I hv seen ppl telling subjective about firsy 15 days buy Option last 15 days sell option etc.

This is actually not a proper way of doing.

Implied Volatility (IV)

Historical volatility (HV).

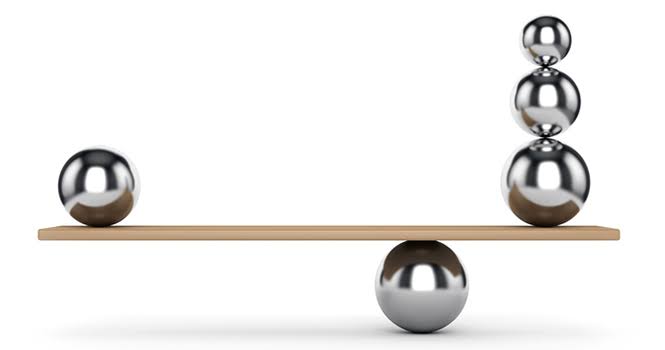

When IV less than HV go for buying option

When IV greater than HV go for selling

This is actually not a proper way of doing.

Implied Volatility (IV)

Historical volatility (HV).

When IV less than HV go for buying option

When IV greater than HV go for selling

For iv observation keep tracking any Option related websites.

But my simple suggestions dont do it complex simply use spread. Its reduced theta and iv issues almost and also easy to adjust.

For adjustment see Long call repair article tree.

But my simple suggestions dont do it complex simply use spread. Its reduced theta and iv issues almost and also easy to adjust.

For adjustment see Long call repair article tree.

Now spread also hv 2 types either credit or debit one. If ur view sideways to Directional better go credit one. If u r looking purely directional then debit is best.

Note: otm credit hv big risk than Reward but otm debit spread hv low risk setup in Option Strategy.

#option

Note: otm credit hv big risk than Reward but otm debit spread hv low risk setup in Option Strategy.

#option

• • •

Missing some Tweet in this thread? You can try to

force a refresh