Illumina ($ILMN) Acquires GRAIL: Pros, Cons, & Questions

Earlier today, Illumina announced its intent to acquire cancer-screening company GRAIL for $8 billion, marking its most direct foray into clinical #genetics.

Here's what we think:

🔗: businesswire.com/news/home/2020…

Earlier today, Illumina announced its intent to acquire cancer-screening company GRAIL for $8 billion, marking its most direct foray into clinical #genetics.

Here's what we think:

🔗: businesswire.com/news/home/2020…

I'll begin with some positives (✅).

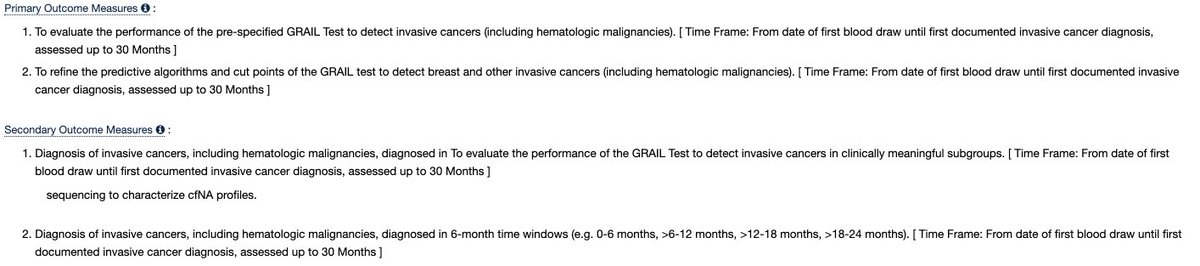

GRAIL's test (Galleri) is being evaluated in some of the largest clinical studies within genomics. Three of these studies are ongoing:

PATHFINDER (n=6,200; Ends Jan 2022)

STRIVE (n=99,481; Ends May 2025)

SUMMIT (n=50,000; Ends Aug 2030)

GRAIL's test (Galleri) is being evaluated in some of the largest clinical studies within genomics. Three of these studies are ongoing:

PATHFINDER (n=6,200; Ends Jan 2022)

STRIVE (n=99,481; Ends May 2025)

SUMMIT (n=50,000; Ends Aug 2030)

I'm basing timelines off of the study completion dates (see below). I'm doing this because I believe the secondary outcome measures are more relevant to commercialization and/or reimbursement, as is the case w/ STRIVE, for example.

clinicaltrials.gov/ct2/show/NCT03…

clinicaltrials.gov/ct2/show/NCT03…

These are powerful studies that should drive adoption and payment, but they're far from generating results.

The version of Galleri commercializing in 2021 is powered by GRAIL's CCGA (n=15,000) study, which I'd encourage all of you to read.

annalsofoncology.org/article/S0923-…

The version of Galleri commercializing in 2021 is powered by GRAIL's CCGA (n=15,000) study, which I'd encourage all of you to read.

annalsofoncology.org/article/S0923-…

In CCGA, Galleri achieved the best, published performance for a multi-cancer early detection liquid biopsy (see below). These are the numbers Illumina referenced this morning. If you aren't familiar with these measures, I've defined them below.

ARK already has written about the results of CCGA (see below). I'll resurface CCGA later when I discuss the negatives of GRAIL's (Illumina's) clinical evidence.

ark-invest.com/newsletter/iss…

ark-invest.com/newsletter/iss…

We think GRAIL's methylation-based approach is unique and powerful. This approach is low cost and enables detection of early stage disease. Not sure what this means? That's okay, see some of my previous threads:

ark-invest.com/newsletter/iss…

ark-invest.com/newsletter/iss…

https://twitter.com/sbarnettARK/status/1303818411328393221

Galleri was awarded a breakthrough device designation, meaning it could take advantage of accelerated FDA review and stable, national reimbursement if (a) CMS finalizes its MCIT pathway and (b) GRAIL pursues and succeeds in MCIT. What's this? See below:

ark-invest.com/newsletter/iss…

ark-invest.com/newsletter/iss…

As part of Illumina, GRAIL may have faster access to Illumina's existing lab infrastructure and international partners, not to mention the company's name, brand, and visibility.

