If I can get the purchase price of a large self storage facility around 100x monthly revenue it’s worth looking at closely.

Under 75x monthly revenue is generally a very good deal with 25%+ CoC.

Small facilities, under 30,000 sf, that multiple drops slightly.

Under 75x monthly revenue is generally a very good deal with 25%+ CoC.

Small facilities, under 30,000 sf, that multiple drops slightly.

https://twitter.com/jonathanmpaul/status/1304636005853483008

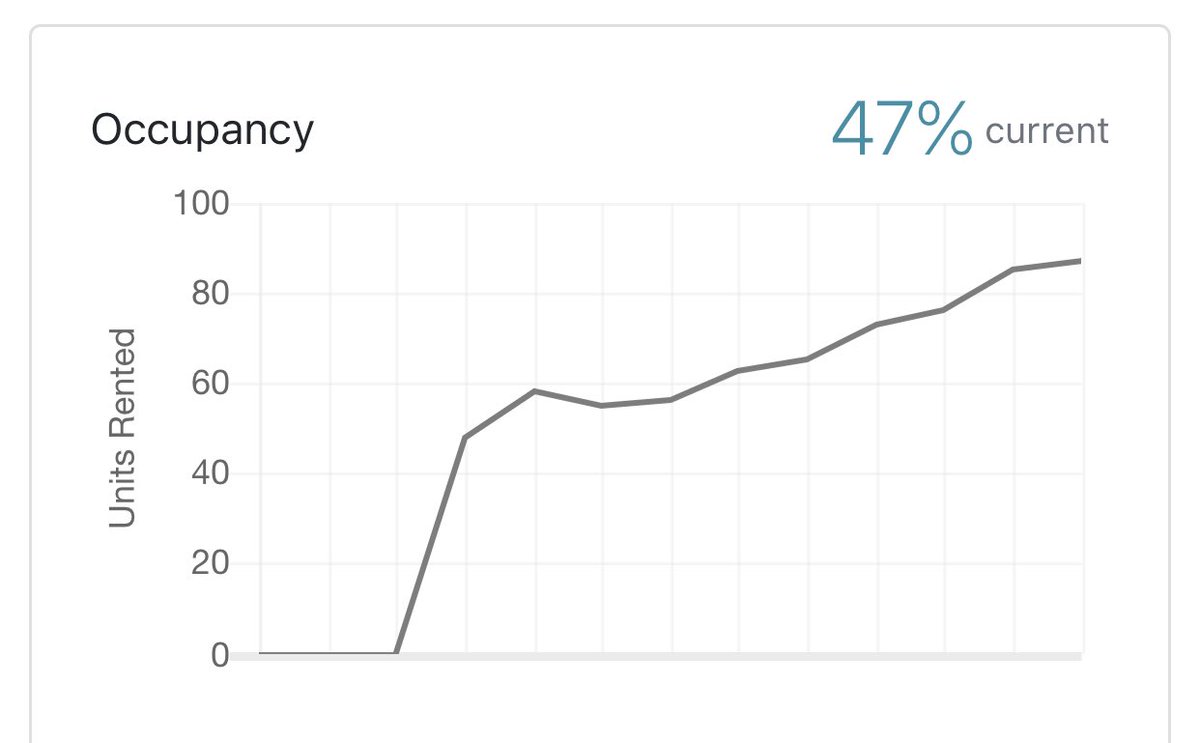

Value add deals, with low occupancy and higher risk, you want to be more like 40x monthly potential and 150x current revenue.

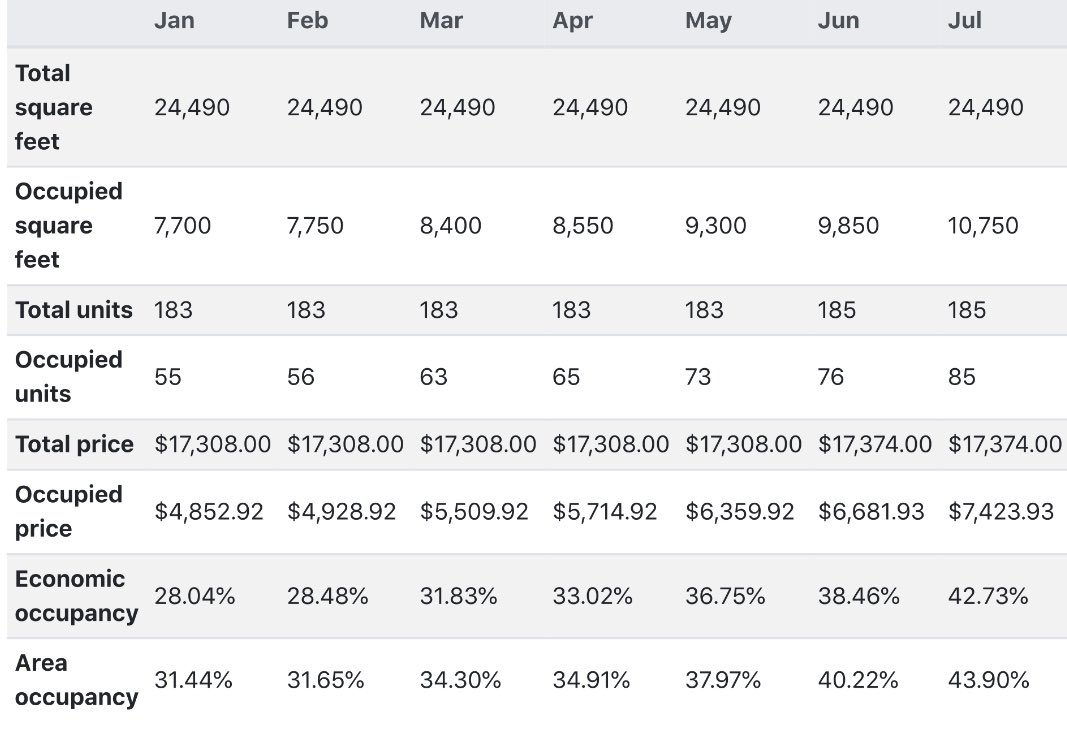

These are the figures on our Erie deal. It’ll be a situation where we can refi out 2x capital at 18-24 months.

These are the figures on our Erie deal. It’ll be a situation where we can refi out 2x capital at 18-24 months.

https://twitter.com/sweatystartup/status/1293713385297793038?s=21

https://twitter.com/sweatystartup/status/1293713385297793038

Small facilities, under 12,000 sf require lower multiples to be profitable and worth it for me at this point. The cash on cash hits around 10% when you purchase at 80x cash on cash.

The margin on these smaller facilities is around 40%.

The margin on large facilities is 70%

The margin on these smaller facilities is around 40%.

The margin on large facilities is 70%

The two most important factors are total potential revenue and achieved revenue.

These are the baseline metrics I use to underwrite every deal.

These are the baseline metrics I use to underwrite every deal.

• • •

Missing some Tweet in this thread? You can try to

force a refresh