Grenke AG (XTRA:GLJ): For Your Fraud Financing Needs. Viceroy’s report is now live. We put the spotlight on Grenke’s chicanery; swindling small businesses, laundering money for criminals, & accounting fraud.

viceroyresearch.org/2020/09/15/gre…

#Grenke #fraud $GLJ #thread 1/n

viceroyresearch.org/2020/09/15/gre…

#Grenke #fraud $GLJ #thread 1/n

THE COVER UP: Grenke’s global expansion through purchase undisclosed related party franchises is a fraudulent scheme perpetrated on a mass scale, designed to hide fake cash or enrich insiders, or both. $GLJ 2/n

>€100m of acquisitions made by Grenke since 2011 were from undisclosed related parties controlled by Grenke executives and other insiders. These transactions are similar to Wirecard, Lernout & Hauspie and Steinhoff playbooks. $GLJ $WDI $SNH 3/n

This is Fraud 101. Through relationships with undisclosed parties Grenke books profits. We believe these profits are largely fictional. Any cash generated is fictional. By buying out the undisclosed related party Grenke turns fictional profits into fictional goodwill. $GLJ 4/n

The tail-end of Grenke’s loans are clearly non-profitable but no impairments are recognized on its books to reflect this. Subsidiary accounts show Grenke crisscrossing transactions: paying premiums for non-performing leases from franchises it immediately acquires. $GLJ 5/n

Failure to disclose related party transactions is a serious audit failure and Grenke are in breach of international accounting standard (IAS) 24.

ifrs.org/issued-standar…

$GLJ #fraud 6/n

ifrs.org/issued-standar…

$GLJ #fraud 6/n

THE FULL SUITE: Grenke’s banking division has been a conduit for the proceeds of crime and money laundering, and could face the loss of its banking license. $GLJ 7/n

Grenke Bank was a conduit for the proceeds of crime and money laundering, receiving money from binary options scams & unregulated trading platforms. Breaches could result in the suspension or loss of @grenkebank license and/or special supervision to protect depositors. $GLJ 8/n

Grenke’s capital raising activities face serious headwinds due to critical internal control failures at Grenke Bank which undermine its guarantee on >$5b of bonds. This guarantee is critical to Grenke’s S&P BBB+ rating – keeping it just two notches above junk status. $GLJ 9/n

Consequences faced by Grenke Bank will have fatal repercussions for the Grenke group as whole. Among other factors, Grenke’s bank issues together with undisclosed related party transactions and audit failures alone will provide reason for debt recourse. $GLJ 10/n

THE CON MEN: Grenke’s leasing model facilitates and encourages fraud from resellers, creating bad debt, protracted legal disputes and defrauding SMEs, government, charities. $GLJ 11/n

