"Tired of your old Test 1? Always found the linakage too rigidly mechanical? Then welcome to the new, improved Metric A!" Or so the marketing spiel seems to go. But look below the surface and you'll find all the same logical flaws and a near identical ramping up of costs. 1/

https://twitter.com/Sam_Marsh101/status/1303410998003539969

I will try and keep this as accessible as possible, because #USS can't be allowed to bluff their way through this stuff. First, a recap. What was wrong with Test 1? 2/

There were a number of criticisms of Test 1, but the main one was that it unnecessarily drove up deficits and contribution rates based on a very flimsy premise (a "large and demonstrable mistake" in @MikeOtsuka's words). 2/ medium.com/@mikeotsuka/us…

The Joint Expert Panel's criticisms of Test 1 and the intense focus on self-sufficiency in their first report were extensive. In their second report, JEP recommended a dual-discount rate (DDR) as an alternative to Test 1. 3/

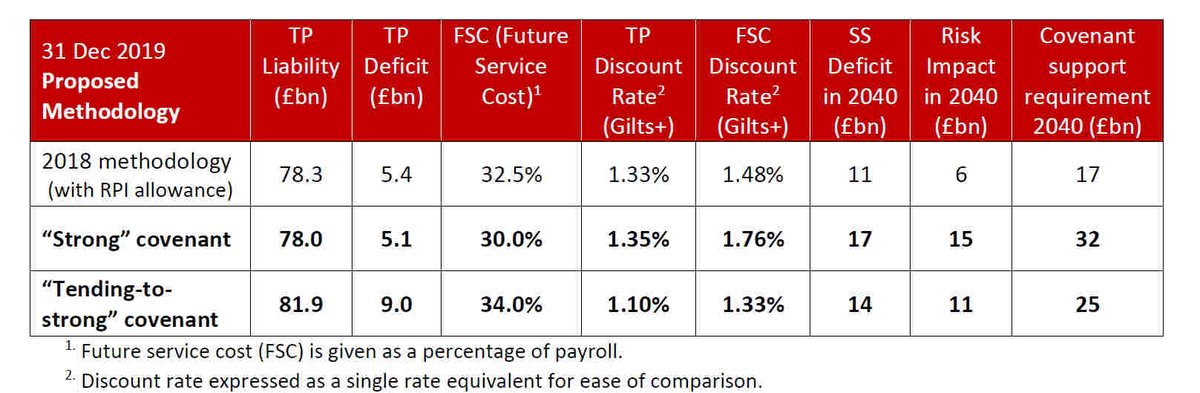

#USS have been quick to point to the adoption of a dual-discount rate in their new methodology. But where-as JEP saw the dual discount rate itself as a replacement for Test 1, #USS have turned Test 1 into Metric A (presumably Algorithm Alpha was rejected) and added it on top. 4/

So how does Metric A compare with Test 1? It measures almost precisely the same thing, based on the same flimsy premise. And while it no longer drives de-risking (the DDR takes care of that) it drives up deficits and costs to just the same extent, possibly more. 5/

I'll try and write something on the details soon. In short, where Test 1 restricted the Year 20 'reliance on covenant' by de-risking, Metric A restricts it by ramping up the prudence. In fact, the restriction placed by Metric A looks to be even tighter for the same inputs. 6/

In their second report, JEP said "#USS could continue to target self-sufficiency with an adjustment made for the reliance on employers (as implied by Test 1) but the Panel feels that this would be inappropriate for an open scheme, as we explained in our first report". 7/

JEP also added that there needed to be work on "the replacement of Test 1 with new tests that are simpler to communicate, take account of the need for a new LTO, allow for the unique nature of the Scheme and the buy-in of the sector". 8/

In relying on the same flawed logic as before, Metric A is no easier to communicate or understand than Test 1, doesn't take into account the unique nature of the sector, and still targets self-sufficiency with an adjustment made for the reliance on employers. 9/

I think it is safe to assume Metric A will be rejected by both @UCU and @UniversitiesUK, assuming both representative groups are consistent with their positioning at the VMDF. We are expecting a (public) document from @Aon_UK to employers soon. 10/

I have long been of the view that those in charge of #USS bear a heavy responsibility for the turmoil that's engulfed higher education over recent years. JEP's closing remarks evaluated against the failed VMDF and cloth-eared 2020 valuation only serve to bolster my opinions.11/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh