medium.com/ussbriefs/the-…

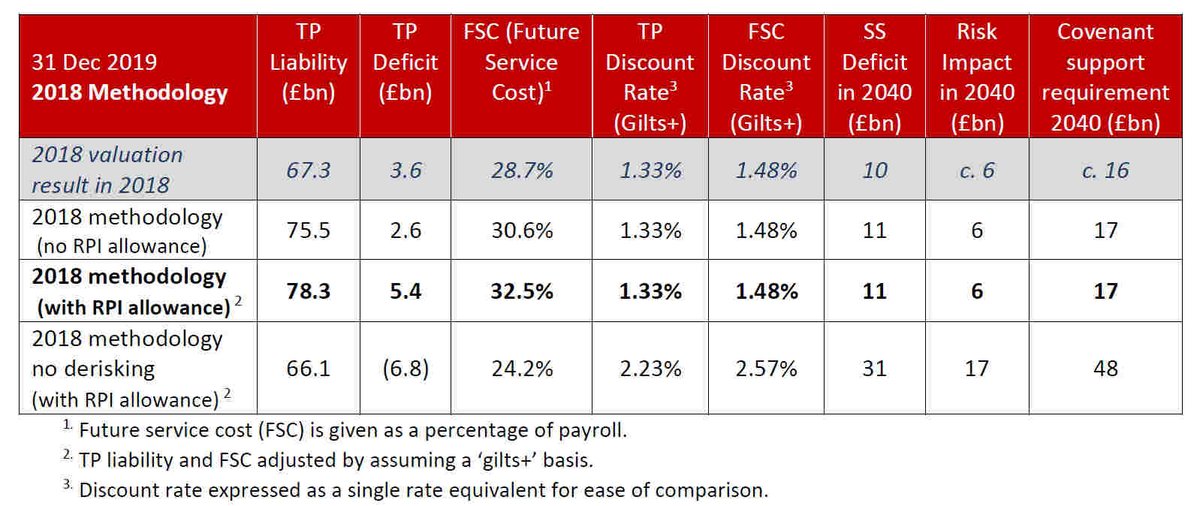

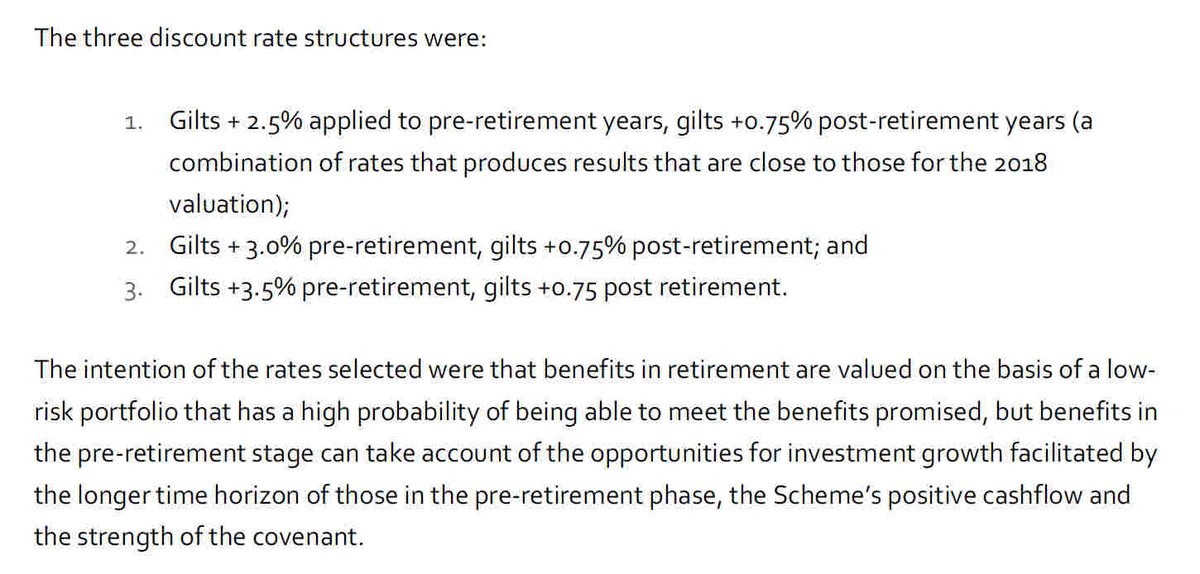

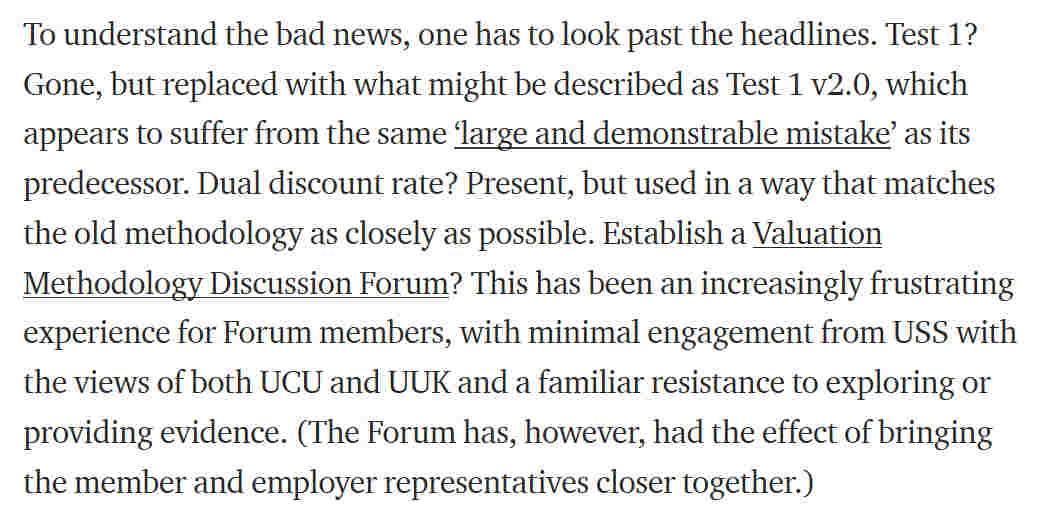

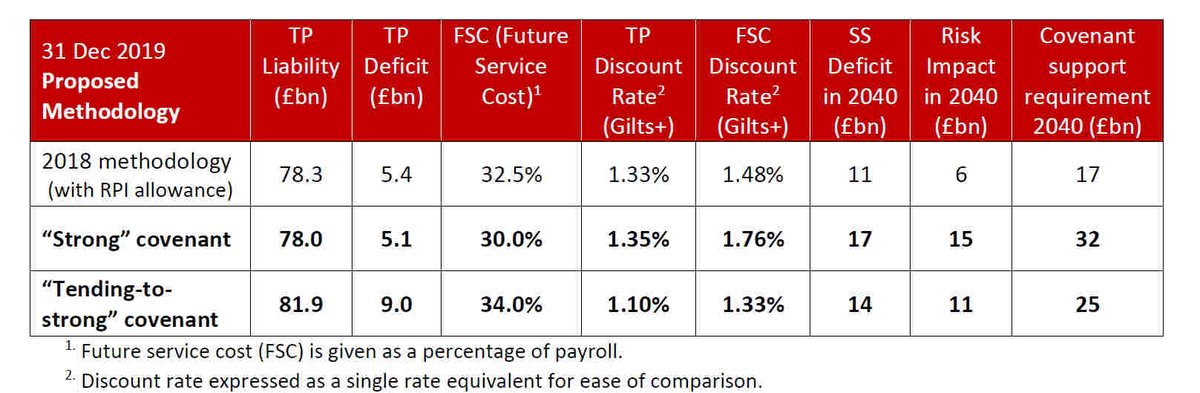

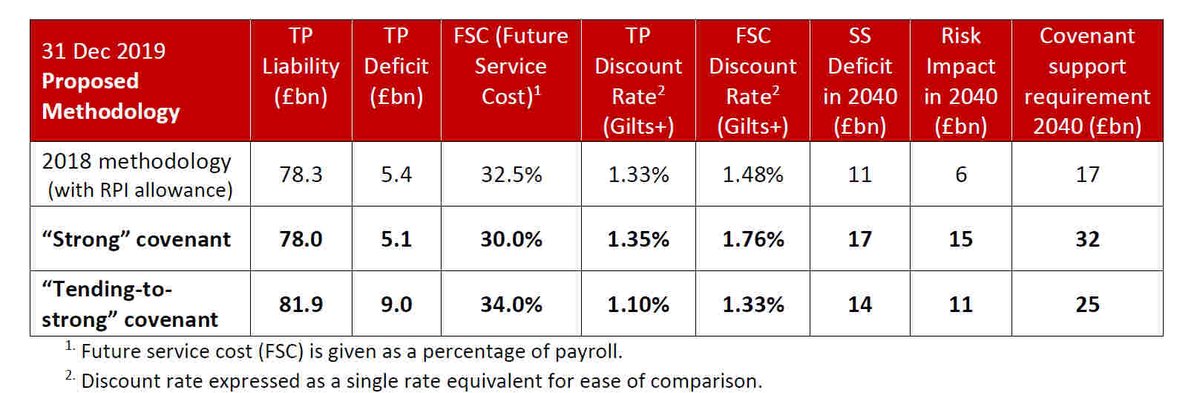

1. The dual-discount rate they illustrate is a very close match for their old methodology;

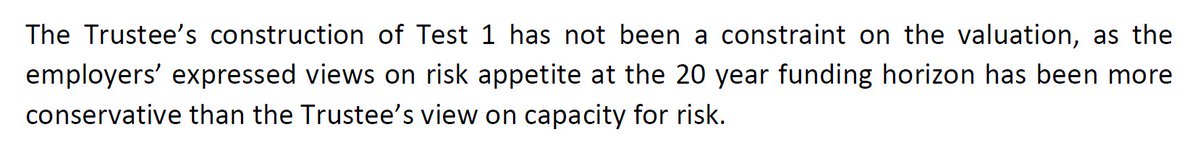

2. Test 1 has been replaced by Test 1 v2.0;

3. We are still hitting a brick wall when it comes to evidence.

2/

What about Test 1?

8/