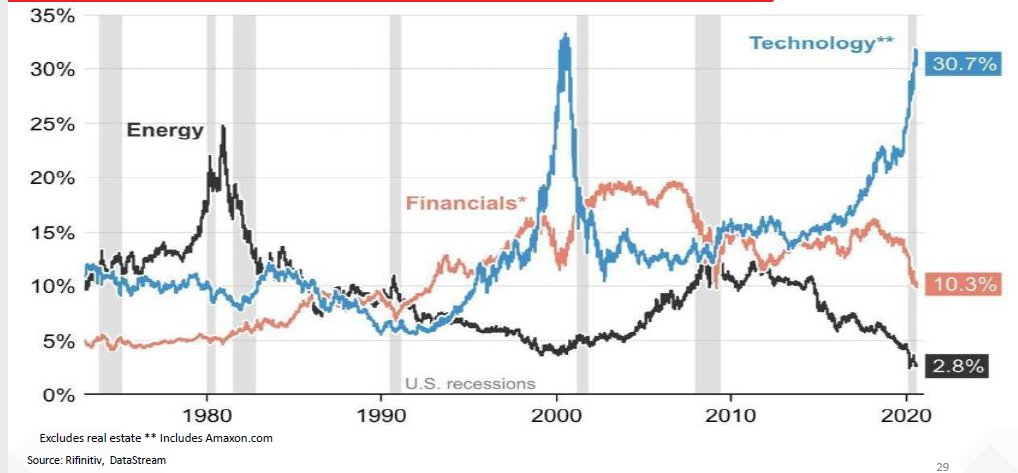

Tech stocks have been the driver of the market rally, with Tech now comprising over 30% weight in Markets. The chart shows how different sectors behaved for last many years.

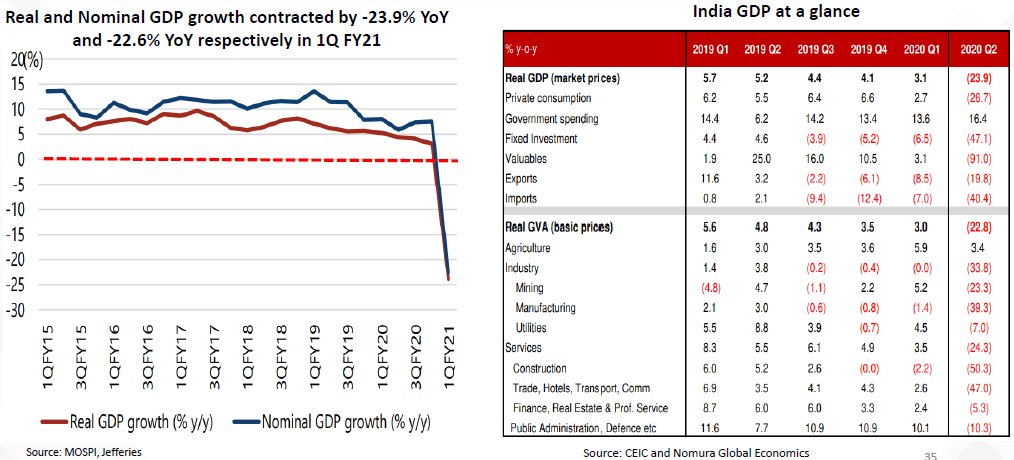

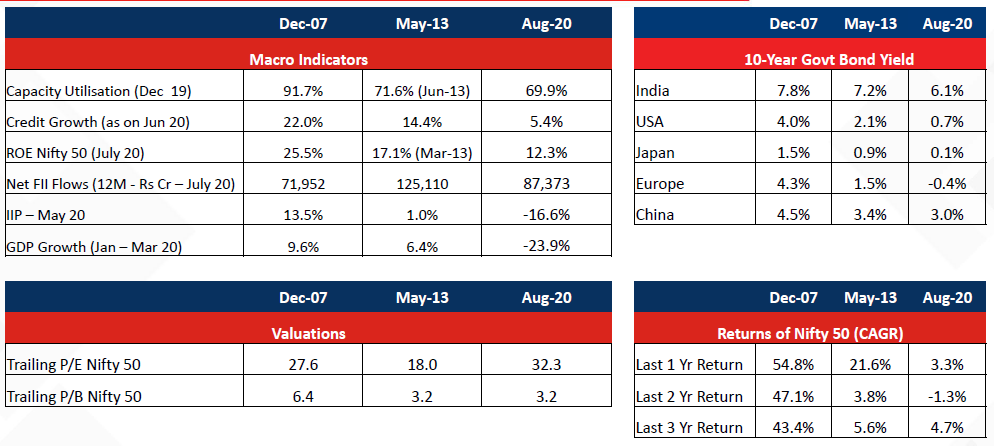

We have already seen in the news pages that India's #GDP growth has contracted by -23.9%. The contraction is across all sectors in India as can be seen in the table to the right.

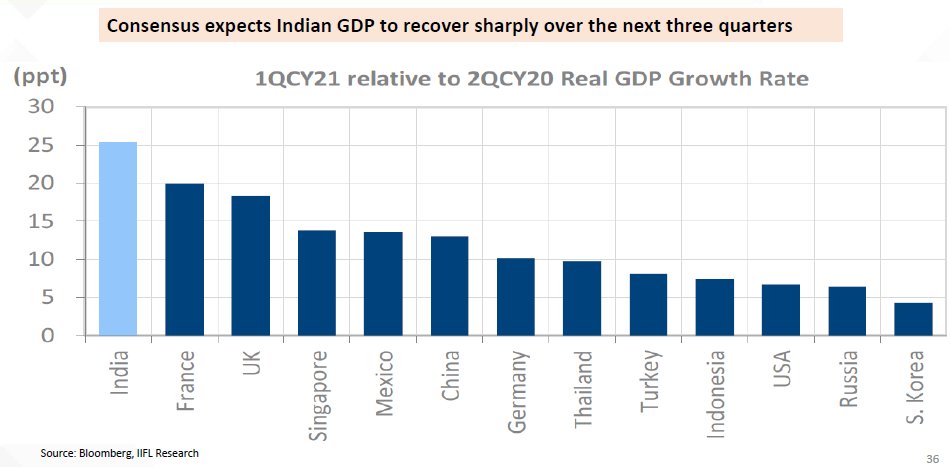

The market consensus expects that there could be a sharp recovery from here over next 3 quarters. As per the source in the chart, the growth rate for Q1 2021 next year is expected to be materially higher from here on.

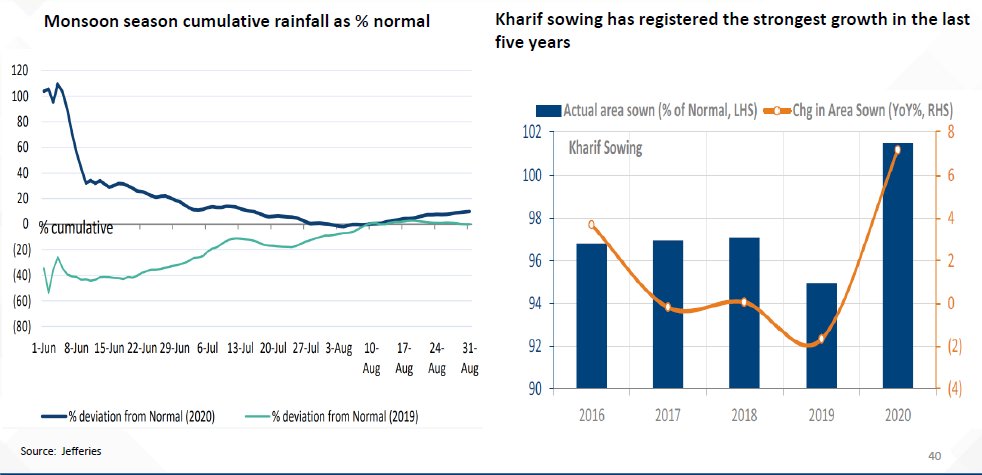

Agriculture has been relatively not impacted. Good rainfall has aided the growth here. This is also reflected in healthy Tractor sales data.