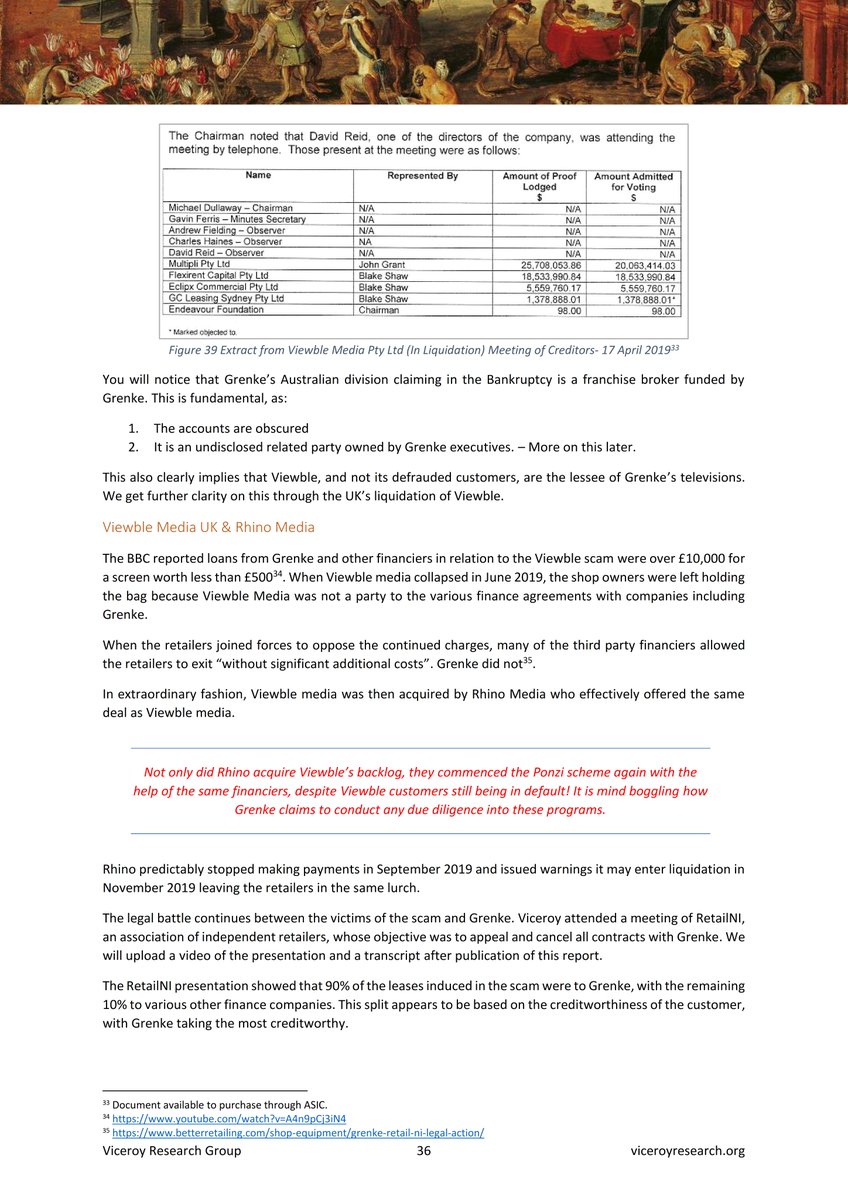

Viewble Media, Rebl Media and Rhino media were three separate, large-scale international, hundred million-euro Ponzi-schemes enabled by Grenke’s lease financing. The schemes leased €500 (valued at €10k-15k each) televisions to thousands of SMEs, financed by Grenke. $GLJ 12/n

Given the opportunity and plethora of complaints it received, Grenke continued to allow Viewble and Rhino media to issue leases, while denying they were aware of “side-arrangements” despite being written into Grenke contracts. $GLJ 13/n

It has been confirmed that the UK’s FCA is currently examining evidence regarding the finance arrangements provided by Grenke in the Viewble fraud. @TheFCA $GLJ 14/n

Direct Technology Solutions defrauded schools across the UK through the lease of overpriced IT equipment from Grenke. The laptops had a retail price of £350-400 each but were charged at £3,750. Each school received 100-200 laptops. $GLJ 15/n

Plan Corporate Services offered UK charity @missingkind a £10,000 donation and covering the Grenke lease on three new printers for a year for £23,000. @ServicesPlan never made the payments leaving Missing Kind responsible for >£100k in leases. $GLJ 16/n

Leasing of small ticket tech is becoming redundant in outdated, diminishing business segments. $GLJ 17/n

THE MANAGEMENT: Grenke is onto its 3rd audit committee chairperson since May 2018, and it’s COO “oversees” accounting. None have ever held chartered accounting designations we could find. This is astounding given $GLJ ’s complexity and frequent capital market tapping. $GLJ 18/n

Grenke management and board had a mass exodus over the last 2 years. One supervisory member appears to have been fired due to insider trading. $GLJ 19/n

Viceroy Research believes Grenke AG’s stock is uninvestable due to blatant accounting fraud, including dozens of undisclosed related party transactions, and the complete lack of internal controls, right down to individual due diligence on customers. $GLJ 20/n

Grenke’s bonds are hovering above junk territory due to capital adequacy stemming from its banking business, which we believe is hiding fake cash, and is actively used to launder money for binary options scams, crypto scams, and fraudulent unregulated trading platform. $GLJ 21/21

• • •

Missing some Tweet in this thread? You can try to

force a refresh