hello Nature as an asset class, seems #wallstreetconsensus getting more ambitious every day ft.com/content/f04fc3… via @financialtimes

this is not a lone - however powerful US voice - biodiversity and natural capital have been on the policy agenda for a while, and @greenfinanceobs has been warning about it

https://twitter.com/greenfinanceobs/status/1303255149217972229?s=20

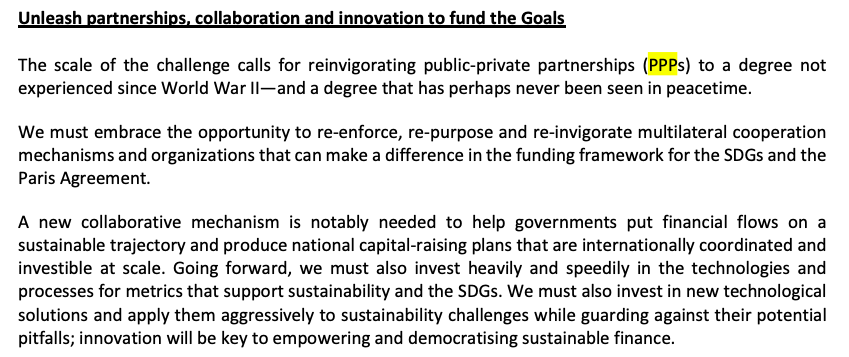

rhetorical strategy in Maximising Finance for Nature similar to Maximising Finance for Development:

1. Identify and quantify financing gap. Use large numbers to make it obvious governments/public money cannot do it.

1. Identify and quantify financing gap. Use large numbers to make it obvious governments/public money cannot do it.

2. Frame government action as a question of subsidies to dirty industries.

Never ever suggest this may be a question that regulation would sort much faster.

Never ever suggest this may be a question that regulation would sort much faster.

3. Then bring in Derisking state: why subsidies dirty polluters when you can subsidise private financiers with tax breaks, incentives & regulatory measures.

Note here when private finance talks about regulation, they dont mean dirty activities.

They mean deregulation of finance

Note here when private finance talks about regulation, they dont mean dirty activities.

They mean deregulation of finance

• • •

Missing some Tweet in this thread? You can try to

force a refresh