GRAIL's lead in software engineering and methylation-based ML-training is notable.

GRAIL's lead in software engineering and methylation-based ML-training is notable.

Altogether, we think GRAIL sits firmly within the vanguard of multi-cancer liquid biopsy screening companies. Its main advantages consist of its large, ongoing clinical studies, methylation-focus, machine learning acumen, and Galleri's published CCGA performance.

As a part of Illumina, GRAIL could benefit from accelerated access to testing centers, population sequencing efforts, and healthcare systems. However, we think there are numerous open questions and concerns not being widely addressed.

I'll now switch to the negatives (❓).

I'll now switch to the negatives (❓).

Illumina now will compete with its customers, namely those with existing (or forthcoming) products across several domains like screening, therapy selection, and minimal residual disease monitoring (MRD).

Though not exhaustive, here's a list of GRAIL's comps. Please feel free to suggest others:

Screening: Thrive Earlier Detection, Freenome, Exact Sciences, Guardant Health (GH)

Rx Optimization: Invitae (NVTA), Natera (NTRA), GH, Veracyte, Tempus, Roche

MRD: NVTA, NTRA, GH, Roche

Screening: Thrive Earlier Detection, Freenome, Exact Sciences, Guardant Health (GH)

Rx Optimization: Invitae (NVTA), Natera (NTRA), GH, Veracyte, Tempus, Roche

MRD: NVTA, NTRA, GH, Roche

In our view, these companies (collectively, and individually in many cases), are much better positioned to launch clinical diagnostics. Why?

The expertise/experience to launch successful diagnostic offerings, we think, is outside of Illumina's wheelhouse.

The expertise/experience to launch successful diagnostic offerings, we think, is outside of Illumina's wheelhouse.

Leading medical oncology companies typically have broad domain expertise and/or vertical integration across: regulatory, payor integration, pre/post-test education, biopharma/companion diagnostic partnerships, medical reporting, billing & claims, (cont...)

... lab information management (LIMS), high-throughput lab automation, quality control, clinical decision support tools, etc.

We think these domains are outside of Illumina's and GRAIL's current expertise. Building this infrastructure is expensive and time consuming.

We think these domains are outside of Illumina's and GRAIL's current expertise. Building this infrastructure is expensive and time consuming.

Moreover, we are not encouraged by Illumina's previous attempts at clinical market penetration, namely NIPT and IVD-based oncology products (TruSeq), which are simpler than screening.

Instead, it seems these markets are consolidating to pure-play diagnostic companies.

Instead, it seems these markets are consolidating to pure-play diagnostic companies.

Illumina explained its choice to compete w/ customers because (a) the screening TAM is large ($75B+) and (b) it feels Galleri is unique and differentiated.

We think the TAM could be even larger if younger, high-risk cohorts are selectively screened and prices are low.

We think the TAM could be even larger if younger, high-risk cohorts are selectively screened and prices are low.

So, we agree on the market, but now let's revisit Galleri.

Galleri's ability to reliably analyze methylation, its sole input, was enabled by Twist Biosciences' (TWST) methylation capture panel. Since any test provider can buy Twist panels, it levels the playing field.

Galleri's ability to reliably analyze methylation, its sole input, was enabled by Twist Biosciences' (TWST) methylation capture panel. Since any test provider can buy Twist panels, it levels the playing field.

Indeed, Illumina could try to produce its own capture panels, but it may be expensive, slow, and force revalidation of Galleri's assay protocol. We don't believe Illumina's current reagent abilities to be exemplary (see below):

cancergeneticsjournal.org/article/S2210-…

cancergeneticsjournal.org/article/S2210-…

https://twitter.com/sbarnettARK/status/1303818411328393221

Let's revisit the data, specifically the CCGA study, starting with the study's design.

CCGA was observational, meaning no treatment was altered by the results of the test. This limits our understanding of the 'real-world' effects of such a test.

CCGA was observational, meaning no treatment was altered by the results of the test. This limits our understanding of the 'real-world' effects of such a test.