Monsoon in 2020 (Dark blue) vs 2019. Clearly good rains across the board in India. This is also reflected in very encouraging Kharif sowing.

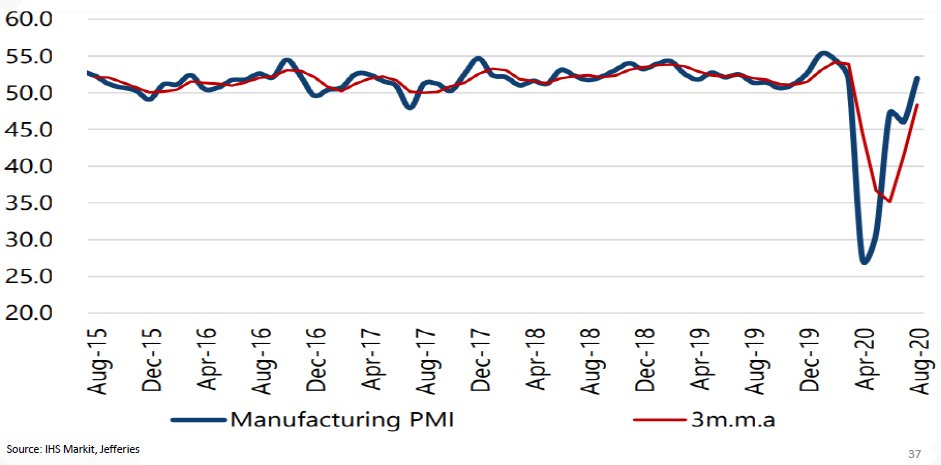

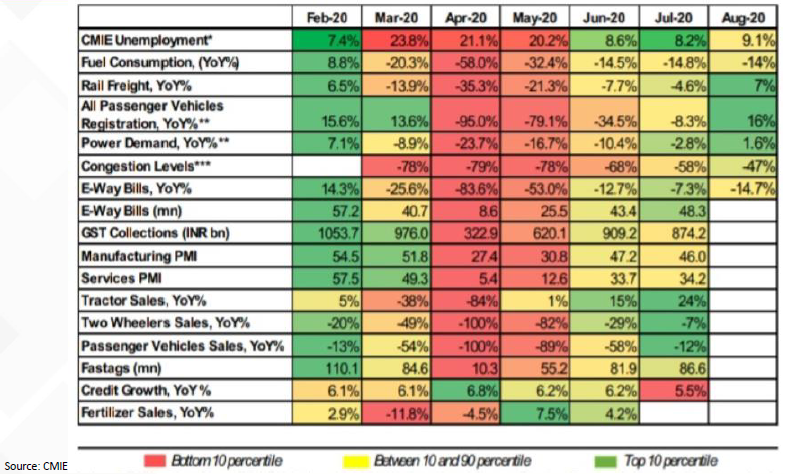

Compared to the initial months of lockdown, Economic Indictators for July & August 2020 are looking better. This would point to gradual recovery with each passing month owing to lifting of lockdown in a stage by stage manner.

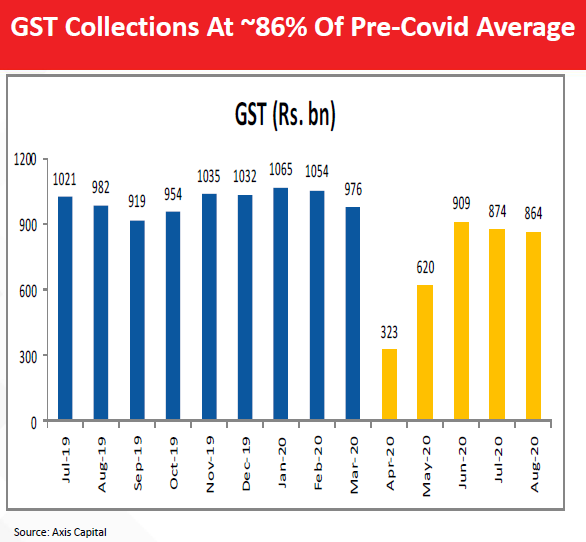

#GST is a good proxy of an economic progress. GST collections in August are now ~86% of pre-Covid levels.

