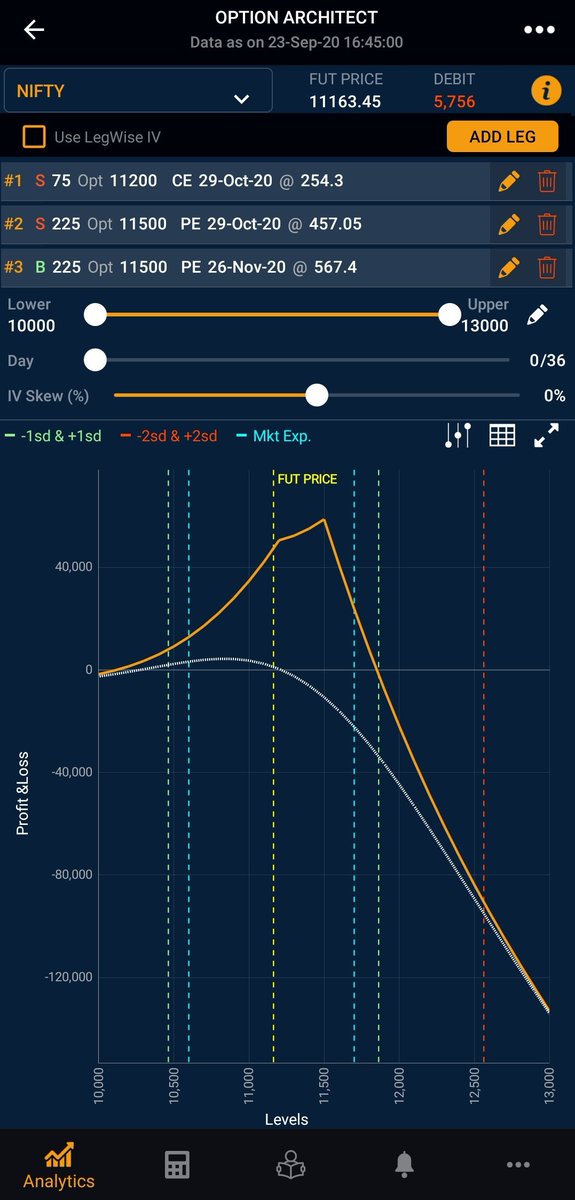

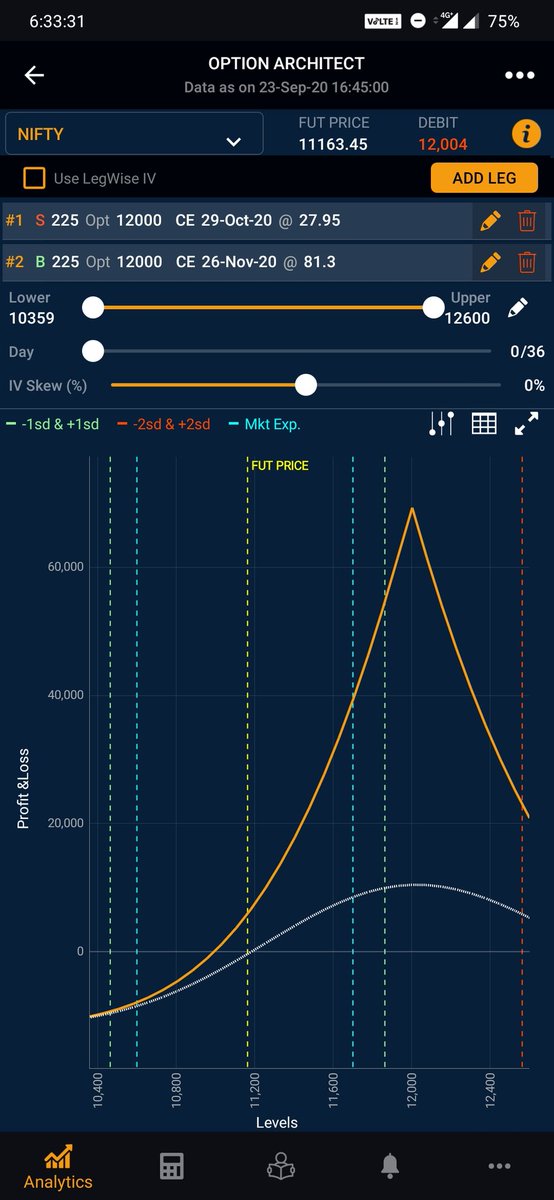

People do itm put calendar instead of otm call calendar. Why give big slippage and stt. Any benefit with it. Just reviewing one adjustment technique.

Views most welcome, also giving free one way of adjustment.

#adjustment #option

Views most welcome, also giving free one way of adjustment.

#adjustment #option

One diffence i can see fut to fut arbitrage pts difference. Rest everything almost same for me.

For any short strike we can manage it net debit otm calendar. Atleast 3x to multiple offset calendar required. But its helpful on downside adjustment than upside bcoz of downside iv shift up helpful than upside tent going to shift small with iv erosion.

As pros- we can get advantage of iv spike on otm put calendar.

Cons- big capital requirement for one lot adjustment.

This adjustment only lift ur payoff breakeven and stop instead bleeding at one level.

Cons- big capital requirement for one lot adjustment.

This adjustment only lift ur payoff breakeven and stop instead bleeding at one level.

This is also u can say synthetic ratio type trade via calendar mixture. Like we talked about diagonal and synthetic ratio.

Itm or otm depending on far month running in discount or premium.

• • •

Missing some Tweet in this thread? You can try to

force a refresh