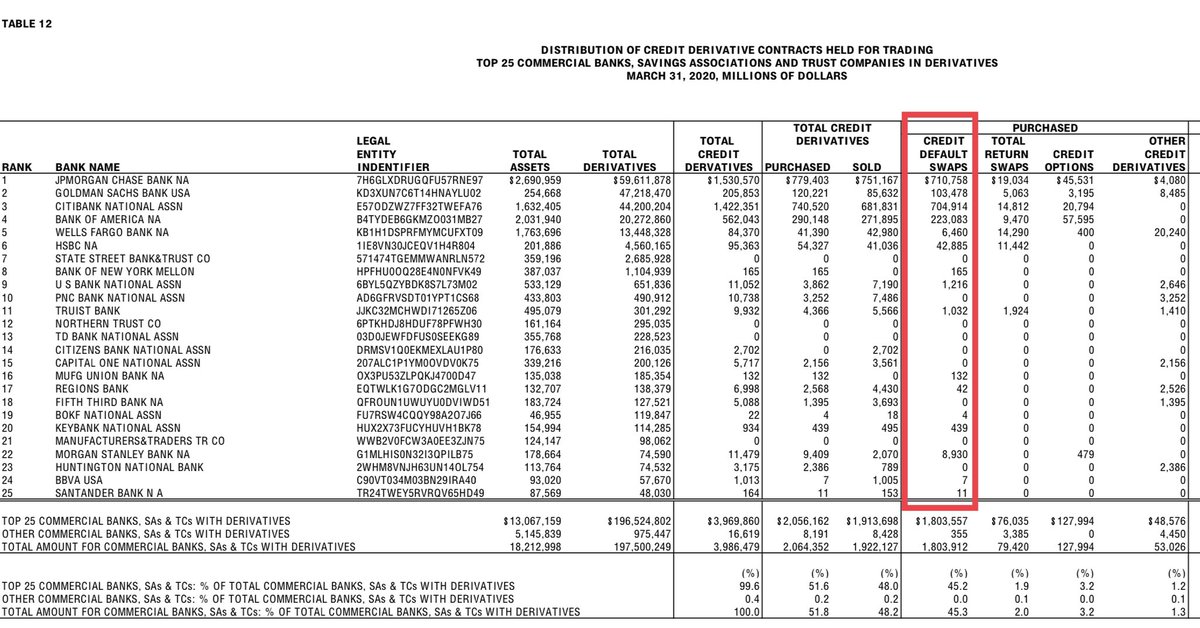

I love the deflation/stagflation/inflation discussion. Here is data to help people understand. Current metric by The #Fed for inflation is the PCE which is Consumer Prices rising & declining, that does not include Stocks, bonds, real estate, gold, food, energy, medical cost.

The Fed metric for deflation/inflation is PCE. PCE’s scope includes both urban and rural households; furthermore it considers both expenditures on behalf of consumers by 3 parties and out-of-pocket expenditures.This broader scope means there is a larger total amount of spending

So the goods the Fed tracks are Durable goods are items that last a household for more than three years and typically carry a larger price tag. Examples of durable goods include cars, televisions, refrigerators, furniture, and other similar items.

Non-durable goods are considered "transitory," meaning that their life expectancy is typically less than three years. These items are also typically less costly and include products like makeup, gasoline, and clothing.

When someone says “Deflation is coming” does that mean durable goods like iPhones, iPads,Teslas, will become cheaper and if you wait you will be able to buy more? No! That’s why it’s Inflation and always will be.

Now if you consider deflation to be stocks, real estate and gold to drop in US dollar prices that’s not what the Fed considers deflation so make sure you know what you are taking about!

• • •

Missing some Tweet in this thread? You can try to

force a refresh