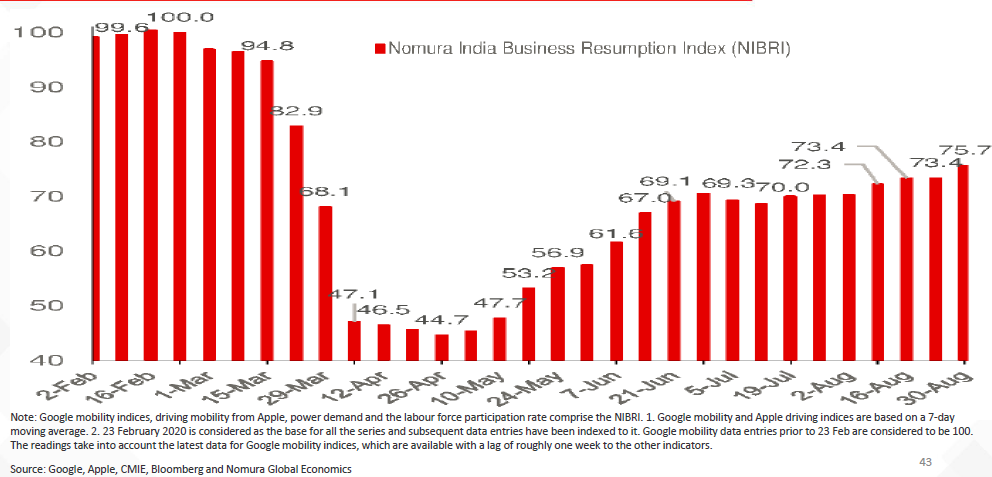

A more detailed look represented by Nomura India Business Index > the recovery is at a slow pace in August 2020.

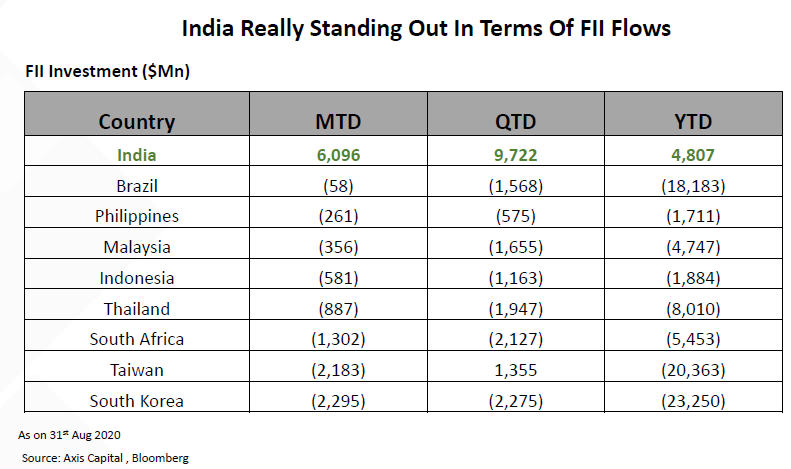

The valuation gap between S&P500 vs rest of the world is quite apparent now. Only time will tell if the funds would flow to Emerging Economies to take opportunity of the valuations.

A snapshot of all the variables in one table is v helpful. Capacity utilisations are all time low, Credit growth is not picking up, NIFTY returns are not healthy and GDP is degrowing in August - most of this is on expected lines and hopefully things will improve from here.

On Bond rates, a very sharp reduction in interest rates across all geographies, with negative rates in Euro zone. I don't recollect if this was ever there ! Clearly these are all the measures which the Govts are trying to get their economies back on track.

