How to get URL link on X (Twitter) App

https://twitter.com/JoeyKoh_/status/1433092145506750467?s=20

https://twitter.com/JoeyKoh_/status/1424372011074166785?s=20

https://twitter.com/NicolasFlamelX/status/1421939189793316866

https://twitter.com/SinoGlobalCap/status/1373662671057383424?s=20

https://twitter.com/JoeyKoh_/status/1392487353646653444?s=20

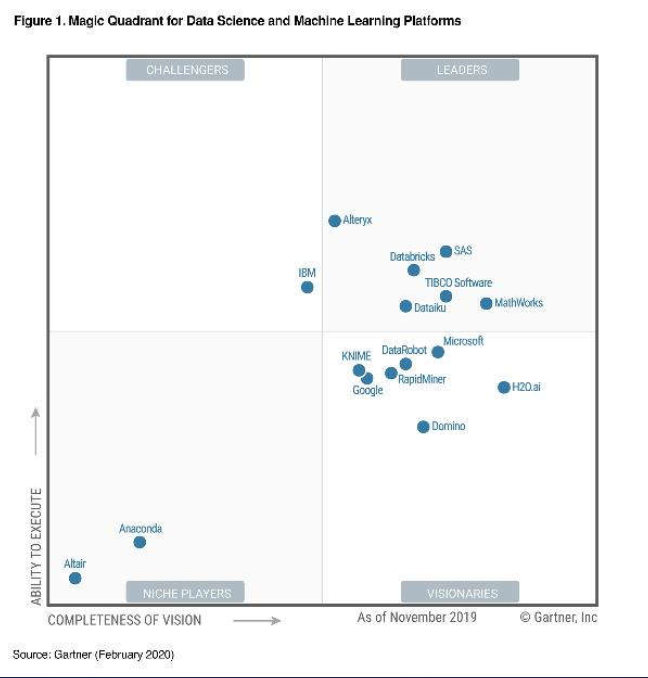

We all know the value of data, but very little of us know how to extract insights & derive its value. $AYX is on every stage of a BI project, from:

We all know the value of data, but very little of us know how to extract insights & derive its value. $AYX is on every stage of a BI project, from: