[1/X] Attempt to explain Orderflow basics. It will be a long thread but will try to make the content worth the read.

Below is a Depth of Market (DOM). The

Blue ones = Bid Limit orders

Red ones = Ask Limit orders

So what happens to these orders in the trade cycle

#Basics

Below is a Depth of Market (DOM). The

Blue ones = Bid Limit orders

Red ones = Ask Limit orders

So what happens to these orders in the trade cycle

#Basics

[2/X] Such limit orders are invariable absorbed by the Market Orders.

It is the Market Orders that drive the markets up and down.

Lesson # 1: Every auction starts with a Bid and an Ask

Lesson # 2: Market orders move the price

It is the Market Orders that drive the markets up and down.

Lesson # 1: Every auction starts with a Bid and an Ask

Lesson # 2: Market orders move the price

[3/X] So how do we track these market orders. We track them on the Footprint aka Cluster charts

GREEN = Buy Market Orders

RED = SELL Market Orders

Market Orders indicate Aggresiveness

GREEN = Buy Market Orders

RED = SELL Market Orders

Market Orders indicate Aggresiveness

[4/X] So what you see on the Foorpint aka Cluster chart is Market Orders and what you see on DOM are the Limit Orders i.e., orders waiting to be executed.

Lesson # 3: A Market Order buys/sells a Limit Order

PS: Exceptions to every rule exist

Lesson # 3: A Market Order buys/sells a Limit Order

PS: Exceptions to every rule exist

[5/X] When the buyers are aggressive, they will take out all the Limit Orders on the Ask side.

Similarly when sellers are aggressive, they will take out all the Limit Orders on the Bid side

This can clearly be seen on the Footprint Chart

Similarly when sellers are aggressive, they will take out all the Limit Orders on the Bid side

This can clearly be seen on the Footprint Chart

The volume is now split between the Buy trades and the Sell trades

Total Volume = Buy Trades + Sell Trades

Total Volume = Buy Trades + Sell Trades

[8/X] Now lets understand the concept of Delta

Delta = Buy Volume - Sell Volume

in a footprint chart

Delta = Buy Volume - Sell Volume

in a footprint chart

[9/X]

Delta = Positive => Aggressiveness on the Buy side

Delta = Negative => Aggressiveness on the Sell side

Generally you would expect Price to move 🆙 when Delta is positive and Price to move 🔽 when Delta is negative

True....but there is a catch...called Divergence

Delta = Positive => Aggressiveness on the Buy side

Delta = Negative => Aggressiveness on the Sell side

Generally you would expect Price to move 🆙 when Delta is positive and Price to move 🔽 when Delta is negative

True....but there is a catch...called Divergence

[10/X] So what is Divergence?

Any two parameters that should be in sync (Price and Delta in this case) towards supporting a particular move (Up or Down) but are in reality not (in sync) form a Divergence

Divergence is best shown by the Orderflow Indicator called Delta Bars

Any two parameters that should be in sync (Price and Delta in this case) towards supporting a particular move (Up or Down) but are in reality not (in sync) form a Divergence

Divergence is best shown by the Orderflow Indicator called Delta Bars

[11/X] Taking a small detour to explain Delta Bars.

Delta Bars are a candle stick chart on Delta. We measure the delta at the open of the candle (always 0) and close of the candle along with Delta Max and Delta Min

What is this Delta Max and Delta Min?

Delta Bars are a candle stick chart on Delta. We measure the delta at the open of the candle (always 0) and close of the candle along with Delta Max and Delta Min

What is this Delta Max and Delta Min?

[12/X] Delta Max is the maximum diff between Buy and Sell Volume at any point in time during the Candle formation.

Delta Min is the minimum diff between Buy and Sell

Now plot a candlestick using Delta Max and Delta Min as High and Low of the Delta Candle and you have Delta Bar

Delta Min is the minimum diff between Buy and Sell

Now plot a candlestick using Delta Max and Delta Min as High and Low of the Delta Candle and you have Delta Bar

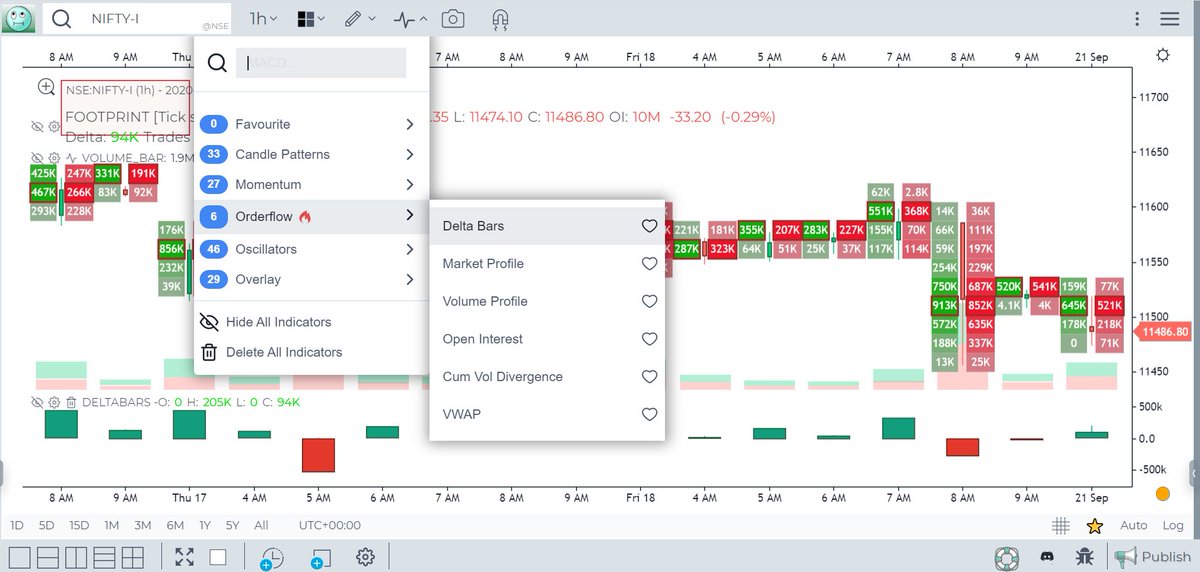

[13/X] To activate Delta Bars, choose from the Indicators menu under Orderflow category

These bars also come in the Cumulative format called Cumulative Delta Bars

These bars also come in the Cumulative format called Cumulative Delta Bars

[15/X] So how does this Divergence take place?

Say, Delta = Positive but Price does not move 🆙

So more aggressive Buy market orders than Sell market orders and yet price does not move up

Why?

Say, Delta = Positive but Price does not move 🆙

So more aggressive Buy market orders than Sell market orders and yet price does not move up

Why?

[16/X] This is so because some institution (FII/DII/Whale) is simply absorbing all the <arket buy orders with Limit orders, which is happening without you coming to know of it..

[17/X] When the institution deems all the market buy orders are absorbed, they start selling with Market orders..

This last bit can be seen with the help of delta divergence

This last bit can be seen with the help of delta divergence

[18/X] We have now scratched the surface of Orderflow....barely

Opening this thread to anyone who wants to build on this content to help everyone

#Knowledge #Sharing #Orderflow #basics

Opening this thread to anyone who wants to build on this content to help everyone

#Knowledge #Sharing #Orderflow #basics

• • •

Missing some Tweet in this thread? You can try to

force a refresh