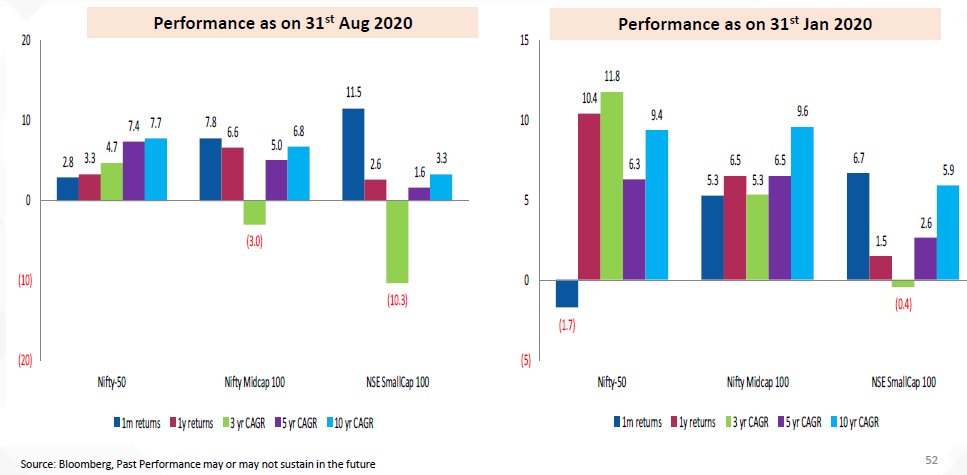

The stock market returns across Large, Mid & Small Caps is below. In last 1 month, the max returns came from Mid & Small Caps. Large Cap returns across all time durations are now +. Small & Mid have yet to show more returns to make returns + for 3 yr durations.

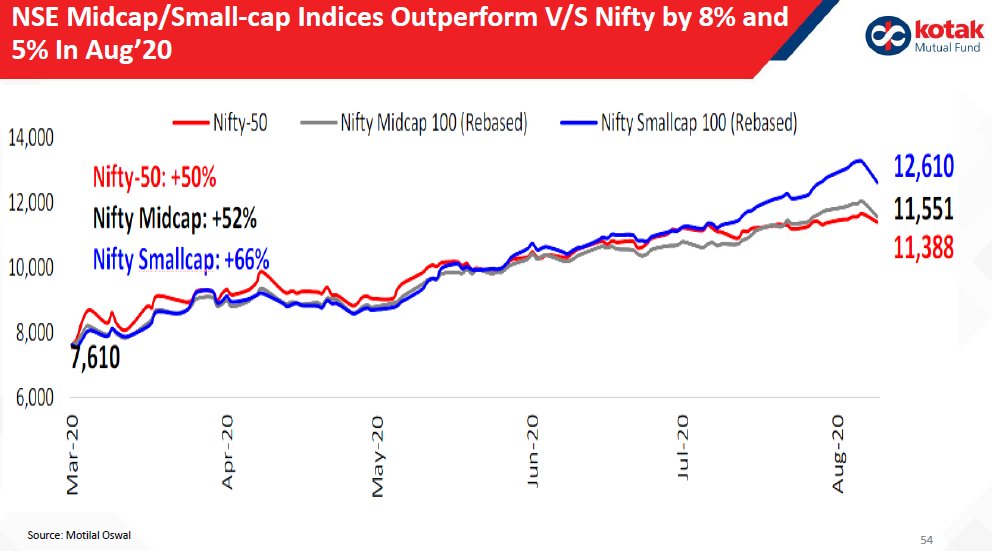

This is more clearly evident in the chart below where recent market move is more driven in Mid & Small Caps post June 2020.

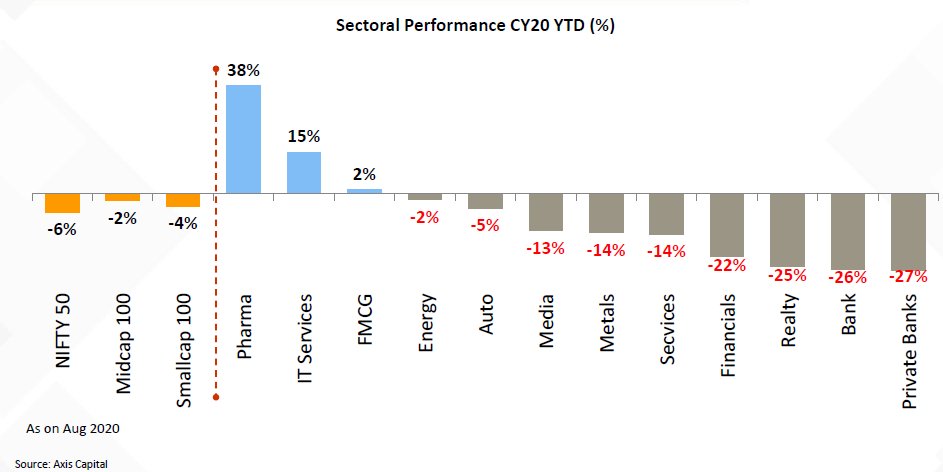

The driver of the returns are primarily driven from Pharma sector which has been in limelight in 2020, followed by IT. FMCG has been relatively flat. Worse hit hv been Banking, Financials & Reality. A sector to watch out is Auto - which forms a major part of manufacturing

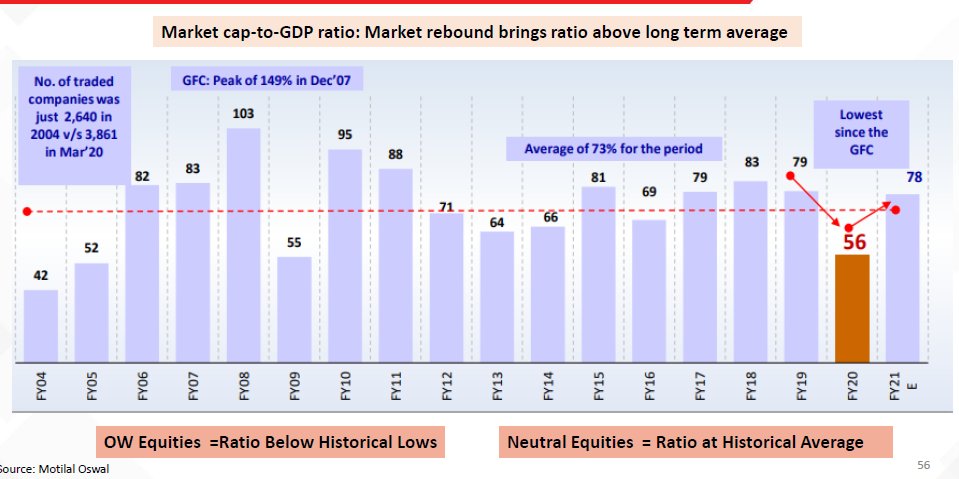

Valuations are now no longer as low as they were in Mar & April.

Indian equities are now above long term averages.

Indian equities are now above long term averages.

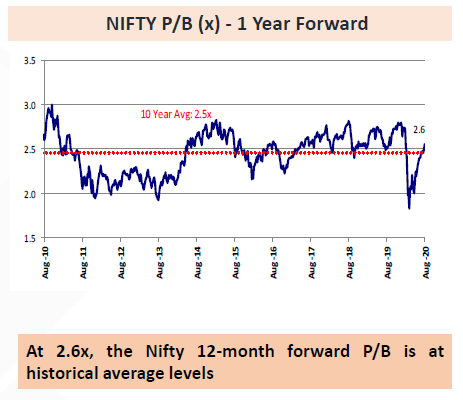

At Price to Book valuation, it is also evident that the recent market run up has resulted in markets being now 'reasonable' valued.

• • •

Missing some Tweet in this thread? You can try to

force a refresh