Rapid whole genome (🧬) sequencing (rWGS) is one of the most exciting (and benevolent) collisions of #AI and #genomics I can think of.

rWGS can diagnose a critically ill child in minutes where previously it took years.

illumina.com/company/news-c…

rWGS can diagnose a critically ill child in minutes where previously it took years.

illumina.com/company/news-c…

A few years ago, Illumina ($ILMN) and Rady Children's Hospital (@RadyGenomics) collaborated to offer sequencing services for diagnosing critically-ill infants and toddlers.

Roughly 70% of rare diseases are genetic and they can take five years to diagnose.

Roughly 70% of rare diseases are genetic and they can take five years to diagnose.

As sequencing costs dropped and #AI got faster, this collaboration became Project Baby Bear: a pilot study for rWGS's diagnostic yield, clinical utility, and health economics in practice.

Several innovative companies joined Rady's in creating a rapid diagnostic pipeline.

Several innovative companies joined Rady's in creating a rapid diagnostic pipeline.

@Clinithink contributed a natural language processing (#NLP) system to scour medical literature and the patient's EHR. Traditionally, this process would be carried out manually.

clinithink.com/life-science

clinithink.com/life-science

Genomic data would be fed to Diploid's (@diploidgenomics) AI-engine, MOON, which can suggest a causal #DNA variant out of ~45 million in just about five minutes.

This result would be verified on Fabric Enterprise; software by @FabricGenomics.

diploid.com/moon

This result would be verified on Fabric Enterprise; software by @FabricGenomics.

diploid.com/moon

After the pilot, Rady's rWGS was covered by Blue Shield of California (~$5,000).

Resurfacing, @ARKInvest believes #AI-accelerated #genomic diagnostics should be less expensive and more accessible in local hospitals. You shouldn't need to travel to receive the best care.

Resurfacing, @ARKInvest believes #AI-accelerated #genomic diagnostics should be less expensive and more accessible in local hospitals. You shouldn't need to travel to receive the best care.

So, where can we go from here?

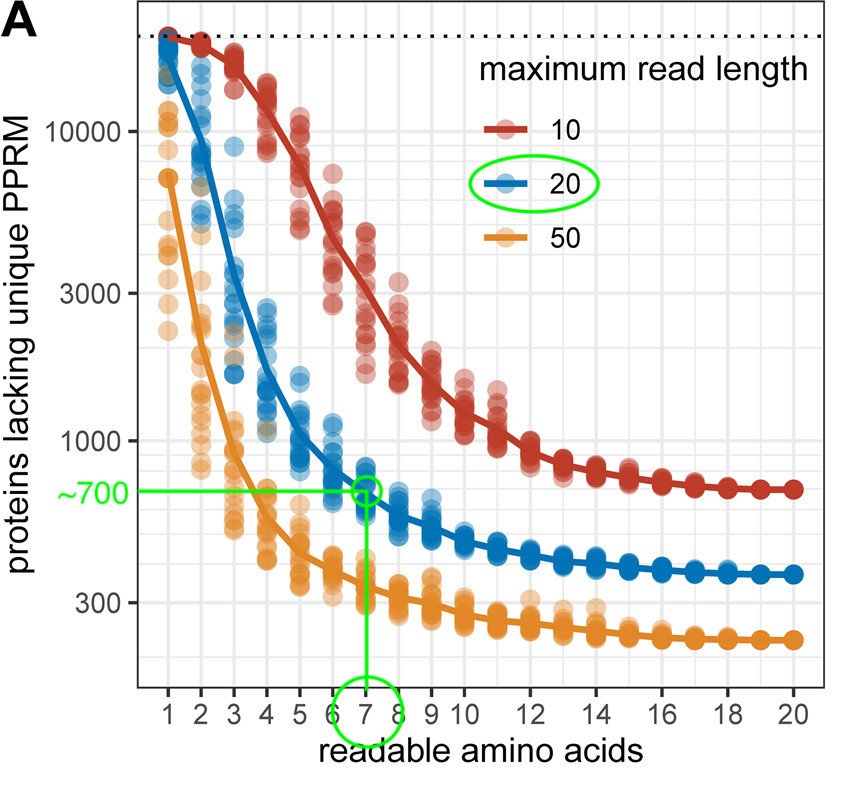

A 2019 @AJHGNews article noted that the rare disease solve rate was <50% when using short read rWGS. The authors argued this rate could increase on long read systems given their ability to decipher hard-to-read variants.

nature.com/articles/s1003…

A 2019 @AJHGNews article noted that the rare disease solve rate was <50% when using short read rWGS. The authors argued this rate could increase on long read systems given their ability to decipher hard-to-read variants.

nature.com/articles/s1003…

For visual learners, @PacBio has a webinar on this topic (tinyurl.com/y3ly77hg).

Interestingly, Pacific Biosciences and Leiden University (@LUMC_Leiden), another hospital using Diploid's MOON, have a long-read/diagnostic summit series called SMRT Leiden.

Interestingly, Pacific Biosciences and Leiden University (@LUMC_Leiden), another hospital using Diploid's MOON, have a long-read/diagnostic summit series called SMRT Leiden.

Earlier this year, Invitae (@Invitae) acquired Diploid to (a) accelerate and lower the cost of its whole exome/genome services and (b) to democratize access to MOON for children's hospitals of all sizes.

ir.invitae.com/news-and-event…

ir.invitae.com/news-and-event…

Given the lower CapEx of PacBio sequencers and cost-declines associated w/ compute, we think some centers could profitably integrate decentralized long-read rWGS services, analyzable over the cloud w/ MOON.

Others have the flexibility to send samples to Invitae's central lab.

Others have the flexibility to send samples to Invitae's central lab.

Moreover, we think Invitae's integration of genetic counseling AI / clinical workflow management tools (@cleargenetics), investments in telemedicine integration, and focus on rationalizing price, could galvanize rWGS adoption.

ir.invitae.com/news-and-event…

ir.invitae.com/news-and-event…

Altogether, rWGS is one of the most benevolent, impactful collisions of different areas of innovation and collaboration among various companies. #NGS #AI

Other Source(s):

radygenomics.org/tag/illumina/

blog.diploid.com

programs.pacificbiosciences.com/l/1652/2020-04…

healthcarefinancenews.com/news/blue-shie…

radygenomics.org/tag/illumina/

blog.diploid.com

programs.pacificbiosciences.com/l/1652/2020-04…

healthcarefinancenews.com/news/blue-shie…

NOTE:

A lab/hospital using PacBio, or another long-read platform, would need an LDT/certification to use such a system for diagnostic purposes as none currently are FDA cleared/CE-marked for diagnostic purposes.

A lab/hospital using PacBio, or another long-read platform, would need an LDT/certification to use such a system for diagnostic purposes as none currently are FDA cleared/CE-marked for diagnostic purposes.

• • •

Missing some Tweet in this thread? You can try to

force a refresh