Investments | Tax | Insurances

Ex KPMG / Deutsche Bank London / Prudential

https://t.co/zzZbvDfBDL

Contact Via https://t.co/s7I1tDojm0

How to get URL link on X (Twitter) App

https://twitter.com/dmuthuk/status/1312745331193389056To know about tech, learn from any of the ICICI group companies. Miles ahead. Compared to ICICI Pru, HDFC Life is in stone age. Marcellus may say channel checks, but I am a part of the channel and their customer too. If Tech is the reason, then they got it wrong.

Big spread between India vs US 10 year rate curve. US is

Big spread between India vs US 10 year rate curve. US is

https://twitter.com/banyanfa/status/1292389704927567875Another one is a recent entrant and its founder enjoys immense respect. Sticks to quality. By its Investment process, I believe that it won't buy Reliance till the business is a compounder and it gets free cashflow. Cites it's recent underperformance to not holding Reliance.

The scale of corrections in MidCap & Small Caps is hugeeee. Midcaps still 30% lower compared to 2018 start and Small caps, still 50% lower.

The scale of corrections in MidCap & Small Caps is hugeeee. Midcaps still 30% lower compared to 2018 start and Small caps, still 50% lower.

Their core brand which is behind the success is Fevicol. The Company is adding variants and premiumization to this Core product. See the different variants of the same product to address all forms of adhesive requirements. Latest entrant is a Spray.

Their core brand which is behind the success is Fevicol. The Company is adding variants and premiumization to this Core product. See the different variants of the same product to address all forms of adhesive requirements. Latest entrant is a Spray.

1. Sabka time aayega - Each asset class ends up coming to the top slot and then after that sooner or later goes right at the bottom.

1. Sabka time aayega - Each asset class ends up coming to the top slot and then after that sooner or later goes right at the bottom.

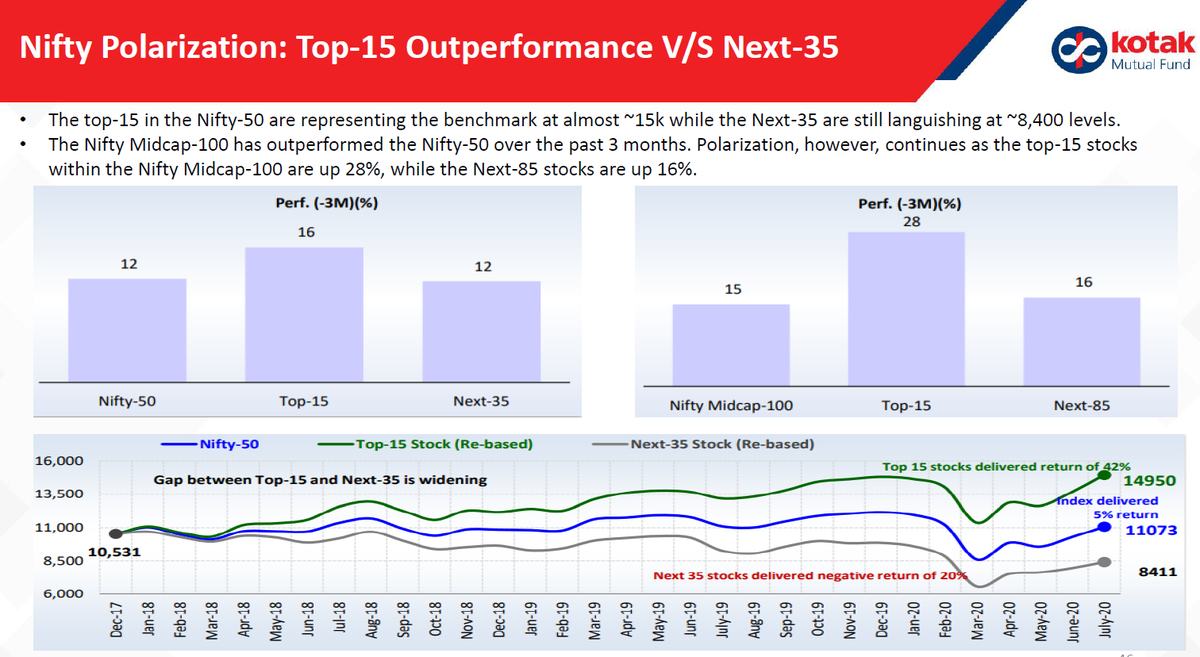

Same is in India. Top 15 stocks in NIFTY are at a level of NIFTY 14950 and rest are at the levels of ~8400 levels. Extreme polarision led by Reliance

Same is in India. Top 15 stocks in NIFTY are at a level of NIFTY 14950 and rest are at the levels of ~8400 levels. Extreme polarision led by Reliance

Fund likes these which are relatively new, but haven't received a star rating yet, end up getting ignored. I hv always held a view that Star rating based investing is like driving while looking at the rear view mirrors.

Fund likes these which are relatively new, but haven't received a star rating yet, end up getting ignored. I hv always held a view that Star rating based investing is like driving while looking at the rear view mirrors.

One's return depends truly in which asset category they invest and how long do they stay invested. Compounding happens every where, but the scale depends upon the underlying growth rate of the Investment. The higher the growth rate, higher is the risk (volatility).

One's return depends truly in which asset category they invest and how long do they stay invested. Compounding happens every where, but the scale depends upon the underlying growth rate of the Investment. The higher the growth rate, higher is the risk (volatility).