💀Exposing Wall St Fraud & Bubbles: Forecasted record high gold prices, inflation crisis.

How to get URL link on X (Twitter) App

Then when #inflation took off after @WTF_1971 money supply 🚀 increased 100% from 1970-1980

Then when #inflation took off after @WTF_1971 money supply 🚀 increased 100% from 1970-1980

United States currency paper is composed of 75% cotton and 25% linen.

United States currency paper is composed of 75% cotton and 25% linen.

The #GreatFiatPonziScheme is the name to the destruction of the US Dollar where America allowed elitists to control the money supply with the Federal reserve act of 1913. But don’t let this fool you they tried for 80 years since 1830 but was held off by our presidents till 1913.

The #GreatFiatPonziScheme is the name to the destruction of the US Dollar where America allowed elitists to control the money supply with the Federal reserve act of 1913. But don’t let this fool you they tried for 80 years since 1830 but was held off by our presidents till 1913.

The Fed metric for deflation/inflation is PCE. PCE’s scope includes both urban and rural households; furthermore it considers both expenditures on behalf of consumers by 3 parties and out-of-pocket expenditures.This broader scope means there is a larger total amount of spending

The Fed metric for deflation/inflation is PCE. PCE’s scope includes both urban and rural households; furthermore it considers both expenditures on behalf of consumers by 3 parties and out-of-pocket expenditures.This broader scope means there is a larger total amount of spending

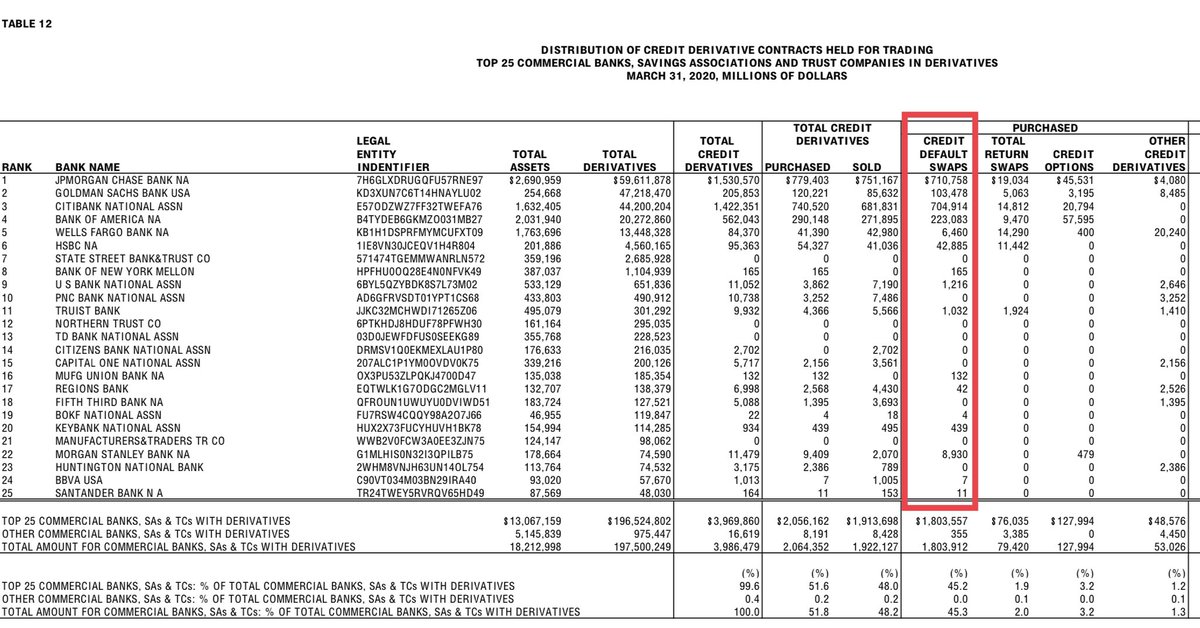

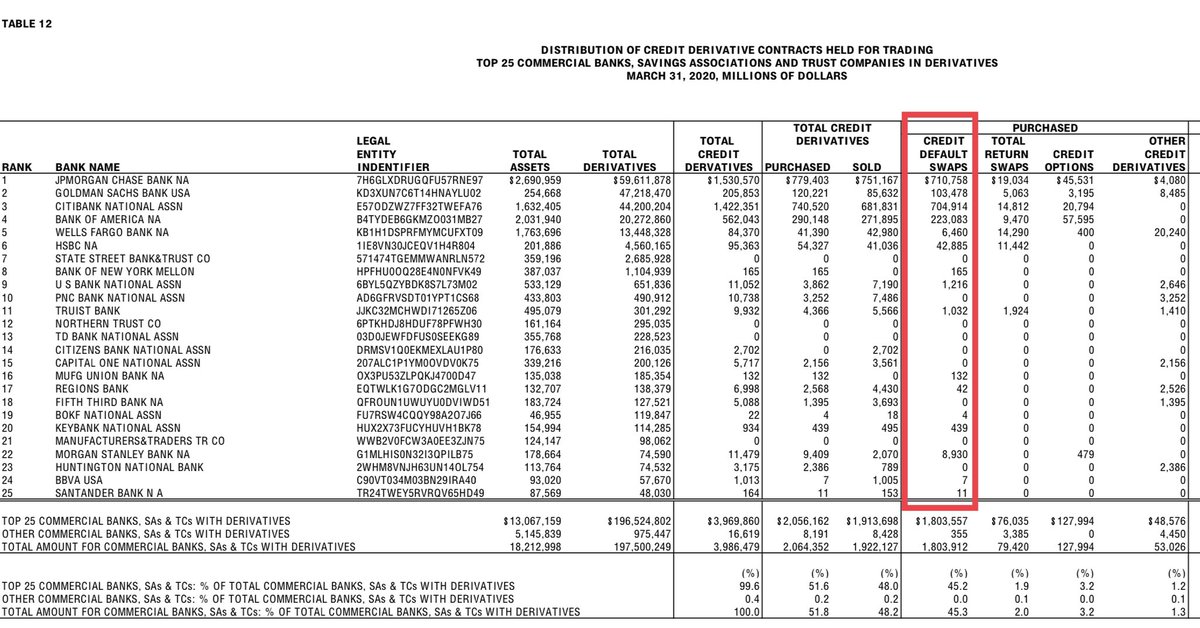

Why are the banks buying trillions in CDS?! #AskingForAFriend @DiMartinoBooth @GeorgeGammon @bondstrategist @chigrl @HRGPFOREVER @EndTheFed001 @RetirementRight @NorthmanTrader @hendry_hugh @PeterSchiff @realJosephRich

Why are the banks buying trillions in CDS?! #AskingForAFriend @DiMartinoBooth @GeorgeGammon @bondstrategist @chigrl @HRGPFOREVER @EndTheFed001 @RetirementRight @NorthmanTrader @hendry_hugh @PeterSchiff @realJosephRich