Just spent about a day's worth of time to do my due-D of Alteryx $AYX. God I wish AYX can automate it. 🙃

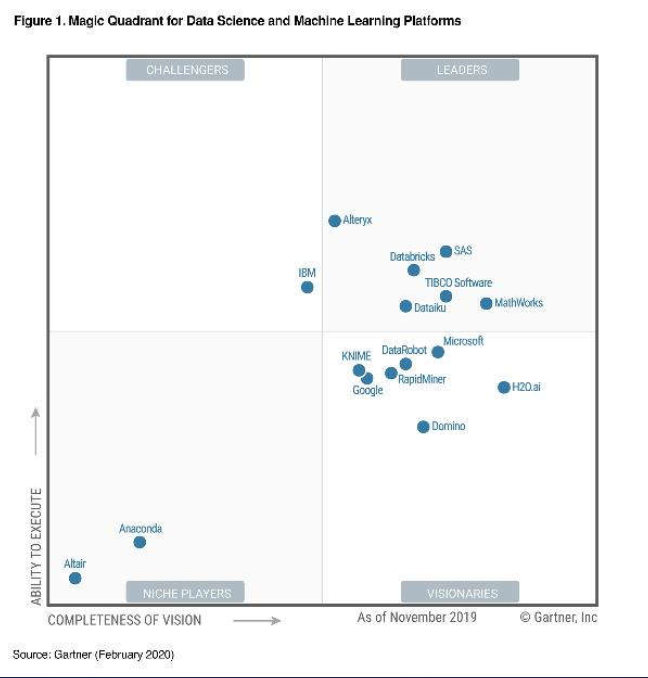

A leader in Gardner's magic quadrant for DS and ML platforms.

This is a thread on $AYX, one platform to automate it all.

Credits to @StackInvesting @hhhypergrowth

(1/N)

A leader in Gardner's magic quadrant for DS and ML platforms.

This is a thread on $AYX, one platform to automate it all.

Credits to @StackInvesting @hhhypergrowth

(1/N)

We all know the value of data, but very little of us know how to extract insights & derive its value. $AYX is on every stage of a BI project, from:

Prep, Manipulation, Analysis, Modelling, Deploying (my opinion).

Every employee deals with data, & $AYX empowers them.

(2/N)

Prep, Manipulation, Analysis, Modelling, Deploying (my opinion).

Every employee deals with data, & $AYX empowers them.

(2/N)

Their core service revolves around their Designer application. Designer provides the pipeline with which data goes in as input, & insights/information come out as output. With drag & drop items, even employees without any coding/modelling background can deliver insights.

(3/N)

(3/N)

Everybody must've had pain points trying to consolidate data from multiple points & trying to work the analysis in Excel. Oh the date formatting! 🥲 With $AYX's Designer, the magic happens with a click.

Famously known as their 'land' in land & expand strategy.

(4/N)

Famously known as their 'land' in land & expand strategy.

(4/N)

As the user realizes the potential, word gets out & more people start using it. With more users, there is value in bigger projects, which require strong collaborative management tools & computing resources.

Meet Server, offering a self-serve analytics platform.

(5/N)

Meet Server, offering a self-serve analytics platform.

(5/N)

Server provides:

1) Enterprise scalability (depending if on-prem or cloud server)

2) Sharing & collaboration

3) Analytics governance

The platform allows for a centralized server for job scheduling & automation for analytical workflows, among others.

(6/N)

1) Enterprise scalability (depending if on-prem or cloud server)

2) Sharing & collaboration

3) Analytics governance

The platform allows for a centralized server for job scheduling & automation for analytical workflows, among others.

(6/N)

Connect & Promote are the other 2 offerings, extensions to Server.

Connect: links up $AYX users in an enterprise-wide collaborative engine.

Promote: manages the deployment, mgmt., monitoring of predictive models into real-time production Applications.

(7/N)

Connect: links up $AYX users in an enterprise-wide collaborative engine.

Promote: manages the deployment, mgmt., monitoring of predictive models into real-time production Applications.

(7/N)

I don't think I've done a great job in explaining them, but @StackInvesting's article speaks in-depth about these 4 products. I referenced heavily on that article to understand the products. Thanks!

softwarestackinvesting.com/alteryx-ayx-q1…

(8/N)

softwarestackinvesting.com/alteryx-ayx-q1…

(8/N)

In Q2'20 $AYX pivoted from the 'empowering of citizen data scientists' to being a leader in 'Analytic Process Automation'. This (imo) encompasses a wider value proposition, into being the only pipeline where enterprises can 'deliver better & faster business outcomes'.

(9/N)

(9/N)

With that, they also introduced 2 new products:

Analytics Hub & Intelligence Suite. The hub is a 'our next-generation automation & collaboration product', whereas the Suite is a 'our augmented machine learning and text mining product'.

(10/N)

Analytics Hub & Intelligence Suite. The hub is a 'our next-generation automation & collaboration product', whereas the Suite is a 'our augmented machine learning and text mining product'.

(10/N)

These tie in together into the vision of a platform that "unifies analytics, data science & BPA in 1 self-service platform to accelerate digital transformation, deliver high-impact biz outcomes, accelerate the democratization of data & rapidly upskill modern workforces"

(11/N)

(11/N)

@hhhypergrowth's article on this new APA platform shows exactly the direction & trajectory of where $AYX is heading towards. This helped me understand a great deal about their new offering. Thanks!

hhhypergrowth.com/an-alteryx-pla…

(12/N)

hhhypergrowth.com/an-alteryx-pla…

(12/N)

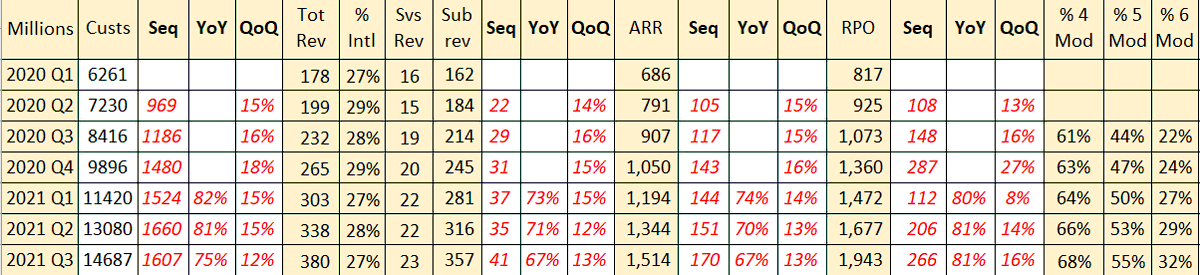

Financials:

DBNER from 134% -> 126% over the past 6 Qs.

Cust. growth ~ +400 QoQ past few Qs.

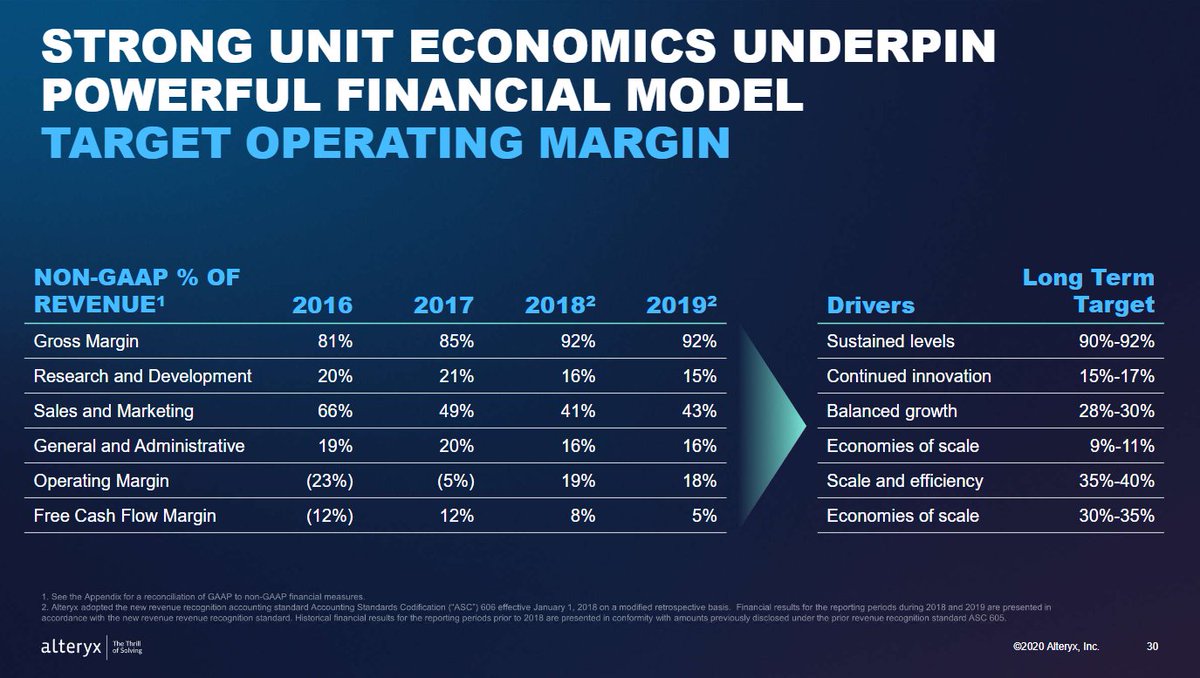

Gross Margins at 90%.

They are currently guiding for just a 10-11% YoY rev increase for FY20 (too conservative imo). We'd have to see Q3 for the use of their new platform.

(13/N)

DBNER from 134% -> 126% over the past 6 Qs.

Cust. growth ~ +400 QoQ past few Qs.

Gross Margins at 90%.

They are currently guiding for just a 10-11% YoY rev increase for FY20 (too conservative imo). We'd have to see Q3 for the use of their new platform.

(13/N)

I am a simple person, & coming from a Business Analyst background (was my major), I can see the clear value of a platform like $AYX & the benefits it will bring to any company wanting better & more insightful business outcomes.

(14/N)

(14/N)

Price got beaten down ~30% after Q2 results, but if anything that makes $AYX even more attractive now.

I will buy a starter position first, before adding to the position with next month's contributions.

(15/N)

I will buy a starter position first, before adding to the position with next month's contributions.

(15/N)

If you reached here, it means you had the patience to sit through bang avg thread writing. Thanks for your patience, & this awful exercise (1 hour+) will make me a better investor, as I'm then able to articulate my investment thesis.

Work hard, Invest harder.

(end)

Work hard, Invest harder.

(end)

• • •

Missing some Tweet in this thread? You can try to

force a refresh