New wp with @FSobbrio @francedrago @ChSantantonio #EconTwitter

Many countries used lockdowns to control the pandemics. We provide quantitative estimates of benefits in terms of reduction of mortality by #COVID19👇

tinyurl.com/y5u6elxs

(also @cepr_org DP15317) 1/n

Many countries used lockdowns to control the pandemics. We provide quantitative estimates of benefits in terms of reduction of mortality by #COVID19👇

tinyurl.com/y5u6elxs

(also @cepr_org DP15317) 1/n

We focus on Italy -- one of the first country struck by #COVIDー19 -- where the lockdown design offers a source of exogenous variation in the intensity of the lockdown at a granular level 2/n

In the second (economic) lockdown (March 22) the Italian government defined a detailed list of essential economic activities. All other activities were either suspended or allowed to operate only remotely 3/n

This list provides a source of exogenous variation in the share of active workers at the municipal level that we recovered by matching the list with data on the number of workers at the municipal-NACE 3 digits level 4/n

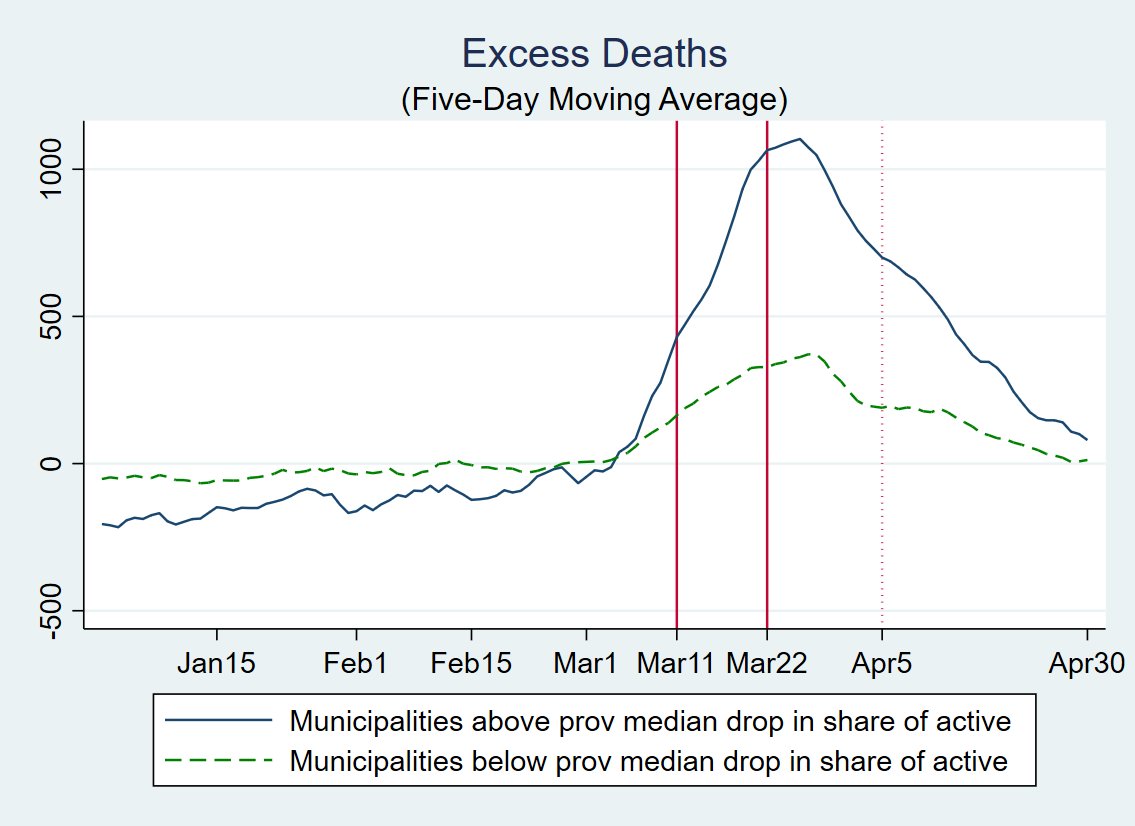

We apply a diff-in-diff methodology by comparing excess deaths in municipalities experiencing a reduction in the share of active population above vs below the provincial median and before vs after the lockdown addressing potential violations of the parallel trend assumption 5/n

We use excess deaths at the municipal-day level as proxy of Mortality by Covid-19. This overcomes, at least partially, issues related to differences in classifications of deaths due to Covid-19, testing, and hospital capacity (Buonanno et al., 2020; Galeotti and Surico, 2020) 6/n

The key results show that the intensity of the economic lockdown is associated to a statistically significant reduction in mortality by Covid-19 and, in particular, for age groups between 40-64 and older, with large and more significant effects on the elderly. 7/n

Back of the envelope calculations indicate that 4,793 deaths were avoided, in the 26 days between April 5 to April 30, in the 3,518 municipalities which experienced a more intense lockdown. 8/n

We do not find effects of the lockdown in the south of Italy. This is not surprising because the effects of the epidemic were modest in the south. But this finding is useful as a “placebo exercise” and tends to exclude other confounding mechanisms. 9/n

By exploiting mobility data at the municipal-daily level (EnelX) we also observe that municipalities with a larger contraction in the share of active population experienced a reduction in daily aggregate mobility of around 53 kilometers per 1,000 residents 10/n

Why are our results important? They provide a simple methodology to assess the effect of the lockdown in other countries and help to understand the overall cost effectiveness of the Italian lockdown. 11/n

Some additional details on our analysis: we also control for municipality-specific dynamics (7-lags of daily excess deaths) and daily-shocks at the provincial level. 12/n

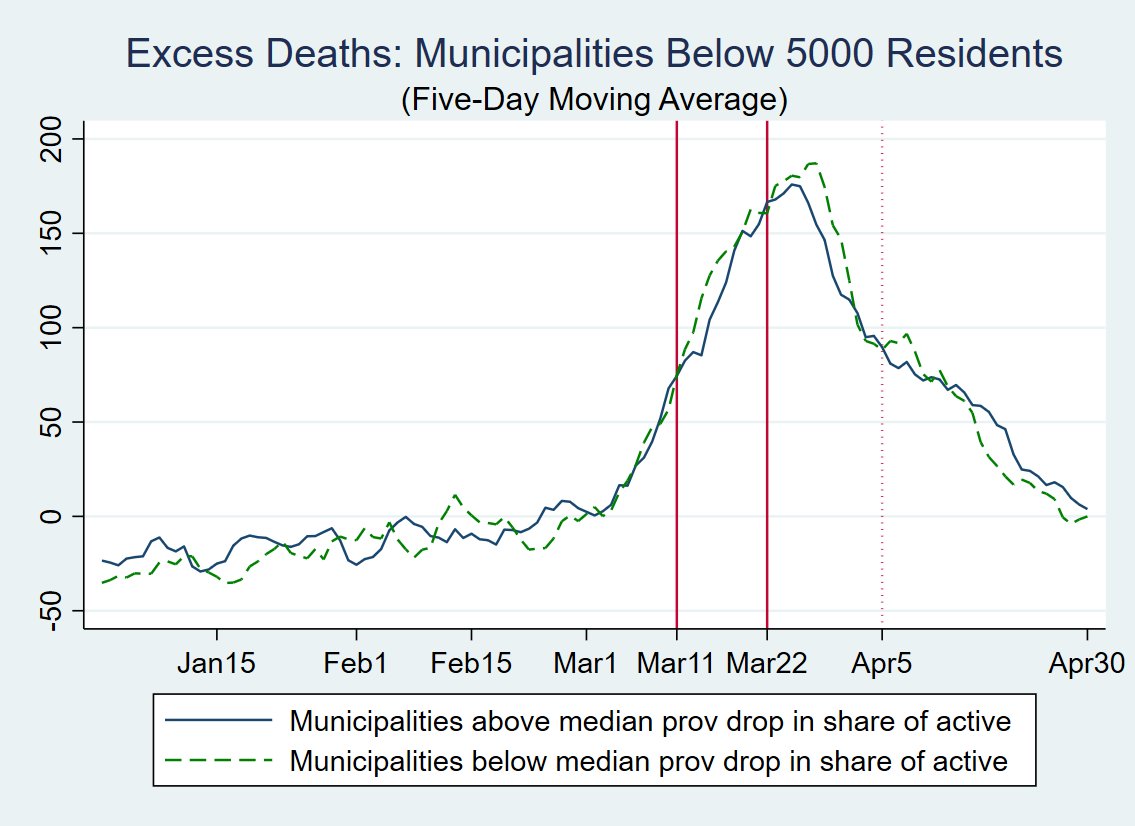

Our analysis is based on quite granular data because Italian municipalities are rather small having a median population of around 2,500 residents and a median size of around 21 kilometers. 13/n

The results are robust to a battery of checks and hold also on various sub-samples of municipalities with more similar or almost identical pre-trends, as for example municipalities with less than 5,000 residents 14/n

In the paper, we discuss possible alternative channels that may explain our results such as a reversion-to-the mean or the effect of the first Italian lockdown on mobility. The available evidence does not seem to support these alternative stories. 15/n

Caveat: our diff-in-diff exercise is clearly not based on experimental evidence and cannot pin down the mechanism through which the lockdown reduced excess mortality. 16/n

As such, we do not claim same effects would necessarily hold in different settings (e.g., when + masks available). Therefore, our results cannot provide direct policy implications. Yet, we hope our results might be informative on effects of the Italian lockdown measures n/n

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh