#ETMONEY has been leading the charge in providing the most seamless MF investing experience. And now after 4 years & 11 million transactions, we wanted to look at how #Indians are investing and what changes have happened in these 4 years. Time for India Investment Report #2020

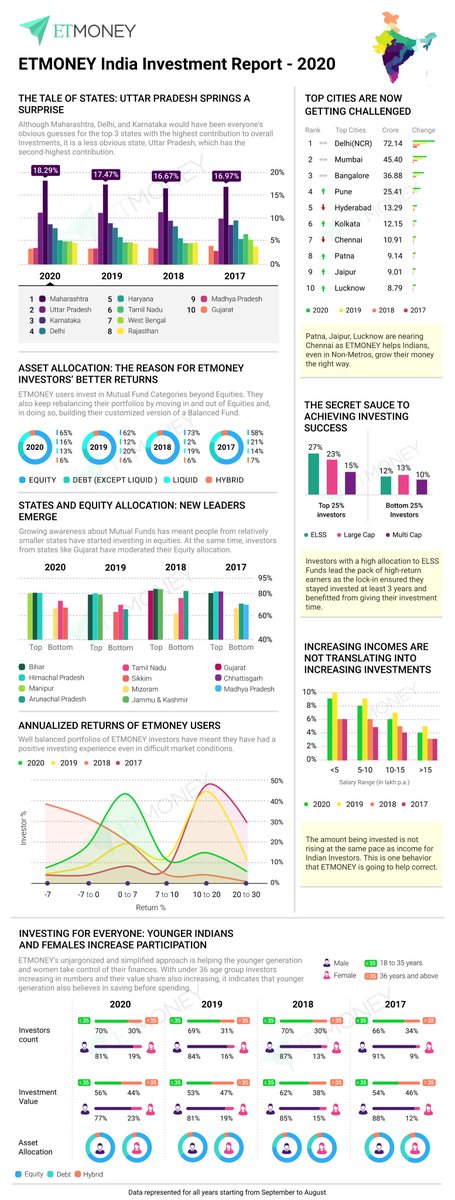

First up - The tale of States. While Maharashtra sits pretty on top in the list of top contributions by value, Uttar Pradesh, a relatively less obvious state takes second spot. We're proud to have made investing accessible to Indians in every nook & corner of this vast country🙂

In the second part of this tale of states, we analyzed Equity Allocation from each state. And this time it was the smaller states that came on top. That’s because as awareness about #MutualFunds grow, people from states like J&K are latching onto equities🥳

Next up, the #topcities. Metros continue to lead the charge here but non-metros are catching-up & fast. #Patna, #Lucknow, and #Jaipur are now in the top 10 cities and at this rate will overtake #Chennai very soon. In fact, over 55% of ETMONEY investors today are from non-metros👍

Our un-jargonized approach is democratizing investing at multiple levels. The percentage of women investors on ETMONEY has gone up from 9% to over 19% in the last 4 years. And the best part, they have near-perfect portfolios! 💃💃

Another heartening thing is that even the younger generation is getting on the bandwagon of investing and saving, thanks to this ease. The number of under 36 investors and their value share has gone up in the last 4 years📈

We all want the secret sauce that can help us succeed as investors! 🪄🪄 We (sort of) found it. A mix of ELSS Funds, Large Cap Funds, and Multi-Cap Funds had the major allocation in portfolios of ETMONEY’s top 25% investors.