Moreover, the final validation cohort (n=1,264), which yielded the performance #'s referenced on today's call, had a ~52% incidence rate of cancer. This means 52% of those 1,264 had cancer.

In reality, only 1.3% of persons aged 50+ are diagnosed with cancer annually.

In reality, only 1.3% of persons aged 50+ are diagnosed with cancer annually.

This makes me wonder if indeed the results are generalizable to the intended use population. You could argue that this is a necessary evil for a cash-strapped startup needing a cancer-enriched cohort for ML training.

However, Thrive Earlier Detection's recent Detect-A study (n=10,000) (which WAS interventional and had a specificity of 99%) wasn't enriched for the presence of cancer. This test also isn't methylation-based.

science.sciencemag.org/content/369/64…

science.sciencemag.org/content/369/64…

GRAIL's test (and commercial efforts) also focus on its tissue-of-origin classifier, which ostensibly enables a doctor to know where a cancer is growing in the body with a 93% accuracy rate. Here's where I really take issue:

GRAIL isn't included false positives in the 93%.

GRAIL isn't included false positives in the 93%.

Let's do some math to make this point:

In a representative population of 1,000,000 people w/ a cancer incidence rate of 1.28% AND using GRAIL's performance data, we get the following results (see below).

With a 44% sensitivity, more of my test-positives will be false than true.

In a representative population of 1,000,000 people w/ a cancer incidence rate of 1.28% AND using GRAIL's performance data, we get the following results (see below).

With a 44% sensitivity, more of my test-positives will be false than true.

Obviously, tissue-of-origin will be wrong for false positives, which may be why they only included true test-positives in the calculation. If we include false positives, the tissue-of-origin readout only will be correct ~42% of the time, not ~93%.

My concern is that a predictive power this low (unless I'm doing my math wrong, which I'm happy to be critiqued on), could be problematic at scale. It seems more likely physicians would flex to a full body PET-CT instead of trusting the TOO readout based on this?

Wrapping up, we're also concerned about Illumina's divesting and reinvesting in GRAIL, especially as it relates to foresight into the industry. We also think the R&D requirements for GRAIL will be significantly more than laid out and that revenue may take longer to ramp.

For example, PATHFINDER uses hereditary cancer risk as inclusion criteria. GRAIL doesn't have this expertise. Will it be harder for them to partner now with an existing vendor? Will they need to develop their own germline workflow? Will they settle for 'vanilla' germline seq?

In conclusion, there's a LOT to consider here. There are positives and negatives and my thoughts here aren't exhaustive. I'd love to hear/get community feedback.

Finally, this is NOT investment advice.

Finally, this is NOT investment advice.

EDIT:

That there are more false positives than true positives is NOT unique to GRAIL's test. This likely will be a challenge to all earlier detection companies. My comments centered more on how TOO could help/hurt post test result.

That there are more false positives than true positives is NOT unique to GRAIL's test. This likely will be a challenge to all earlier detection companies. My comments centered more on how TOO could help/hurt post test result.

EDIT 2:

@wintonARK Brings up a good point on how the tissue-of-origin (TOO) readout could be used in practice.

Physicians could do focused imaging on all positives, identify 93% of true positives, and strip out the 7% of negatives. This may be cheaper than full PET-CT.

@wintonARK Brings up a good point on how the tissue-of-origin (TOO) readout could be used in practice.

Physicians could do focused imaging on all positives, identify 93% of true positives, and strip out the 7% of negatives. This may be cheaper than full PET-CT.

True, this would weaken sensitivity, but could allow for the systematic follow-up of test-positives.

What I'd like to know is if full PET-CT (or other highly-sensitive full body imaging modality) is meaningfully more expensive than focused imaging.

What I'd like to know is if full PET-CT (or other highly-sensitive full body imaging modality) is meaningfully more expensive than focused imaging.

Moreover, I wonder how physicians would behave in this scenario. Would they do focused imaging and risk being in the 7% of incorrect TOO, thereby letting a patient with supposed kidney cancer go home, only to discover they actually had liver cancer instead?

@EdEsplin Do you have a take on this latter way to use TOO (^^)? Thanks

• • •

Missing some Tweet in this thread? You can try to

force a refresh