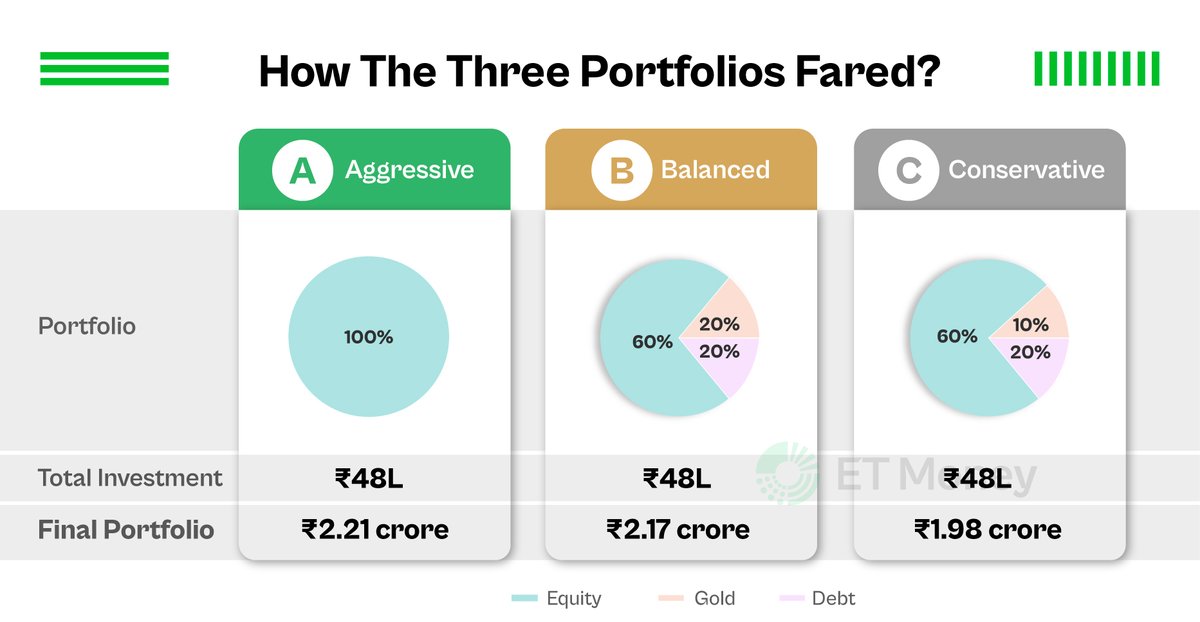

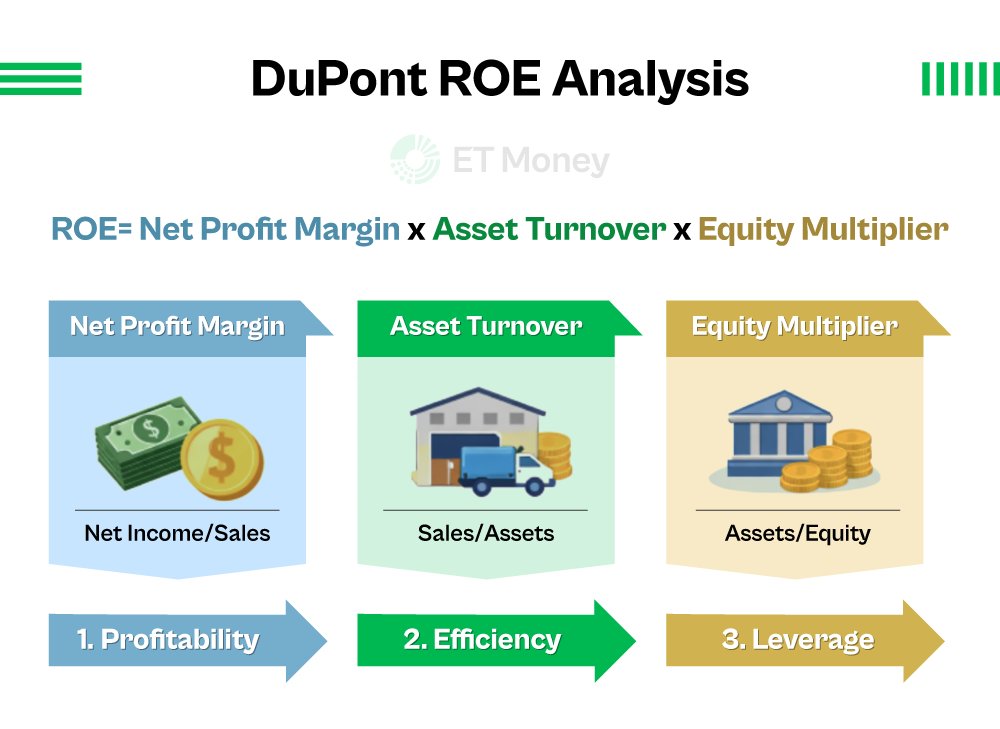

Another investing behavior that is helping ETMONEY users earn better returns is #AssetAllocation. They invest in categories other than equities and regularly rebalance by exiting equities. To help them, we send periodic portfolio health checks 🩺

This behavior of having a balanced portfolio and rebalancing meant most ETMONEY users had a positive investing experience through the years despite tough market conditions 🚀🚀

The next thing is where Indians need to do better. Looking at what percentage of salary Indians are investing, we saw increasing income is not leading to increase in investments. Not investing enough is as harmful as not investing at all. So give your investments a yearly raise💰

Lastly, from SmartDeposit to automated alerts to portfolio health checks, we have done quite a bit to help India invest right. And this report is a testament to how our efforts are making difference in the lives of Indian investors 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh